EUR / USD - Under Pressure given Trade Uncertainty

EURUSD pulled back slightly, settling near the 1.0420 level, influenced by profit-taking and the continued resilience of the dollar. Technical analysis indicates potential for further downside if the pair falls below the 1.0400 level, with support around 1.0330 to 1.0345, although there is a divergence between technical indicators and fundamental factors. The euro faces additional challenges from weaker economic data in Germany and the ECB's monetary policy decisions, including anticipated interest rate cuts on January 30th, which could exert downward pressure on the currency.

Geopolitical factors, particularly U.S.-EU trade relations and potential tariffs, remain critical in influencing the EUR/USD. The US administration's suggested tariffs on European imports could impact the euro's value against the dollar, although the lack of concrete plans has led to a relatively stable dollar. Markets will continue to pay close attention to the trade talk developments, as any firm announcements on tariffs could lead to significant currency volatility.

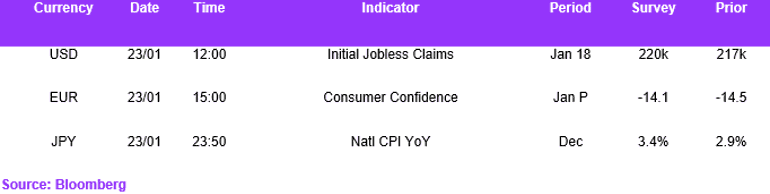

Tomorrow's consumer confidence indicator could provide the momentum for EURUSD to break out of its current range, particularly if the figure deviates from expectations. Otherwise, the markets will likely remain focused on Trump's announcement to influence the pair's direction.

USD / JPY - Japan's CPI Guiding the BOJ's Narrative

USD/JPY strengthened yesterday as the pair struggled below the 155 support area. This is despite continued anticipation of the BOJ's upcoming interest rate decision. Speculation of a potential 25-basis-point rate hike by the BoJ adds to the pair's volatility, with their historically unpredictable policy decisions making forward guidance crucial for future trends. The yen's performance is also influenced by domestic factors, such as strong wage growth, which might support further rate hikes. Meanwhile, the US dollar faces challenges, with potential volatility stemming from new policy directions and proposed tariffs under the Trump administration.

Technical indicators show significant resistance at the 20-day SMA of 157.04 and support at the 50-day SMA of 154.91, suggesting that further upward movement may encounter challenges. This is creating a tight range for USDJPY in the meantime. The BOJ's meeting on Friday is crucial. Until then, we anticipate markets will solidify their interest rate expectations with the release of the National CPI tomorrow, which is expected to have accelerated in December from 2.9% to 3.4% YoY. A higher figure would support the market's expectations for a 25 basis points increase from the BOJ. In the meantime, we expect modest volatility within the current ranges for USDJPY.

GBP / USD - Struggling to Find Direction

GBPUSD opened higher on the open but struggled to break above the resistance of 1.2355, closing the day moderately unchanged. Volatility during the day is limited, with the 20-day moving average at 1.23, acting as a robust support level. The robust US dollar and continued concerns over the UK's economic outlook, particularly the rising unemployment rate, contribute to the pair's bearish outlook. Resistance levels stand at 1.2230 and 1.20987.

Market participants should closely monitoring the BOE's upcoming quarterly bulletin for potential policy adjustments that could influence the pair's movement. Meanwhile, the US dollar's strength, supported by rising Treasury yields, continues to challenge the British pound, maintaining a bearish sentiment unless new catalysts emerge.

Economic Calendar