EUR / USD

The EUR/USD has recently shown signs of potential recovery, forming a morning star pattern that suggests a possible bottoming out. Despite this technical recovery attempt, the pair remains under pressure due to the strong U.S. dollar, supported by robust U.S. economic data and rising bond yields. The recent US PPI report, which came in lower than expected at 3.3%, has allowed EUR/USD to regain some ground above the 1.03 level, but resistance levels around 1.0300-1.0340 remain significant hurdles.

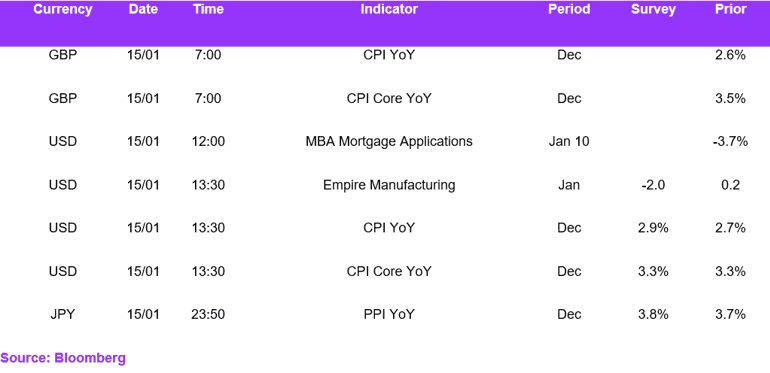

Inflation dynamics in the U.S. and Eurozone are influencing the EUR/USD pair, with persistent high inflation in the U.S. potentially limiting the Federal Reserve's ability to cut interest rates significantly. Conversely, inflation in the Eurozone has shown signs of easing, adding downward pressure on the euro. The divergence in inflation trends and monetary policy expectations between the U.S. and the Eurozone could lead to fluctuations in the EUR/USD exchange rate. U.S. inflation print will be key in guiding the narrative for the pair today.

USD / JPY

The USD/JPY has recently demonstrated strength, with the U.S. dollar rallying against the yen and breaking above the 158 yen level. Despite this upward movement, the pair remains below the key resistance range of 158.50 to 159.00, suggesting the need for a catalyst to push it higher. The Bank of Japan's current policy stance, with no immediate plans for interest rate hikes, continues to exert pressure on the yen, although speculation about a potential shift due to improved business sentiment persists.

Expectations of persistent inflation and robust economic indicators, such as strong labour market data support the strength of the U.S. dollar. This has led to a recalibration of interest rate expectations, with markets now anticipating fewer rate cuts from the Federal Reserve in 2025. The upcoming U.S. Consumer Price Index (CPI) report is expected to influence the USD/JPY pair, as it may impact the Federal Reserve's rate path. If U.S. inflation exceeds expectations, it could delay anticipated Fed rate cuts, potentially pushing the USD/JPY pair higher.

GBP / USD

The GBP/USD has been experiencing notable volatility, influenced by both UK inflation data and U.S. economic indicators. The UK's inflation rate recently eased to 2.5%, which, while still above the Bank of England's target, has created uncertainty regarding potential rate cuts. This uncertainty has led to fluctuations in the GBP/USD exchange rate as traders speculate on the BoE's future monetary policy actions. Additionally, hedge fund selling of GBP due to concerns over the UK's fiscal situation has added downward pressure on the currency.

The GBP/USD is currently testing resistance around the 1.2200 mark, potentially moving higher if this level is breached. In the U.S., headline CPI is anticipated to rise from 2.7% to 2.9% YoY, while core CPI is expected to hold steady at 3.3% YoY. If these projections materialise, the GBP could face further depreciation against the dollar. The UK's weaker economic outlook, coupled with a stronger case for rate cuts in the UK compared to the U.S., continues to add pressure on the pound.

Overall, the pair's movements are closely tied to ongoing economic data releases and central bank policy signals from both the UK and the U.S.

Economic Calendar