EUR / USD

The EUR/USD currency pair is currently under downward pressure, trading at $1.04745, as it struggles to surpass the resistance level at $1.04998. This weakness is influenced by a decline in the German Ifo Business Climate index and robust US consumer confidence data, which have strengthened the US dollar.

Technical indicators, including the 50-day and 200-day EMAs, suggest a bearish trend, with the pair trading below significant moving averages. The RSI is around 35, indicating the pair is nearing oversold territory, which could lead to a reversal if buying interest emerges.

Although Trump's announcement of additional tariffs did not mention Europe, threats still linger. Additionally, a dovish stance from the European Central Bank could further weaken the euro. A break above the 1.064 resistance level could signal a bullish shift, but the prevailing sentiment remains bearish. Market participants are closely monitoring upcoming economic data and policy announcements, with the possibility of the EUR/USD reaching parity by mid-2025.

USD / JPY

The USD/JPY currency pair is currently influenced by the Bank of Japan's core inflation data, which remains above the 2% target, fuelling speculation of a potential rate hike in December. This anticipation could strengthen the yen, potentially driving the pair toward 153.5, while a delay in rate hikes might see it trend toward 156.

U.S. economic indicators, such as consumer confidence and housing data, are pivotal, with strong figures potentially bolstering the dollar and driving USD/JPY higher. Recent declines in U.S. Treasury yields have exerted downward pressure on the pair, highlighting the impact of U.S. monetary policy on its trajectory.

Technical analysis suggests USD/JPY is range-bound, with resistance around 155.00-155.50 and support near 153.00. The pair recently experienced a modest upward movement, closing at approximately 154.25, slightly above the 20-day SMA of 153.93, suggesting a mild bullish sentiment. The resistance level at 156.11 remains untested, indicating potential upward movement if bullish momentum strengthens.

Overall, the USD/JPY dynamics are characterised by the divergence in monetary policy between the U.S. and Japan, with traders remaining vigilant for any shifts in these factors.

GBP / USD

The GBP/USD currency pair is currently experiencing a significant downward trend, recently hitting a six-month low. This decline is influenced by both technical and fundamental factors, including a "death cross" formation between the 20-day and 200-day simple moving averages, which signals a bearish outlook. Momentum indicators such as the MACD and RSI suggest continued weakness, with the RSI nearing oversold territory, indicating potential for a corrective bounce.

The weakening retail inflation in the UK, as indicated by the BRC Shop Price Index, has dampened investor sentiment towards the GBP. Meanwhile, the strength of the US dollar, bolstered by robust economic data like consumer confidence, has added pressure on the pair. Key support levels are identified at 1.2445 and 1.2300, with resistance at 1.25773, and a break below 1.2445 could lead to further declines.

Geopolitical uncertainties, including potential US tariffs, contribute to the bearish sentiment. Overall, the outlook for GBP/USD remains cautious, with downside risks prevailing unless significant positive catalysts emerge.

EUR / CHF

The EUR/CHF currency pair is currently under pressure due to several macroeconomic factors, including expectations of a dovish stance from the European Central Bank (ECB) amid declining German business sentiment and recession fears. This has led to a weakening euro, compounded by the potential impact of US tariffs on EU goods.

The Swiss franc, viewed as a safe-haven currency, may strengthen against the euro in this uncertain environment. Recent price movements show a slight decline from 0.933 to 0.929, with resistance at 0.933 and the pair approaching oversold territory. The current price is below key moving averages, indicating bearish sentiment, with the 30-day VWAP at 0.94 as a significant resistance level.

A potential bullish scenario could emerge if the pair rebounds from the support level at 0.925. However, a break below this support might lead to further declines. Investors should closely monitor ECB announcements and geopolitical developments for potential impacts on the EUR/CHF pair.

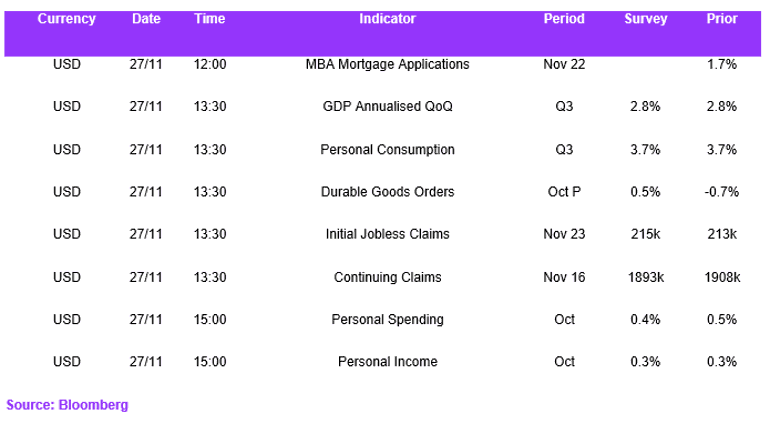

Economic Calendar