Mexican Peso Focus

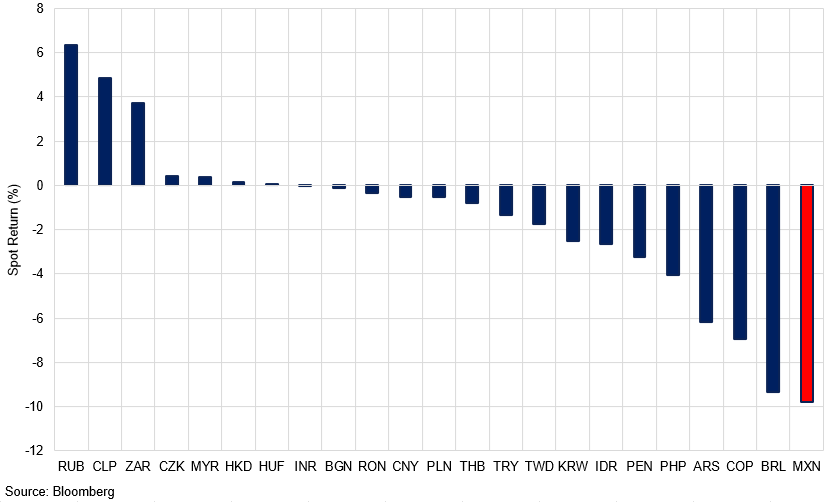

In June, the Mexican Peso experienced one of the sharpest corrections, positioning it as one of the poorest performers among Emerging Nations in recent months. The USDMXN shed as much as 10% since the start of the second quarter. This year, emerging currencies, particularly those from Latin American regions, have faced considerable challenges, such as fiscal and political policy uncertainties, adding to currency volatility in recent weeks.

EM Country FX Performance Comparison Against USD

Mexican Peso was the worst-performing EM currency in Q2 2024.

Mexican Presidential Elections

In particular, Mexico grappled with unprecedented hostility during the largest elections on record. In June, Mexicans went to the polls to choose their next President and the entire membership of Congress, as well as local lawmakers, mayors and council members. Popular incumbent President Andrés Manuel López Obrador, widely known as AMLO, will leave office in October as re-election is not permitted. AMLO, who began his term on December 1st, 2018, won the 2018 presidential election by a landslide and maintained an approval rating of over 60% throughout his presidency. He has built a reputation as an approachable leader by demonstrating a commitment to accessibility by adopting personal austerity measures, engaging with overlooked communities, and openly discussing national concerns.

The newly elected President, Claudia Sheinbaum, the first woman to hold the office, faces significant challenges plaguing Mexico for years. Sheinbaum, the candidate of the Sigamos Haciendo Historia coalition and a member of MORENA, the party founded by AMLO, is expected to continue many of his policies. However, she is also anticipated to introduce her own initiatives and potentially take a different approach in certain areas.

AMLO's administration prioritised social programmes, particularly pension support for the elderly, infrastructure development, and created an investor-friendly environment that attracted companies interested in nearshoring – producing goods for the US market in Mexico. Sheinbaum proposes to follow a model similar to AMLO's but plans for more state intervention in the economy. She has also demonstrated a keen interest in sustainable development and environmental issues.

Mexico Nominal Exports FOB to US

Trade relations between Mexico and the US have been improving in recent years.

Uncertainty surrounding the Presidential Elections earlier in the month caused the Peso to lose 15% within a couple of weeks. However, it managed to claw back some of its losses after President-elect Claudia Sheinbaum chose several cabinet members who are viewed favourably by the market. Among them is Sheinbaum's close ally and former Mexico City finance chief, Luz Elena Gonzalez, who will become energy minister, tasked with revitalising the struggling state oil company and increasing the use of renewables.

