EUR / USD

EUR/USD has recently been influenced by US inflation data and economic indicators from the Eurozone. US headline CPI rose as expected, climbing from 2.7% to 2.9% YoY, while core CPI softened slightly, declining from 3.3% to 3.2%. This divergence suggests that inflationary pressures remain present but are more concentrated in volatile components such as food and energy while underlying price growth shows signs of stabilising. This has temporarily boosted the euro, but the overall trend remains bearish.

Inflation dynamics in both the US and Eurozone remain key. In the US, easing core inflation has led to speculation about potential Federal Reserve rate cuts, which could weaken the dollar and benefit the euro. On Friday, the Eurozone CPI print is out and is expected to remain stable, with the headline at 2.4% and core at 2.7% YoY. These figures would provide some support for the EUR as markets continue to adjust their expectations towards a less dovish ECB and the Fed.

Key support and resistance levels are being closely monitored, with the 1.0235 – 1.0250 range acting as immediate support. A break below this range could lead to further declines, while a break above resistance could signal a move towards 1.0461.

USD / JPY

USD/JPY weakened yesterday, primarily due to a decline in US Treasury yields and mixed US inflation data, which have contributed to the volatility of the US dollar. The lower-than-expected US CPI figures have added uncertainty regarding the Federal Reserve's future actions, impacting the pair's movement and pushing it below the 157.00 level. The pair has faced resistance near 158.52 and found support around 154.64, with the 30-day rolling VWAP at 156.56 acting as a key level.

Simultaneously, the Japanese yen has strengthened, driven by expectations of a potential interest rate hike by the Bank of Japan (BOJ). Remarks from BOJ Governor Kazuo Ueda have fuelled speculation about a possible rate increase, reflecting a positive outlook on Japan's economic conditions, particularly in wage growth and inflation. The yen's appreciation has added pressure on USD/JPY, pushing it towards the support level of 156.00 – 156.50, with potential further declines if US economic data continues to disappoint.

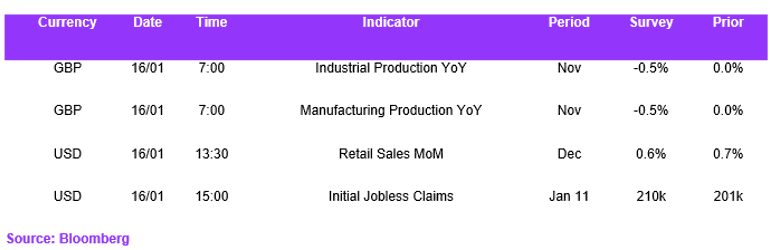

Initial jobless claims and retail sales figures could suggest a slightly weaker macroeconomic picture from the US, prompting a mild correction in USDJPY today.

GBP / USD

GBP/USD continued to fluctuate, influenced by recent economic data releases from both the UK and the US. UK inflation has eased to 2.5% in December, which has fuelled speculation about potential rate cuts by the Bank of England, although the BoE remains cautious about adjusting monetary policy too quickly given budgetary concerns. This softer-than-expected inflation has created market uncertainty as traders closely monitor BoE policy signals for further direction.

In the US, inflation data has also played a significant role, with the Consumer Price Index rising by 2.9% year-over-year in December, easing on the hawkishness of the future path of interest rate decisions by the Fed. The interplay between these inflation figures and central bank policy expectations is crucial, as potential rate cuts in both countries could weaken their respective currencies, impacting the GBP/USD exchange rate. Today, UK data expect to show narrowing of trade deficit – which would be due to better exports given front-loading. A smaller trade deficit would contribute positively to GDP, helping GBP to maintain above the 1.22 level.

Overall, the current inflation trends suggest a more favourable environment for rate cuts, which could influence the GBP/USD dynamics in the near term. Both central banks are expected to remain cautious in regard to their monetary policy choices, and it is unlikely that we will see cuts from either central bank in their first meetings of the year.

Economic Calendar