EUR / USD - Resistance at 1.05 Remains Key

EURUSD weakened due to a strengthening U.S. dollar, bolstered by strong consumer confidence data and potential tariff threats. The pair is testing critical support levels between 1.0420 and 1.0435, with a risk of further decline if these levels are breached. Political risks and anticipated rate cuts by the ECB add to the euro's challenges as large currency speculators increased their net short positions, indicating a bearish sentiment.

The support around 1.04225 could reignite buying interest at this level. Technical indicators such as the 20-day and 50-day moving averages act as minor resistance, while the 200-day moving average indicates a bearish longer-term trend.

The upcoming central bank meetings are pivotal, with the ECB expected to cut rates due to sluggish economic growth and inflation slightly above target. In contrast, the Fed is expected to hold steady. These moves are now priced in, and we expect to see only moderate downside pressure, with limited volatility.

USD / JPY - US Dollar Resilience

USD/JPY rebounded yesterday, primarily driven by rising U.S. Treasury yields, which have increased the attractiveness of the dollar. Despite the BOJ's recent rate hike, the interest rate differential between the U.S. and Japan continues to favour the dollar, suggesting potential for further gains in the USD/JPY pair. The pair has recently moved above the 155.50 level, and if it surpasses the resistance at 156.00 – 156.50, it could target the next resistance range of 158.00 – 158.50.

The recent tariff threats from President Trump have further bolstered the U.S. dollar. Meanwhile, further hawkish narrative from the BOJ's policymakers is needed to bolster the appetite for JPY. Market participants are closely watching the upcoming Federal Reserve meeting, where no change in interest rates is expected, which should help solidify USD's relative strength.

GBP / USD - Economic Concerns Weigh on Pound Prospects

GBPUSD stabilised yesterday, trading within a narrow range that suggests a consolidation phase despite the strengthening U.S. dollar. This stabilisation is supported by technical indicators showing the pair holding within an upward channel, though it faces resistance near the 1.2500 level. The BOE's introduction of the Contingent Non-Bank Financial Institution Repo facility could positively influence the British pound.

However, the pair remains under pressure due to concerns over the UK's economic outlook and global trade tensions. Overall, GBP/USD remains stable for now and is expected to stay range-bound unless significant economic events shift market sentiment.

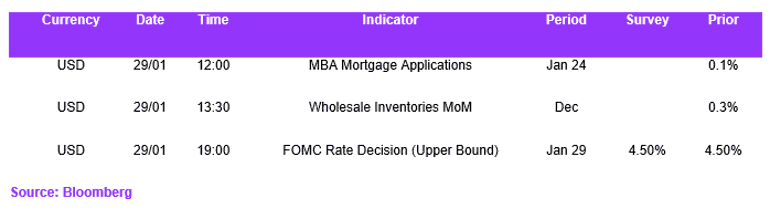

Economic Calendar