On the international front, one of Sheinbaum's key proposals is to create a permanent regional mechanism to coordinate a comprehensive approach to migration, sharing resources, knowledge, and strategies among countries in the region. Sheinbaum aims to maintain a greater presence in multilateral spaces such as the UN General Assembly, the G20, and the Community of Latin American and Caribbean States (CELAC). During his presidency, AMLO prioritised domestic reform, believing that a strong domestic policy is the best foreign policy. Sheinbaum vowed to prioritise trade relations with the US and incentivise companies to relocate operations to Mexico, thereby reducing reliance on Chinese supply chains.

The newly elected President's foreign policy could be significantly influenced by the outcome of the 2024 US presidential election. A second term for President Joe Biden would likely ensure continuity, whereas a victory for Donald Trump could present substantial challenges for US-Mexico relations. As Sheinbaum steps into office, the direction she chooses will be critical in shaping Mexico's future, addressing its persistent issues, and potentially carving out a new path in domestic and foreign policies.

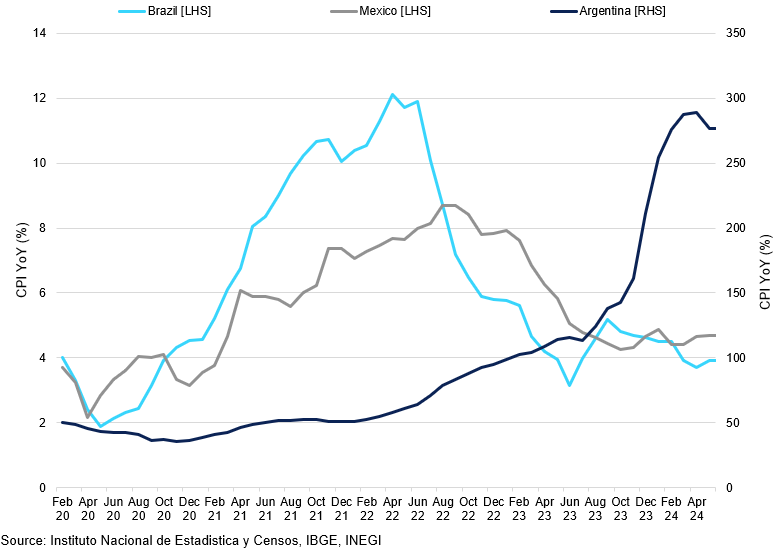

Latin American Inflation Comparison

In line with Brazil, Mexican inflation remains upwardly sticky.

Mexican Economy

Following the central bank's decision to keep interest rates steady at 11.0% last week, attention has now shifted to the next meeting scheduled for August 8th. We believe that the decision to keep interest rates unchanged allows officials time to assess the potential economic impacts of the policies introduced by the newly elected President and respective government. Earlier this year, the central bank started its cutting cycle, marking the first interest rate decrease since early 2021, in an effort to mitigate post-pandemic inflationary pressures.

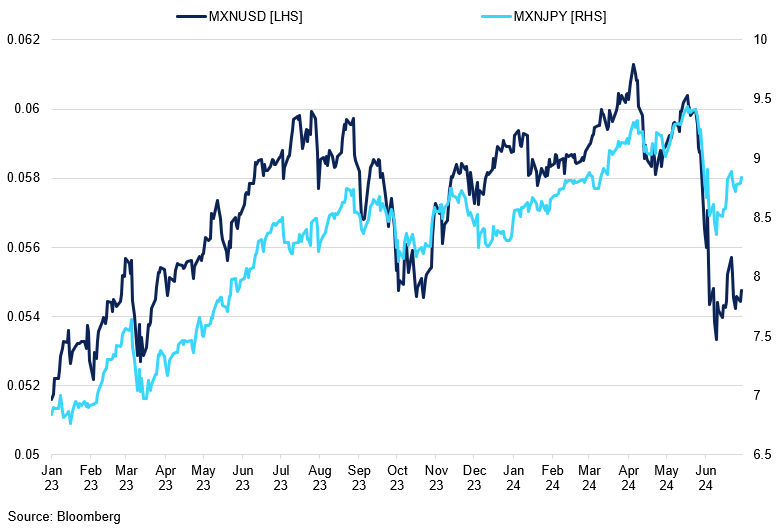

MXN Valuation against USD and JPY

MXN weakened significantly against USD and JPY, its main carry pairs.

