EUR / USD

The EUR/USD currency pair is currently experiencing volatility due to economic data and geopolitical factors. The euro is stabilising within broad ranges after a sharp drop, influenced by upcoming economic reports like the HCOB Services PMI and euro area PPI.

Political instability in France and broader Eurozone challenges, including weak growth and potential ECB rate cuts, are contributing to the euro's weakness. In contrast, the U.S. dollar is supported by strong economic data and expectations of further Federal Reserve rate hikes. This divergence in monetary policy is a key factor in the euro's current pressure.

Technical analysis suggests that if EUR/USD breaks above the $1.0600 level, it could target the next resistance around $1.0700. However, failure to hold the current support could lead to further declines. Investors are closely monitoring upcoming economic data and central bank meetings for further direction.

USD / JPY

The USD/JPY currency pair is currently experiencing a downward trend, testing new lows around the 149 level, influenced by the Bank of Japan's hawkish stance and potential rate hikes. Market speculation suggests a 60% probability of a December rate hike, strengthening the yen. Weaker-than-expected U.S. jobs data has put pressure on the U.S. dollar, potentially amplifying the pair's downward momentum.

Technical analysis indicates that a decisive break below the 149 support level could lead to further declines, targeting the 147 level. However, a reversal above 153 would negate the bearish scenario and signal a return to bullish momentum.

The upcoming BoJ and Federal Reserve meetings are expected to introduce significant volatility to the market. The dollar's role as a safe haven amid global uncertainties could also influence its strength.

GBP / USD

The GBP/USD currency pair has recently shown resilience, attempting to settle above the 1.2670 level despite disappointing UK retail sales data. The pound's strength against the dollar is partly due to the broader weakness in the U.S. dollar, influenced by the latest JOLTs Job Openings report, which led to a pullback in the dollar.

If GBP/USD can surpass the resistance at 1.2700 – 1.2715, it may target the next resistance zone around 1.2850 – 1.2870. The pair is currently trading below the 50-day moving average of 1.29, indicating potential resistance, while the 20-day moving average at 1.27 acts as a nearby support level.

The Bank of England's cautious approach to monetary easing, with fewer rate cuts than anticipated, could support the GBP by maintaining relatively higher interest rates. The U.S. Federal Reserve's potential interest rate cuts could also influence the dollar's strength, impacting the GBP/USD pair.

Traders should remain cautious, as the pound's strength might be tested by further negative economic indicators from the UK. Overall, the GBP/USD pair's trajectory will likely depend on the interplay between UK economic performance and U.S. dollar movements.

EUR / CHF

The EUR/CHF currency pair is currently experiencing pressure due to political instability in France, which has heightened the credit risk premium on French sovereign bonds and raised concerns about the euro's stability. This situation has strengthened the Swiss franc, traditionally viewed as a safe haven, against the euro.

The pair is trading near a critical support level of 0.9255, a threshold not reached since December 2023, and a break below this could lead to further declines towards 0.9085 and 0.8890. Conversely, surpassing the 0.9565 resistance could negate the bearish outlook and prompt a recovery towards the 1.0040/1.1000 resistance zone.

The Swiss National Bank's consideration of interest rate cuts due to low inflation could weaken the CHF, potentially affecting the EUR/CHF exchange rate. However, broader economic factors, such as potential trade disruptions from U.S. tariffs, add to the euro's vulnerability. The market is closely monitoring developments in France, as a no-confidence vote could further destabilise the euro. The SNB's upcoming meeting will be pivotal in determining the future direction of the CHF, leaving the EUR/CHF in a precarious position influenced by political and economic factors.

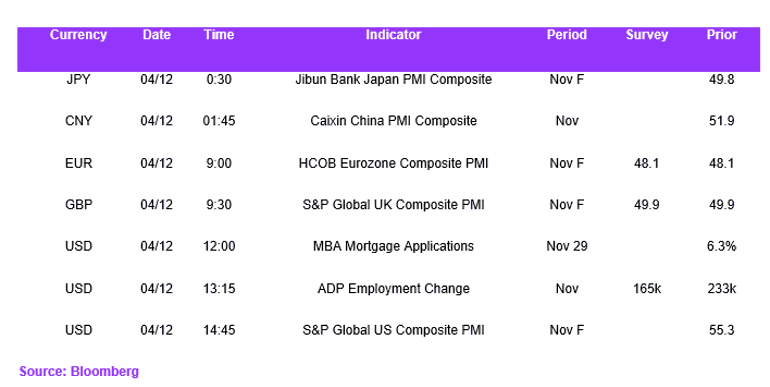

Economic Calendar