US stocks opened higher today following the release of inflation data. The newly released US Consumer Price Index (CPI) data for May indicated that inflation increased less than expected, suggesting that price pressures are easing as we enter the third quarter. The headline CPI was 3.3% YoY in May, down from 3.4% YoY in April, while core inflation softened to 3.4% YoY from 3.6% YoY. This development fuels optimism that the Federal Reserve might lower interest rates in September. Investors are now awaiting this evening's Fed statement to gauge the possible timing of the start of monetary easing. Following these announcements, the dollar index fell below 104.3, and the 10-year US Treasury yield dropped to 4.26%.

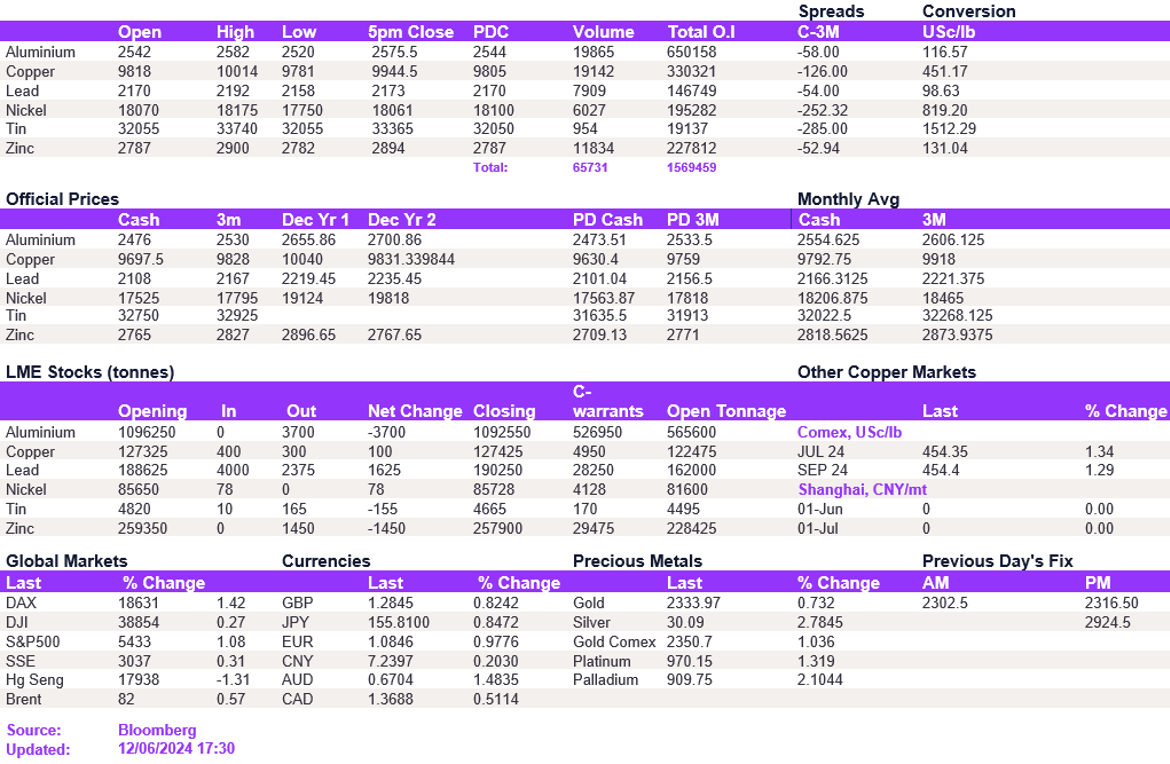

Base metals kicked off the day on a positive note, finding support above the current levels. However, a softer-than-anticipated US CPI report later in the day caused the dollar to weaken, which helped offset yesterday's price weakness. Aluminium's price climbed to $2,575.50/t, while copper, testing the significant $10,000/t, struggled above this level and close at $9,944.50/t. Due to its less liquid market, tin experienced sharp upward pressures, jumping by over $1,000 to reach $33,365/t.

Gold traded at $2,322/oz, while silver recovered yesterday's losses, reaching $29.8/oz. Oil continued its upward trajectory, with WTI at $78.4/bbl and Brent crude at $82.4/bbl.

All price data is from 12.06.2024 as of 17:30