Mexico and Brazil led the way in raising interest rates within the Latin American region, giving these countries more room to implement cuts sooner as they experienced a faster inflation decline. Nonetheless, after considerable softness, prevailing inflation stickiness from the service sector has put a floor to the scale and timing of subsequent interest rate cuts.

As we examine current inflation trends to predict the central bank's potential action, it is becoming more evident that more risks are emerging for CPI to remain upwardly sticky. As of early June, Mexican inflation accelerated more than expected to exceed the central bank's target of 2-4%. The CPI increased 4.78% in the first two weeks of June, above the 4.73% median estimate. Additionally, core inflation accelerated from 4.11% to 4.17% YoY. This uptick can, in part, be attributed to ongoing drought conditions, which have notably driven up the price of food items. However, the persistent rise in service inflation is particularly concerning for policymakers. The issue of inflation remaining stubbornly high looks set to persist over the coming months. Factors like the continuous impact of drought on food production and the steadfast increase in service costs are expected to maintain upward pressure on the overall inflation rate. Consequently, this situation will likely postpone any further rate cuts by the central bank in the coming months.

Mexico's economy has proven to be surprisingly robust, achieving a growth rate of 3.3% in 2023 while maintaining historically low unemployment rates. As we look ahead, we anticipate that the central bank will adopt a cautious stance until September as policymakers monitor challenges posed by a weakening currency, largely due to political uncertainties, alongside persistent inflationary pressures. The cut in September would also align with the Fed's expected rate reduction, which is crucial for influencing investor confidence in higher-risk emerging markets. We expect a cautious and flexible approach from Banco de Mexico policymakers in the coming months.

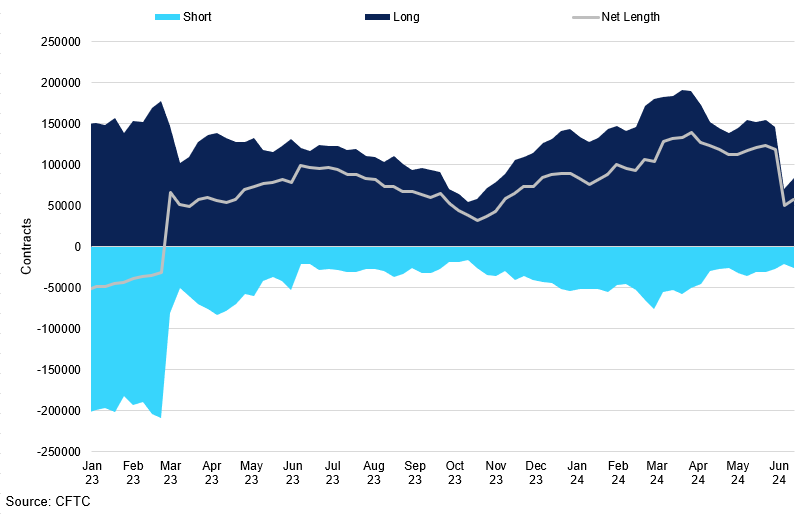

Mexican Peso Non-Commercial COT

Speculative traders have been key to MXN price narrative in recent weeks.

