EUR / USD - Bracing for Potential Tariffs

EUR/USD has experienced significant volatility due to geopolitical tensions and economic data. The euro opened lower on Monday as concerns grew over escalating trade tensions with the United States, which recently imposed tariffs on China, Canada, and Mexico. Although the tariffs on Mexico were postponed for a month, uncertainty remains regarding the potential for new tariffs on Europe. This heightened concern follows President Trump's comments indicating that he aims to target the European Union soon. While the scale and timing of these potential tariffs are still unknown, the prospect of them is putting downward pressure on the euro in the long term.

In the meantime, the support at 1.02 held firmly, and subsequent inflation data helped EURUSD to recover some of the losses later during the day. Eurozone inflation has edged up to 2.5%, driven primarily by rising energy costs, slightly above the ECB's target, prompting a cautious approach to interest rate cuts. This has prompted the market to discount 3bps from the March meeting, however, 25bps are still anticipated by the ECB.

From the technical standpoint, resistance near the 1.044 level remains a challenge. The 20-day and 50-day moving averages also act as significant resistance levels, while the 200-day moving average at 1.07 is a distant target.

Overall, the outlook for EUR/USD is cautious due to ongoing trade tensions and economic uncertainties, which are likely to remain volatile and under pressure in the near term.

USD / JPY - Stability Despite Trade Uncertainty

USD/JPY held their nerve yesterday despite major trade developments and policy announcements. While the dollar initially showed strength against the yen, the pair has since pulled back, testing support levels around 153.50 to 154.00, with potential to move towards 151.50 to 152.00 if it breaks below this range.

Interest rate differentials between the U.S. and Japan continue to play a crucial role, suggesting a possible upward trend for the USD/JPY in the longer term. Tariff threats have bolstered the dollar, while the Bank of Japan's recent rate hike to 0.5% reflects inflation concerns.

Currently, USD/JPY shows modest upward movement, closing at approximately 154.998, with limited volatility. The price remains below the 20-day and 50-day moving averages, indicating potential resistance levels, while the RSI at 44.89 suggests a neutral stance.

We expect the pair to remain rangebound in the near term.

GBP / USD - In Anticipation of the BOE's Rate Cut

GBP/USD has shown resilience, despite trade uncertainty, trading around $1.22864, supported by better-than-expected UK Manufacturing PMI data. This resilience has allowed the pair to attempt a move above the 1.2400 level, although it faces resistance at the 50-day moving average of 1.2408 and further resistance between 1.2485 and 1.2500. A failure to maintain above the pivot point at $1.23004 could lead to a pullback towards $1.22300 and potentially $1.21602.

Markets anticipate an interest rate cut by the Bank of England from 4.75% to 4.5% this week, driven by weak economic growth and inflationary pressures. Such a rate cut could weaken the GBP against the USD. Additionally, new U.S. tariffs have introduced uncertainty, increasing volatility for the GBP/USD pair and contributing to a bearish sentiment towards the Pound.

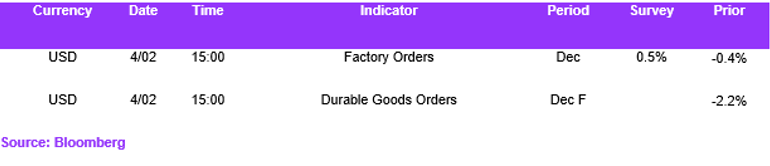

Economic Calendar