US stocks fluctuated today, coming off a week of record-setting performances. Economic figures released indicated a slight dip in New Home sales for January, with numbers falling to 661,000 from December's 664,000. However, these figures still surpass the long-term average, signalling a robust housing market and strong consumer confidence despite enduring high borrowing rates. This continued upbeat data from the world's leading economy suggests the Fed may not be in a hurry to implement monetary easing, with the 10-year Treasury yield holding steady at around 4.3%. The dollar experienced a minor decline, positioning itself at 103.80.

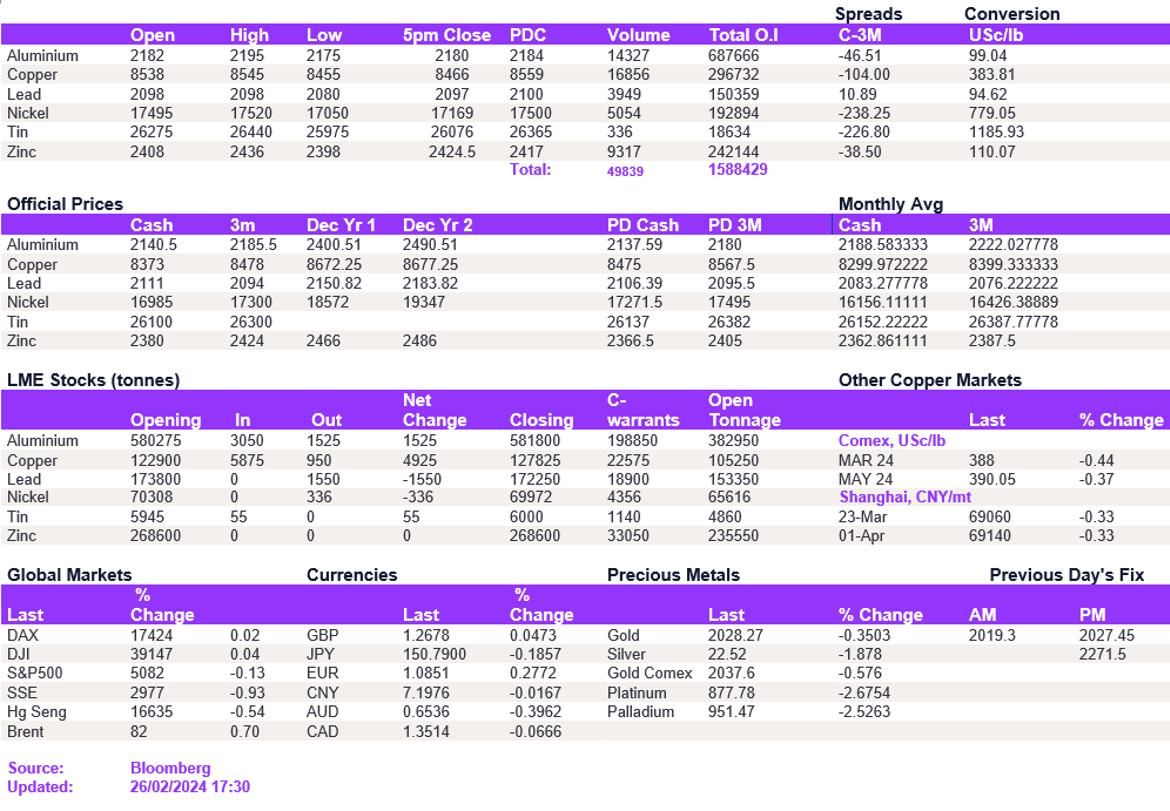

Following last week's strong fluctuations due to geopolitical escalations in Russia, the metals market quieted down. Metals that were most impacted by the news, such as copper and nickel, have seen their gains reverse today, edging back to the average of $8,400/t and $16,500/t, respectively. In particular, nickel losses were quite protracted, erasing the jump above $17,000/t, which we believe was overbought. We expect prices to return to the recent trading range of $16,000-16,500/t, where the market remains fundamentally balanced. Likewise, lead struggled above the $2,100/t level and remained below it at $2,097/t. Aluminium tested the robust support level of $2,175/t but struggled to break below it, given a lack of impetus from the market.

In reaction to the uptick in Treasury yields, gold witnessed a minor decrease, pricing at $2029/oz. Silver saw a more noticeable drop, descending to $22.5/oz. Oil has maintained a stable trading range lately, and this trend is expected to persist as the dynamics of OPEC+ production cuts and heightened geopolitical tensions are counterbalanced by a slackening in global demand. WTI, currently at $77.3/bl, is anticipated to near the $78 mark again, whereas Brent crude, priced at $82.2, will likely reach $83.5/bl in the coming days.

All price data is from 26.02.2024 as of 17:30