Desk Comments

GBP

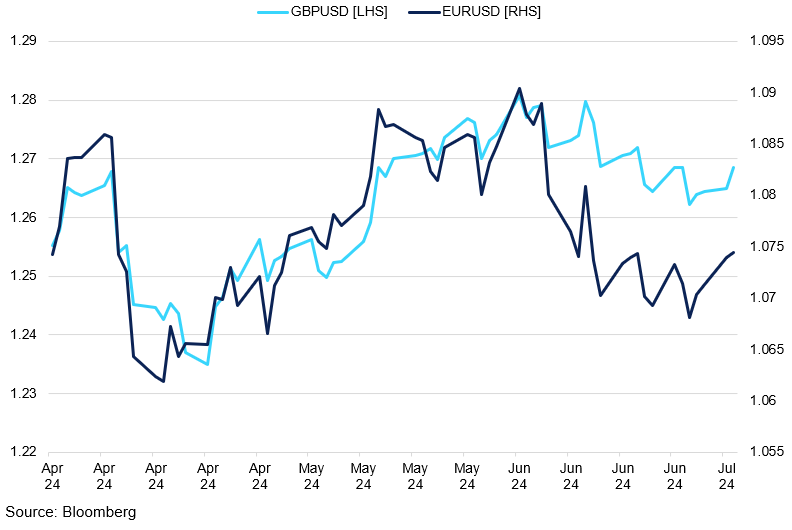

The risk premium added to the UK election has been nominal compared with the French elections as the market is predicting a labour majority as a near certainty. We continue to expect GBP to trade positively in the near term as the UK economy continues to be more resilient and could benefit from a potential change in the narrative on underpriced UK assets as a labour led government will have a more united stance toward the EU and could see a softer implementation of post-Brexit regulation boosting growth and easing inflation through opening of supply chains.

GBP is the best performing G10 currency this year and we believe this is set to continue. The economy recovered from a recession more quickly than estimated and is experiencing the strongest growth in two years. GDP was up 0.7% in Q1 and forecast to be 0.5% for Q2 when the data is released in August. Services and consumer spending are both driving gains aided by a continued rise in wages and a loosening of the cost of living squeeze although its recovery from the pandemic still lags behind its major peers.

The BOE is pricing 43 bp of cuts this year and we believe the risk is for less cuts than priced due to elections and a continued higher print in services. This will boost GBP price action further. We still look to sell EURGBP rallies and also favour being long against low yielding JPY and CHF.

EUR

The EUR price action is currently dominated by the French parliamentary elections. The first round of votes shows Marine Le Pen’s National Rally (RN) has taken a firm win but will likely fall short of an absolute majority of 289 votes that’s needed. The result erased the risk premium added when Macron announced the surprise election. Vol dipped to 5.9 from a high of 6.5 a few weeks ago. EUR price action also reacted positively. In our view there is still a lot of political uncertainty with other parties trying to form a tail left coalition or centrist coalition, which still points to a lack of budget progress. The risk of contagion is limited, and we expect further consolidation ahead of the 2nd vote. 10 year German and French bonds have also narrowed.

We anticipate no changes in policy from the ECB after last months cut. Inflation remains persistent and the ECB is likely to delay any more cuts until more data is available. The direction of the EUR is very hard to call in the near term due to political uncertainty. Technically the EUR is trading lower and an absolute majority by either the RN or NFP would be seen as negative while only if Macron performs better than expected or can form a technocratic government would the outlook improve.

GBP and EUR vs USD

Both the sterling and the euro have fallen, weighed on by political uncertainty surrounding election outcome.

