US stock markets were closed today in observance of Juneteenth, after closing at record highs yesterday, driven by Nvidia's continued surge to new peaks. Nvidia has now surpassed Microsoft to become the world's most valuable company. The dollar index remained mostly flat at 105.2. Meanwhile, UK Consumer Price Index (CPI) fell to 2% YoY in May, the lowest reading since July 2021. However, services and core inflation remain higher than in the Eurozone, and the BoE’s Monetary Policy Committee is widely expected to keep rates on hold this Thursday.

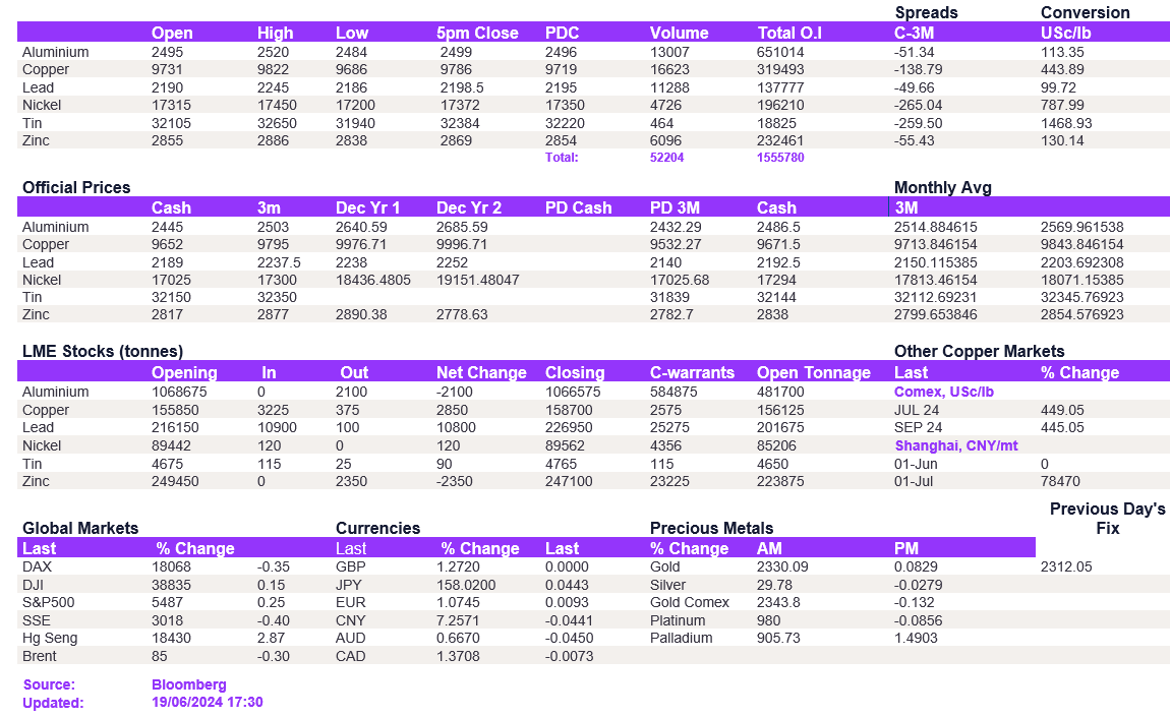

The recent streak of declines in the LME space halted today, with a slight rebound seen across the board. Copper edged up, trading at $9,761.5/t, while aluminium remained mostly unchanged at $2,496.5/t. Nickel hovered around the $17,370/t level. Elsewhere, lead tested $2,250/t but later declined to $2,200.5/t, while zinc traded at $2,861/t.

Gold edged slightly lower, trading at $2,326.2/oz. Conversely, silver edged higher, standing at $29.6/oz. Oil continued its upward trajectory today, with WTI at $81.8/bbl and Brent at $85.7/bbl.

All price data is from 19.06.2024 as of 17:30