EUR / USD

The EUR/USD currency pair is currently under bearish pressure, trading below key pivot points with immediate support around 1.0200. This decline is driven by the strengthening U.S. dollar, bolstered by robust employment data, rising Treasury yields, and the Federal Reserve's hawkish stance on interest rates. The euro's weakness is compounded by economic challenges in the Eurozone, including weak retail sales and high energy costs, alongside the European Central Bank's more dovish expectations for monetary policy relative to the Fed.

Inflationary pressures in both the Eurozone and the United States are influencing the EUR/USD dynamics. The anticipation of U.S. inflation data is critical tomorrow, as any unexpected rise could further strengthen the dollar, potentially pushing the EUR/USD pair lower. In contrast, the ECB's potential rate cuts in the coming months could further weaken the euro, maintaining pressure on the currency pair.

Overall, the EUR/USD is likely to remain under pressure as markets await clearer signals from upcoming inflation reports and central bank actions.

USD / JPY

The USD/JPY currency pair is currently experiencing upward momentum, driven by the strength of the U.S. Dollar, which is supported by robust U.S. economic data, particularly in employment. This strength has diminished expectations of dovish actions from the Federal Reserve, while the Japanese Yen faces pressure due to uncertainty surrounding the Bank of Japan's monetary policy. Inflationary releases in both the United States and Japan tomorrow are influencing the pair, with strong U.S. economic conditions contributing to inflation concerns and speculation that the Federal Reserve may halt interest rate cuts at the start of 2025.

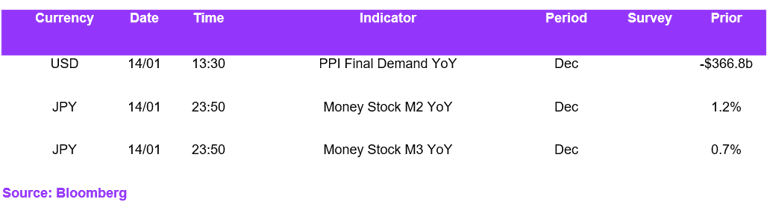

Technical analysis indicates a bullish continuation for the USD/JPY pair, with the formation of an ascending channel and an inverted head and shoulders pattern. The pair's ability to maintain levels above 157.00 and potentially move towards resistance at 158.50 – 159.00 suggests further upside potential, although liquidity dynamics and upcoming U.S. economic data releases, such as the PPI and CPI, could introduce volatility.

The Bank of Japan's upcoming decision on interest rates adds another layer of potential volatility, as any shift in the BoJ's monetary policy could strengthen the Yen, impacting the USD/JPY exchange rate. In particular, following the speech by BOJ's policymakers, there is a growing expectation for an interest rate hike next week, with forward swaps pricing in 14bps worth of hikes for the meeting, which could provide resistance for the pair. Still, we do not anticipate a trend reversal in the pair's momentum in the longer term, given a less dovish outlook for the Fed.

GBP / USD

The GBP/USD currency pair is currently experiencing significant bearish pressure, with trading levels around 1.22192 and 1.21288, indicating challenges for the pound against the dollar. This bearish trend is supported by the pair trading below key pivot points and both the 50-day and 200-day EMAs, with resistance levels at 1.23618 and 1.23174, posing hurdles for any potential bullish reversal. The strength of the U.S. dollar, bolstered by strong economic data and rising Treasury yields, further pressures the GBP/USD pair, while the Bank of England's cautious monetary policy approach as well as budgetary outlook adds to the pound's challenges.

Inflation dynamics will play a crucial role in influencing the GBP/USD exchange rate this week. The U.S. is facing inflationary pressures, with expectations of higher CPI and PPI readings potentially impacting the Federal Reserve's monetary policy and strengthening the USD. The UK is also dealing with stickier inflation, and the Bank of England's outlook sees a moderate cutting cycle this year akin to the Fed. While this should help provide robust support for the pair at 1.20, we do not anticipate a trend reversal in the pair's momentum in the meantime. Upcoming inflation data releases and central bank communications are key factors to watch.

Economic Calendar