US stocks opened lower today, mirroring declines in Asian stocks after the PBOC decided to leave its main interest rate unchanged at 2.5%. China's industrial production decreased more than expected in May, dropping from 6.7% YoY to 5.6% YoY. Additionally, China's home prices fell faster than anticipated in May despite the country's efforts to support the property market, indicating ongoing economic challenges. In the US, the Empire Manufacturing Index, which measures the health and performance of the manufacturing sector in New York State, rose from -15.6 to -6.0 in June, surpassing the 2-year average. The dollar edged slightly higher to 105.5, while the 10-year US Treasury yield increased to just below 4.3%. All eyes are on the French Elections, which are overshadowing central bank meetings, and several economic data releases this week.

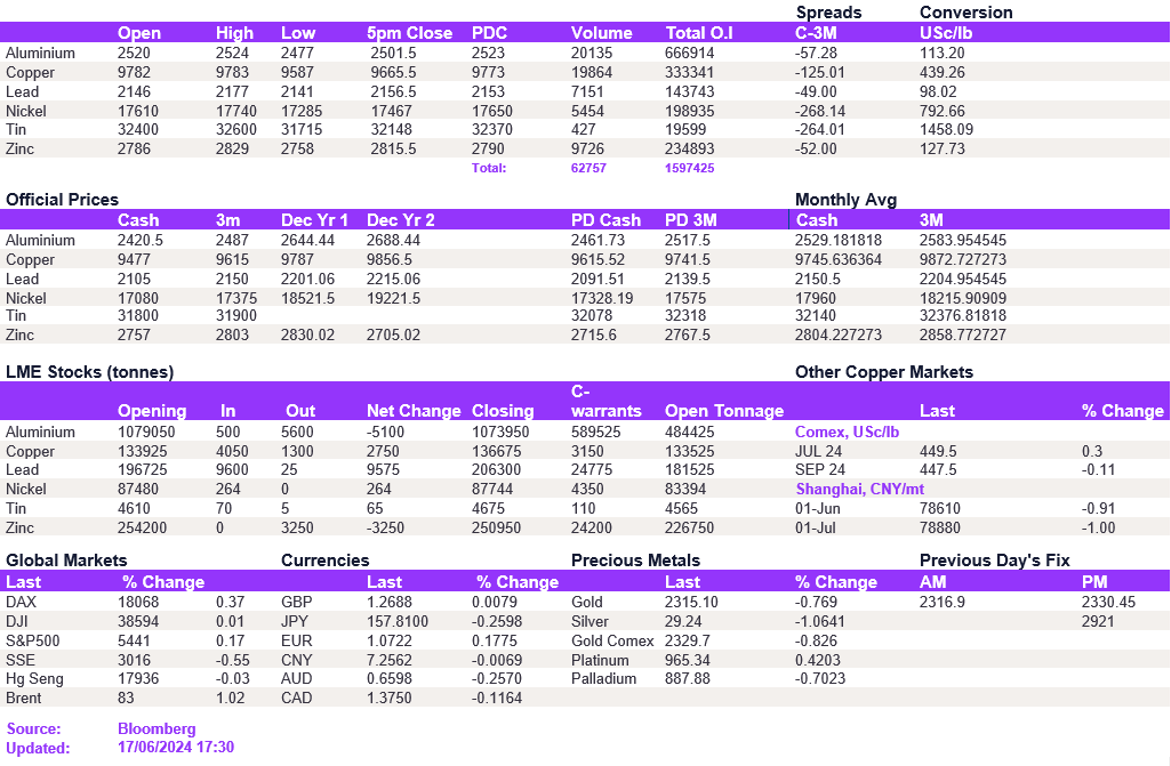

Meanwhile, the political uncertainty in Europe data had little influence on the complex today, as metals mirrored their performance from last Friday at the week's opening. Despite ongoing efforts to bolster the country's major property sector, weaker home price figures from China, and the PBOC's decision to leave its key policy rate unchanged underscore the persistent fragility of the domestic market. Aluminium edged lower, testing the robust support level of $2,500/t, closing above it at $2,501.50/t. Copper tested the $9,680/t level again, but prices struggled to break below it completely, prompting the metal to close at $9,665.50/t. Meanwhile, nickel extended its weakening trend for the 15th consecutive trading session, reaching $17,467/t.

Precious metals softened today, with gold decreasing to $2,323.2/oz and silver edging lower to $29.4/oz. Conversely, oil traded higher, with WTI at $79.5/bbl and Brent crude at $83.5/bbl.

All price data is from 17.06.2024 as of 17:30