Dollar Weakness Drives Key Currency Gains

EUR / USD - Signs of a Potential Sentiment Shift?

EUR/USD showed resilience yesterday, climbing above the 1.0400 level and testing the 50 DMA resistance at 1.0413, suggesting a potential shift in market sentiment. This upward movement comes despite a slightly weaker Euro Area Services PMI, as the US dollar continued to retreat, influenced by a growing trade deficit figure.

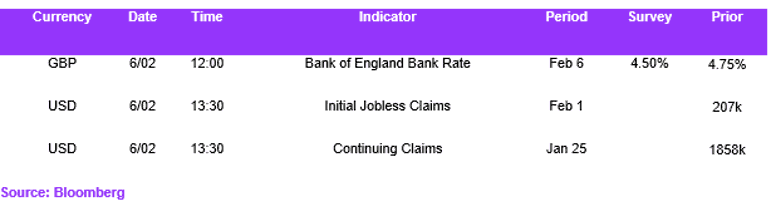

Tomorrow's initial jobless claims are expected to reaffirm the strength of the US labour market, with predictions of 207,000 claims, down from 214,000 the previous week. This should help stabilise the recent downward trend of the US dollar.

A break above the 50 DMA level for EUR/USD could prompt the pair to gain momentum towards the recent high of 1.0521 before reaching 1.0600.

In the meantime, the resistance at 1.0413 is crucial, and a break above this level could further enhance the market's risk-on appetite.

USD / JPY - Japanese Wages Drive Yen Strength

USD/JPY sold off yesterday, breaking through a strong support level at 154.00 and closing below the 200-day and 100-day moving averages, which are at 152.80 and 152.73, respectively. The decline was driven by a weakening US dollar and strong wage data from Japan. Specifically, Japan's data indicated ongoing inflationary pressures, with wages increasing by 4.8% year-over-year, the largest rise since 1997.

This data puts further pressure on the BOJ to hike interest rates, which is narrowing the yield gap in forward expectations between the two central banks. This compression in spreads is contributing to the appreciation of the yen.

Due to the technical break below the longer-term moving averages, there is potential for further decline in USDJPY. The next robust support level is at 150.50.

GBP / USD - A Watchful Eye on the BOE

GBP/USD showed resilience, with a moderate bullish momentum prompting the pair to settle above the 1.2500 level despite weaker-than-expected UK Services PMI data.

The pair's daily chart has indicated a potential for a breakout from a downtrend channel, forming a head and shoulders base, with higher highs in both the RSI. However, yesterday's longer upper wick formation suggests that the resistance level at 50 DMA at 1.2502 remains robust.

The markets have fully priced in a 25 basis point cut from the BOE tomorrow. If this move occurs, we expect only a limited reaction from the market. Instead, the US dollar will continue to play a crucial role in shaping the GBP/USD narrative.

Economic Calendar