Labour & PMI Data Releases Set to Steer Market Momentum

EUR / USD - The Pair Eyes Key Breakout

EUR/USD experienced a moderate upward momentum during the day, primarily driven by weaker-than-expected US job opening data, which has led to a pullback in the US dollar. This has provided support for the euro as it approaches the 1.0400 level, although markets remain cautious. A successful break above this level could see the euro targeting resistance levels at 1.04192 and potentially 1.04659, while failure to maintain its position could lead to downward pressure towards support levels at 1.02711 and 1.02109.

The ongoing uncertainty regarding the US's implementation of tariffs on various economies, including the European Union, is weighing on the EUR/USD prospects. Moreover, the prevailing divergence between the ECB and the Fed's monetary policy path presents challenges for the pair to rise significantly in the long term. Although recent inflation data from the eurozone surprised the markets, it was insufficient to shift attention away from the ECB's dovish stance for 2025, as economic growth prospects remain the main concern.

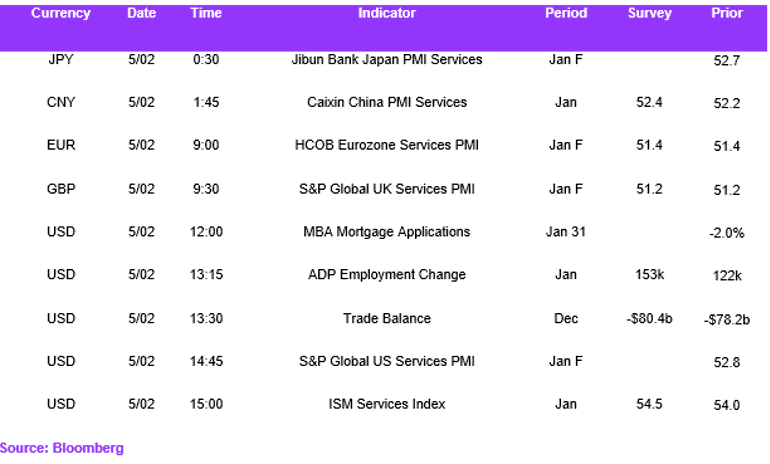

From the technical standpoint, resistance levels at 1.0400 and the 50 DMA at 1.0416 are robust. Today's US labour and PMI releases are crucial for guiding the dollar. Specifically, the market expects the ADP figures to increase from 122,000 to 150,000 in January, indicating a strengthening labour market. Any results that deviate from market expectations could introduce volatility for the pair and are essential for assessing the dollar's outlook today.

Overall, we expect resistance at the 50 DMA to remain robust in the meantime, capping EUR/USD gains.

USD / JPY - Testing Key Support Levels

USD/JPY weakened slightly during the day, nearing a strong support level of 153.50, which has been resilient in recent days. Recent US economic data, particularly the weaker-than-expected JOLTs Job Openings report, has led to a pullback in the US dollar, weakening the pair. Despite this, the interest rate differential continues to support the US dollar against the yen over the longer term, suggesting that buying on dips remains a viable strategy.

Geopolitical factors, including the upcoming meeting between Japanese Prime Minister Shigeru Ishiba and US President Donald Trump, could influence the USD/JPY pair, although significant changes in trade relations are not anticipated. Additionally, foreign investment activities in Japan, such as KKR's tender offer for Fuji Soft, could impact the yen's valuation and, consequently, the USD/JPY rate. Markets will monitor these events to help gauge the outlook for USD/JPY.

From a technical standpoint, USD/JPY faces resistance near the 50-day moving average at 155.01, capping potential gains unless there is a strong fundamental trigger. Meanwhile, the 200-day moving average at 152.81 provides a significant support level. Overall, USD/JPY is expected to continue experiencing choppy volatility, remaining mostly rangebound.

GBP / USD - Cautiously Optimistic Despite BOE's Dovishness

GBPUSD edged higher yesterday, primarily due to the weakness of the US dollar, which has been affected by disappointing economic data such as the JOLTs Job Openings report. This has led the pair to test resistance levels around 1.2485 to 1.2500. The broader market sentiment is also influenced by geopolitical developments, including recent tariff announcements and subsequent delays, adding volatility to the GBPUSD during the day.

The upcoming Bank of England meeting is a significant focus, with expectations of a 25-basis-point rate cut aimed at addressing sluggish inflation and supporting economic growth in the UK. Despite this, the British pound has shown resilience, partly due to hopes of avoiding new trade tariffs.

Technical analysis indicates a rising bullish sentiment, particularly evident from the increasing lower shadow of the candle, which suggests that the market is rejecting prices below the 1.2400 level. However, for a positive outlook on the pair, the resistance at 1.2505 must be breached first.

Overall, the outlook for GBP/USD remains cautiously optimistic, contingent on upcoming economic data and the BOE's decision.

Economic Calendar