EUR / USD

The EUR/USD currency pair is currently facing a challenging environment. The euro is struggling against the US dollar due to its unfavourable relative performance against the US economy. In particular, continued political issues in France and Germany are weighing on the bloc's budget prospects, and the muted economic performance is exacerbating the weakness.

The pair recently experienced a slight decline, moving from approximately 1.057 to 1.055, with the 20-day SMA acting as a nearby support level. The euro has been attempting to breach the 1.0600 resistance level, influenced by expectations of potential interest rate cuts by both the Federal Reserve and the European Central Bank, with the latter expected to bring more cuts further down the line. This divergence in monetary policy expectations continues to favour the dollar, exerting downward pressure on the EUR/USD.

Technical indicators suggest potential bullish momentum for the euro, with historical trends indicating December as a favourable month. Traders are closely watching the upcoming US Consumer Price Index report, which could significantly influence the dollar's trajectory and the EUR/USD pair. Markets expect a 2.7% YoY growth in November, which could underscore continued inflation stickiness in the US, prompting the Fed to initiate a much shallower cutting cycle than originally expected.

Overall, while market sentiment leans towards a stronger dollar in the near term, historical trends and technical signals offer some hope for stabilisation in the euro's performance against the dollar 1.06.

USD / JPY

The USD/JPY currency pair has been attempting to climb above the 151.00 level, driven by the interest rate differential favouring the US, which supports a bullish outlook for the dollar. Despite higher-than-expected nonfarm payroll data released last week, subsequent data points to resilient US performance, increasing the likelihood of fewer rate cuts from the Fed in the long term.

The pair's upward momentum suggests a potential move towards the resistance range of 153.00 to 153.50 if the trend continues. However, traders are in a holding pattern, awaiting key US inflation data that could significantly impact the pair's direction.

Japan's revised GDP figures for Q3 have not significantly altered the yen's trajectory, and the Bank of Japan's upcoming rate announcement adds uncertainty. Expectations for the December hike have diminished following the unusual central bank meeting scheduled yesterday. Still, economists and markets are favouring a rate hike next Thursday. As of today, forward swaps expect a 6bps hike at a 20% probability.

The BoJ's commitment to yield curve control and negative interest rates contrasts with other central banks' tightening policies, contributing to the yen's depreciation.

Overall, the pair's movement will likely be driven by upcoming economic data and central bank decisions, with a bias towards further gains if US economic indicators remain strong.

GBP / USD

The GBP/USD currency pair is currently attempting to establish itself above the 1.2800 level, with support near 1.2715 and resistance expected between 1.2850 and 1.2870. The US Dollar Index remains flat, allowing the GBP to capitalise on this stability.

The absence of major U.S. economic reports today suggests that market sentiment and positioning will play a crucial role in the pair's movement. Rising Treasury yields have not significantly impacted the GBP/USD, indicating resilience in the pair. The Bank of England's monetary policy, particularly interest rate decisions, remains a key factor influencing the GBP's strength against the USD.

The pair faced resistance near the 50-day moving average at 1.28, while the 200-day moving average at 1.29 remains a significant barrier, suggesting a consolidation phase. Overall, the GBP/USD is likely to remain volatile, with key economic data releases and central bank meetings shaping its near-term direction.

EUR / CHF

The EUR/CHF currency pair is currently navigating a complex landscape influenced by both the Swiss National Bank (SNB) and the European Central Bank (ECB). The pair continued to soften in recent weeks, with the latest move below the key support at 0.93.

Over the past day, EUR/CHF experienced a slight decline, with the price moving from approximately 0.929 to 0.927, reflecting a minor downward trend. The pair tested a support level around 0.927, while resistance remains unchallenged at 0.933 and 0.944, indicating a constrained trading range.

The SNB is expected to cut its key policy rate by 25 basis points in December 2024 to manage the Swiss franc's strength against the euro, driven by Switzerland's low inflation rate. Meanwhile, the ECB is also expected to adopt a more dovish stance with a likely 25bps rate cut this week, which could weaken the euro further. Political instability in major eurozone economies like France and Germany adds to the euro's vulnerability, potentially increasing demand for the Swiss franc as a safe haven.

Overall, the EUR/CHF pair may experience downward pressure due to these combined economic and political factors.

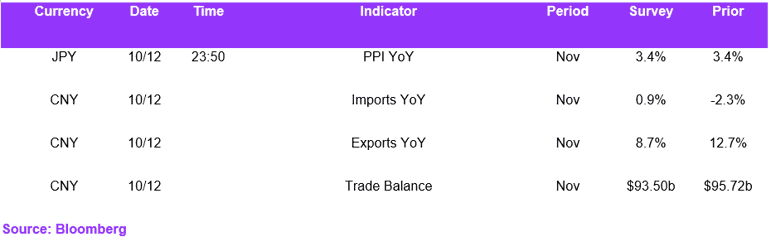

Economic Calendar