EUR / USD

The EUR/USD currency pair is currently experiencing modest bullish momentum, trading around 1.05274, influenced by both economic and political factors. Recent mixed PMI figures from the Eurozone, particularly the contraction in the services sector, have contributed to a subdued outlook for the euro. The European Central Bank (ECB) is expected to implement a 25 basis point rate cut in December, which should provide support for the currency at the 1.04 level, given a moderately dovish narrative.

Technical analysis indicates that the EUR/USD is near a critical resistance level at 1.05416, with support at 1.04827. The US dollar's performance, pressured by weaker-than-expected ISM Services PMI data, has provided some support for the euro. Political instability in France adds to the euro's challenges, potentially affecting business and consumer confidence.

Market participants are closely monitoring upcoming US economic data, including non-farm payrolls, which could introduce volatility. Overall, the EUR/USD pair remains in a delicate balance, with central bank policies and geopolitical uncertainties playing pivotal roles in its near-term direction.

USD / JPY

The USD/JPY currency pair is currently experiencing volatility, with recent movements indicating a potential shift in market sentiment. As of early December 2024, the pair is attempting to stabilise below the 150.00 level, influenced by a resilient but softening dollar. Technical indicators show the USD/JPY is testing key support levels, with 149.55 acting as a critical floor. A breach below this level could lead to further declines, targeting lower Fibonacci retracement levels around 148.15 and potentially 146.12.

Conversely, a sustained move above 150.00 could see the pair testing resistance levels at 151.28 and 153.40. The disparity between US and Japanese interest rates remains significant, traditionally supporting the dollar, but recent dynamics suggest caution. Market expectations for a Bank of Japan interest rate hike have diminished following the statement by policymakers that the BOJ's decision for December will be data-dependent, contributing to the yen's depreciation. The upcoming U.S. Non-Farm Payroll report is likely to be a significant market mover, potentially providing more clarity on the pair's direction.

GBP / USD

The GBP/USD currency pair is currently exhibiting a cautiously bullish trend, trading around 1.27185, supported by the Bank of England's hints at an improvement in the UK's Services PMI. The weakness of the US dollar, influenced by disappointing economic data such as the ISM Services PMI and ADP Non-Farm Employment Change, has contributed to the pound's relative strength.

The pair has climbed above the 1.2700 level, testing resistance at 1.2715, with potential targets at 1.2850 if it breaks above this resistance. Technical analysis indicates the GBP/USD is trading above its pivot point at 1.26916, suggesting potential for further gains. Immediate resistance is seen at 1.27217, with additional targets at 1.27452 and 1.27693, while key support levels are at 1.26610, 1.26408, and 1.26173.

The broader market sentiment is influenced by geopolitical uncertainties and mixed US economic signals, with traders awaiting further insights from upcoming UK economic data and Bank of England remarks.

The potential for further declines in the US dollar could provide additional support for the GBP/USD. Overall, the pair's outlook remains cautiously optimistic, contingent on breaking key resistance levels and the broader performance of the US dollar.

EUR / CHF

The EUR/CHF currency pair is currently influenced by macroeconomic factors and specific financial activities, notably the CHF 160 million syndicated term loan by the R&S Group, which underscores strong demand for Swiss francs. This demand is further evidenced by the oversubscription of the loan, indicating confidence in the Swiss financial market and potentially boosting the CHF's value relative to the euro.

Political instability in France adds pressure on the euro, creating uncertainty in the Eurozone's economic outlook. The European Central Bank's anticipated interest rate cuts through 2025 may further weaken the euro. Meanwhile, the Swiss franc benefits from its status as a safe-haven currency amidst global uncertainties, supported by the Swiss economy's stability and the Swiss National Bank's monetary policy.

The euro's weakness against the dollar, influenced by US economic resilience, also affects the EUR/CHF pair. The pair remains below key resistance levels, indicating a bearish sentiment in the short term. Overall, the EUR/CHF pair may remain under pressure, with the euro facing challenges from political and economic factors, while the CHF gains strength.

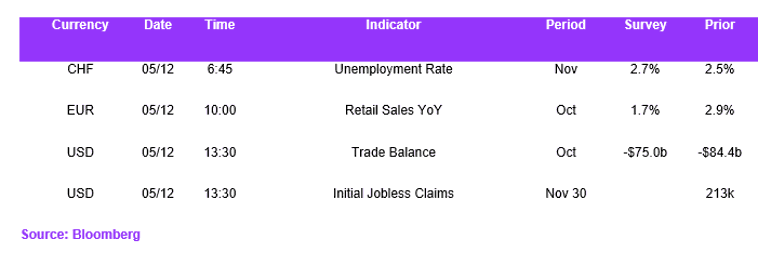

Economic Calendar