EUR / USD - Navigating Resistance Amid Mixed Signals

EURUSD struggled above the 1.0450 level yesterday, struggling to gain momentum higher. The dollar weakened as markets discounted their imminent tariff risk premiums, leading to an expectation of a less aggressive monetary policy from the Federal Reserve. Despite these gains, the euro encounters significant resistance around the 1.06 level, with a sustained move above this threshold necessary to confirm a bullish trend. The pair's direction will likely be influenced by upcoming central bank meetings, particularly from the ECB and the Fed this week, with traders expecting a 25bps cut and no change, respectively. If this materialises according to market expectations, we expect a modest EURUSD response.

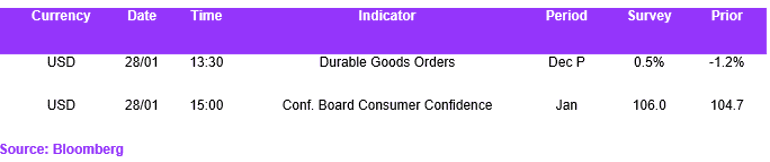

Overall, the EUR/USD outlook remains cautiously optimistic, with the potential for further gains if key resistance levels are breached. However, the market remains sensitive to geopolitical and economic developments. Markets are likely to remain cautious on the upside, with key events on inflationary indicators and central bank decisions. In particular, tomorrow's US consumer confidence indicator breaking outside of market expectations could introduce volatility for EURUSD.

USD / JPY - BOJ and the Fed's growing Divergence

USD/JPY sold off as a joint response to the BOJ's rate cut and a weaker dollar. Technically, USD/JPY is testing critical support levels around 153.50 to 154.00, potentially moving towards the 151.50 to 152.00 range if these levels are breached. The pair is also attempting to break below an ascending wedge formation, which could indicate a bearish trend reversal. Resistance is expected around the 155.00 level, limiting any potential upward movement.

The market's anticipation of further hikes by the BOJ is already reflected in the currency's performance, suggesting limited volatility in the near term. Overall, the short-term outlook remains bearish, with key support levels being closely watched by.

GBP / USD - Volatility Persists as Markets Await Clarity

GBP/USD remained volatile during the day, struggling above the 50 DMA at $1.2524. Key support is at $1.24275. The US dollar's weakness, influenced by declining Treasury yields and a less hawkish narrative from the Federal Reserve, is contributing to the dollar's softness. However, the British pound is facing downward pressure due to mixed economic data and uncertainties surrounding the UK's fiscal policies.

Technical indicators, including the 50-day and 200-day EMAs, suggest a bearish bias in the near term. A failure to hold above the pivot point at $1.24275 could lead to increased selling pressure. On the upside, if the pair breaks above the resistance level of $1.25047, it could target the next resistance at $1.25751.

Overall, the GBP/USD outlook remains uncertain, with market participants awaiting further clarity on economic policies and global trade developments. We expect markets to retest the 50 DMA level once again today.

Economic Calendar