US stocks began the week on a positive note as investors awaited US CPI data, which will provide insights into the timing of the Fed’s initial interest rate cuts. The anticipation of rising inflation has tempered expectations for a June rate cut, with forward swaps now indicating only a 53% likelihood of a mid-year reduction, compared to a 93% chance for the ECB. The dollar experienced a slight dip to 104.2, while the 10-year US Treasury yield held steady at 4.43%.

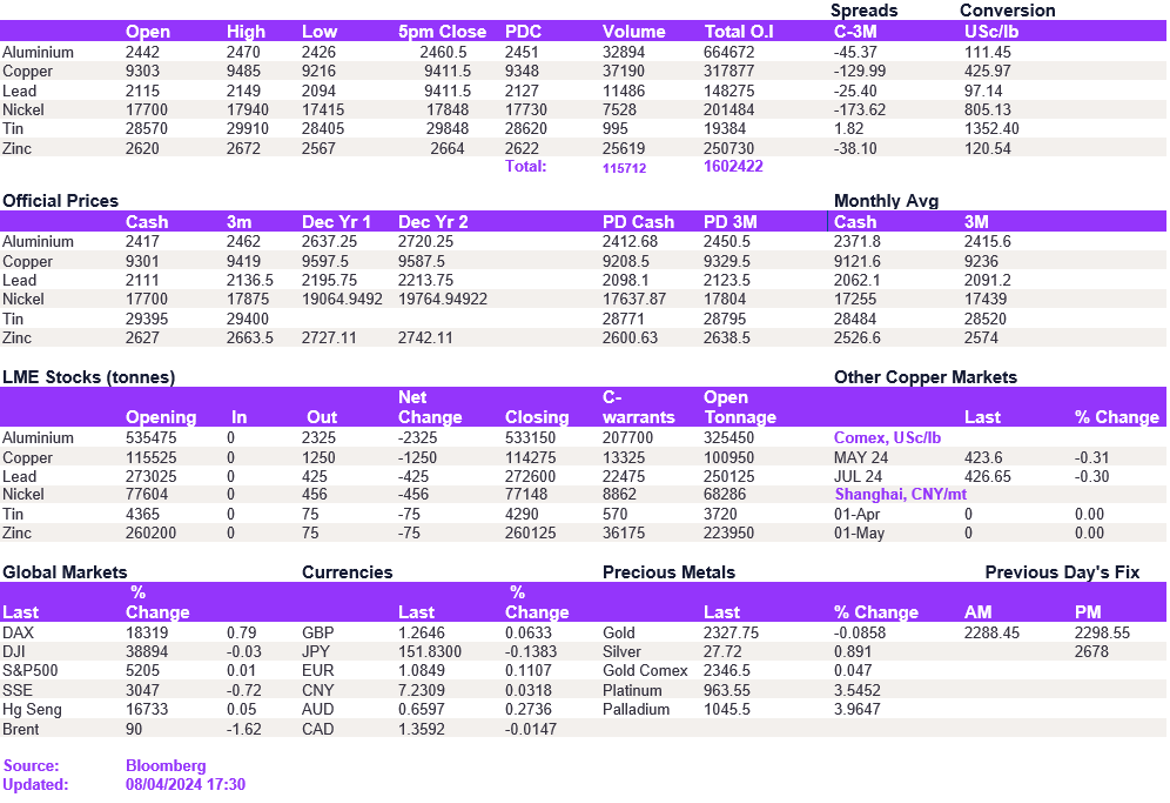

Base metals held steady today and maintained the gains made last week. The recent upward trend was due to high speculative appetite, but investors are now looking at the fundamental trend to determine if demand is increasing in China and the West. In particular, iron ore futures broke back above the $100/mt level, suggesting that the narrative might be improving for the place of the metal. Aluminium and copper once again tested robust resistance levels at $2,450/t and $9,400/t, looking comfortable to break above these levels. We expect prices to gain a marginal upside before seeing some softness.

In the commodities market, gold continued its upward trajectory, setting a new record at $2,331/oz. Silver also appreciated, reaching $27.8/oz. Meanwhile, oil prices saw a slight pullback but remained high, with WTI and Brent crude trading at $86/bl and $90/bl, respectively.

All price data is from 08.04.2024 as of 17:30