EUR / USD

The EUR/USD currency pair is currently under pressure due to recent U.S. inflation data, which pointed to reacceleration non-core components. This prompted the US dollar to strengthen, causing the EURUSD pair to test the 1.05 level. Technical analysis indicates a potential downward trend if the pair remains below the 1.05370 pivot level, with support around 1.04988 and 1.04597. The RSI at 39.83 suggests a bearish sentiment, and the price is below the 20-day, 50-day, and 200-day moving averages, indicating continued downward pressure.

The Federal Reserve's anticipated rate cut in December could influence the pair's trajectory, while the European Central Bank's dovish stance may add further pressure on the euro. Resistance is seen at 1.05677, with a bullish scenario requiring a break above the 1.0631 resistance level. Geopolitical factors and economic indicators within the Eurozone, such as GDP growth and employment figures, also impact the euro's performance.

Overall, the EUR/USD exchange rate remains on the back foot given U.S. and Eurozone monetary policies and economic conditions.

USD / JPY

The USD/JPY currency pair has been experiencing upward momentum, primarily driven by rising U.S. Treasury yields and US dollar, given a less dovish Federal Reserve stance. Recent U.S. inflation data meeting expectations has reinforced the dollar's strength, making it attractive to investors.

The pair is currently testing significant technical levels, including the 200-day moving average, which could act as a pivotal point for future movements. If the pair sustains a break above this level, it could target higher resistance levels around 153.50 and potentially 156.00. However, failure to sustain above the 200-day moving average might invite selling pressure, pushing the pair towards lower support levels.

The Bank of Japan's a more accommodative monetary policy stance contrasts with the Fed's tightening approach, further supporting the dollar's strength against the yen. Overall, the USD/JPY outlook remains cautiously bullish, contingent on U.S. economic indicators and yield movements.

GBP / USD

The GBP/USD currency pair is currently in a consolidation phase, trading within a range of 1.2715 to 1.2800, as traders await new catalysts. Recent U.S. inflation data has slightly strengthened the U.S. dollar, keeping the pair stable. The U.K.'s upcoming 10-year bond auction, with projected yields of 4.48%, could significantly influence the GBP's performance.

Technical analysis indicates strong support around 1.27335, with potential resistance at 1.2850 – 1.2870 if the pair breaks above 1.2800. A decline below 1.27335 might expose the pair to downside risks, targeting support levels at 1.26927 and 1.26501. The Bank of England's cautious interest rate stance and potential shifts in Federal Reserve policy are key factors to watch.

Overall, the GBP/USD is in a wait-and-see mode, with traders closely monitoring economic indicators and central bank actions.

EUR / CHF

The EUR/CHF currency pair is currently experiencing potential bullish signals, influenced by upcoming decisions from the Swiss National Bank (SNB) and the European Central Bank (ECB). The SNB's interest rate decision, with market opinions divided between a 25 or 50 basis point cut, is a key event that could significantly impact the pair.

Recent technical indicators suggest a possible reversal in the downward trend, with bullish signals from the MACD and a bullish engulfing candle observed. Resistance levels for EUR/CHF are identified at 0.9334, 0.9446, and 0.9520, while support levels are at 0.9256 and 0.9211. The Swiss franc's strength, driven by its safe-haven status amid global uncertainties, remains a critical factor.

Traders should be cautious of the volatility surrounding the SNB decision and the subsequent ECB policy announcement. Overall, the EUR/CHF pair appears to be positioned for potential gains, contingent on the outcomes of these key central bank decisions.

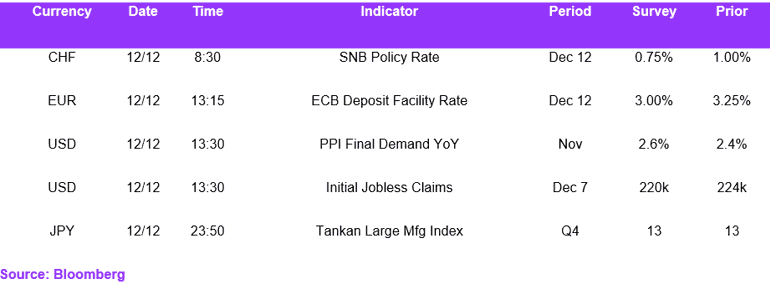

Economic Calendar