EUR / USD

The EUR/USD currency pair is currently experiencing a bearish trend, with the euro struggling to maintain upward momentum and failing to break above the 1.0600 level. This weakness is compounded by disappointing economic data from Germany and political instability in France, which have heightened investor anxiety and contributed to the euro's decline. The eurozone's manufacturing sector remains in contraction, further weighing on the euro.

Meanwhile, the U.S. dollar has strengthened, supported by robust economic data and expectations of a shallower cutting cycle of the Fed in comparison to the ECB. The dollar's safe-haven status amid global uncertainties and geopolitical tensions has also bolstered its strength.

The current price remains below significant moving averages, including the 20-day, 50-day, and 200-day SMAs, suggesting a bearish sentiment in the short term. If the EUR/USD breaks below the 1.0400 level, it could signal additional downside risk. However, any potential relief rally would need to overcome resistance at the 1.0600 mark to gain traction.

USD / JPY

The USD/JPY currency pair is currently experiencing a slight rebound after testing a key technical level, with the price hovering just above 150.00. This movement is influenced by broader gains for the US dollar against other major currencies.

Speculation about a potential rate hike by the Bank of Japan (BOJ) is adding to market uncertainty, with Governor Ueda hinting at a possible increase. Inflation in Tokyo has surpassed the BOJ's 2% target, sparking discussions about a December rate hike, though weaker wage growth trends remain a concern. A rate hike could strengthen the yen, potentially pushing the USD/JPY pair toward 147.5, while a delay might see it rise above 150.

The yen's recent appreciation is linked to the unwinding of carry trades and anticipation of the BOJ's next move. Meanwhile, U.S. economic indicators, such as job openings and the non-farm payrolls report, will also play a role in determining the pair's trajectory. Overall, the USD/JPY pair remains under pressure, with potential for further volatility as traders await key economic data and central bank decisions.

GBP / USD

The GBP/USD currency pair has been under pressure due to disappointing UK economic data, particularly the decline in the UK Manufacturing PMI from 49.9 in October to 48.0 in November. This has contributed to the British pound's retreat against the strengthening U.S. dollar, which has been bolstered by a better-than-expected ISM Manufacturing PMI report. The divergence in economic performance between the UK and the U.S. has led to a bearish outlook for the GBP/USD pair.

Technically, the pair is facing challenges, with a critical support level identified at 1.2575 – 1.2590, and a breach below this level could lead to further declines. The current price of 1.2664 is below the 50-day moving average of 1.29, indicating potential bearish sentiment.

A bullish scenario could see the pair breaking above the 1.274 resistance, while a bearish scenario might push the price towards the support level at 1.251. The broader market sentiment favours the U.S. dollar, driven by geopolitical tensions and its safe-haven status. Overall, the GBP/USD pair is likely to remain under pressure in the near term, influenced by both fundamental and technical factors.

EUR / CHF

The EUR/CHF currency pair is currently under downward pressure due to political instability in France and a struggling eurozone manufacturing sector, which have weakened the euro. The European Central Bank's anticipated interest rate cuts are expected to further depreciate the euro against the Swiss franc.

Meanwhile, the Swiss franc remains strong as a safe-haven currency amidst these uncertainties. The Swiss National Bank (SNB) has maintained stability in Swiss sight deposits, suggesting no immediate domestic financial strain. However, the potential for further euro weakness could lead to a decline in the EUR/CHF exchange rate, prompting possible SNB intervention to prevent excessive franc appreciation.

Over the past day, the pair experienced a slight decline, with the price moving from approximately 0.9317 to 0.9306. The current price is below significant moving averages, indicating potential resistance and a bearish outlook if the price falls below the recent support level of 0.9248. Monitoring the euro's trajectory and the SNB's policy signals will be crucial for anticipating the EUR/CHF pair's future direction.

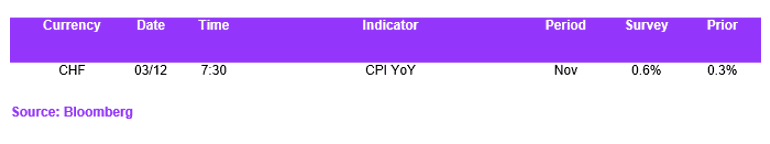

Economic Calendar