Markets Respond to US Tariffs

EUR / USD

EURUSD gapped lower late Sunday after the Trump administration announced tariffs on China, Mexico, and Canada. The pair briefly breached the 1.02 support level before recovering some losses to 1.0228. While no direct tariff measures were implemented against the European Union, news over the weekend is likely to significantly boost the dollar at the Monday market open, leading to a sell-off in EUR/USD. These tariffs may lead to increased inflationary pressures in the US, influencing Federal Reserve monetary policy decisions and result in markets anticipating fewer interest rate cuts this year.

The European Union has raised concerns about potential US tariffs on EU products, which could further weaken the Euro. With growing expectations that the EU may be the next target for US tariff announcements, pressure on the Euro is increasing. Any such announcement could lead to another decline in the EUR/USD exchange rate.

While we expect the 1.02 support level to hold in the coming days, the Euro should remain under pressure today as the markets analyse the tariff news and its implications.

USD / JPY

On Sunday, USDJPY briefly spiked above the 155.50 level following the announcement by the Trump administration to implement tariffs on China, Canada, and Mexico. However, this momentum did not persist, leading to a moderate correction down to 155.20. The markets do not expect a trade disruption between the US and Japan, which contributed to this pullback.

While the US dollar may introduce some volatility into the pair's trading behaviour today, these fluctuations are likely to be less significant than those seen with currencies from developed nations.

Overall, USDJPY should strengthen today, but the yen's safe haven properties might limit significant upward gains.

GBP / USD

GBPUSD weakened to 1.2275 on Sunday following the announcement of tariffs by the US on China, Mexico, and Canada, which led to a stronger valuation of the dollar. Retaliatory measures from the affected countries could disrupt global trade flows, negatively impacting the economic outlook for major economies, including both the UK and the US.

Additionally, with the Bank of England (BOE) meeting scheduled for this week, bearish pressures are increasing on GBPUSD. The BOE is expected to cut interest rates by 25 basis points to 4.5%. This dovish approach, along with internal dissent within the central bank, could place further downward pressure on the GBP against the USD later in the week.

As markets digest the tariff news today, GBPUSD is expected to remain under pressure.

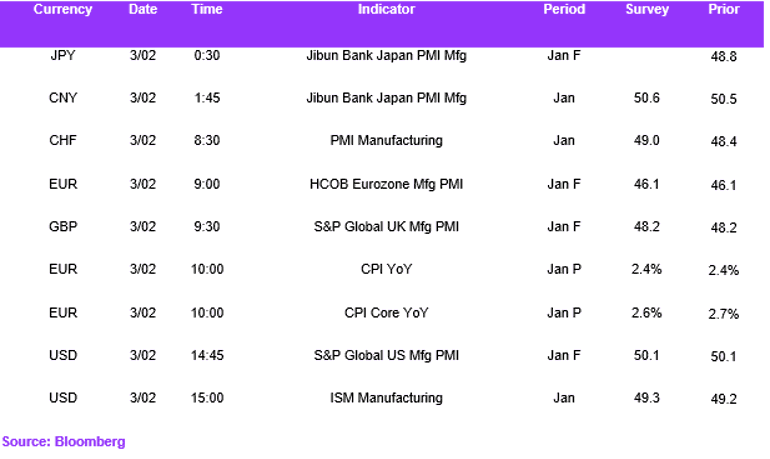

Economic Calendar