USD

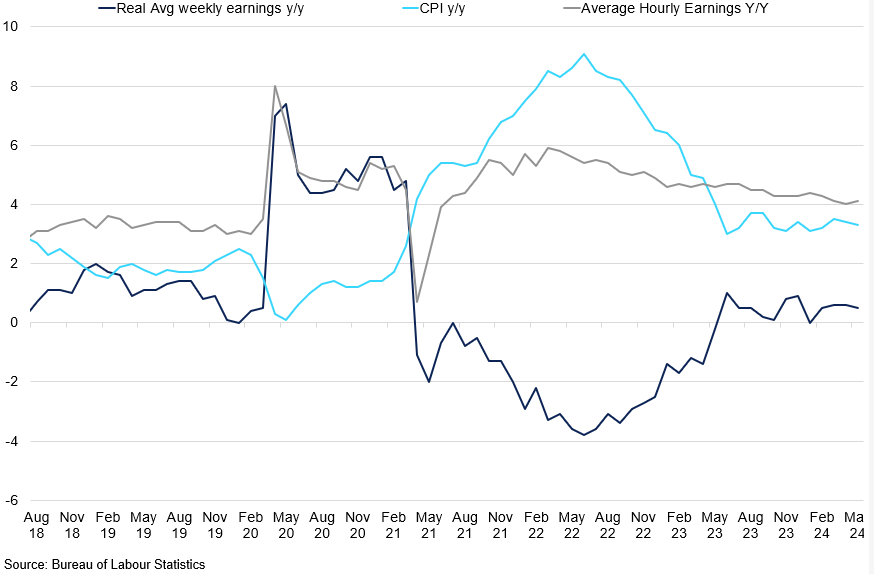

USD appreciated against all the G10 majors in a volatile month driven by a slightly more hawkish Fed, with dot plots showing fewer cuts expected in 2024 and fuelled by increased political risk in Europe. Economic data has been mixed NFP, PMI’s ISM service index showing strong figures, while disinflation narrative is also picking up traction following downshift in retail sales spending and soft CPI, PPI and Core PCE readings, the later softest in 3 years.

US Wages vs CPI

Inflation, and in turn, real average income remains sticky.

The economic situation in the US means the FED can wait and is unlikely to act on rates before Sep. By then, we should have 3 sets of Employment and Inflation numbers which will provide a lot better picture of the state of the US economy. We believe data will show inflation under control and economy cooling by then. While payrolls are the first number most look at, we will be keeping an close eye on the unemployment figure which is currently just short of the half point rise that triggers the Sahm Rule, an indicator watched by the Fed which provides early indication of a looming Recession; If triggered, we would expect some prolonged USD weakness as a result. The desk still expects to see a 75-basis point cut in 2024, which could happen in one go if the FED doesn't take the opportunity to cut before the elections, hence our bearish view going into end of the year.

The US elections have already started impacting markets and is likely to become increasingly impactful as we approach Nov 3rd. Following the first debate last week between Biden and Trump, polls suggested the incumbent Biden lost by a large margin with calls for him to step down as a nominee. In response to the Debates, USD move was muted but there has been an aggressive bear steepening move in treasuries amid the growing prospect of a Trump win, which could have longer term USD impact.

Our Outlook

Our View

Considering the upcoming months, we see limited upside potential for the Mexican Peso due to various factors. Although the persistence of high interest rates might yield differential support for MXN, we anticipate that other influences will override any strong gains. While the impact of major political uncertainties has diminished, the longer-term political landscape still appears uncertain. The current Mexican administration's push for its reform agenda looms over the market, which could dampen interest in the Mexican Peso—previously favoured for carry trades with JPY—over a longer horizon. This pair, in particular, has been significantly impacted by the unwinding of carry trades, leading to a notable decline in its value in recent weeks.

Technical Analysis

GBPUSD

GBPUSD has been consolidating in a small range after failing to break 200-week MA or failing to close above white downtrend. We expect GBPUSD to consolidate between the wedge formed by white downtrend lines and green trendline. On the upside, a close above white trend line and the 200-week moving average likely to lead to retest of 2023 highs at 1.3142, with a break above could see the cross target 2022 highs @ 1.3749. On the downside, a close below green trendline could lead to a move lower with support coming @ 1.2037 and then 1.18; support beyond there coming at 1.1420 (61.8% fib).

EURUSD

EURUSD remained within the wedge, and we expect EURUSD to continue trading rangebound with a break out of the wedge indicating future direction. On the upside, a break above white trend line could see market test Red trendline/200day Ma, with a close above leading to market testing highs from July @ 1.1276, with resistance beyond there coming at 1.1495/1.1500. On the downside a break below blue trend line will lead a test 1.05/1.0448 (lows from Sep), with a close below to lead to further declines to 1.02 (61.8% Fib).