US stocks opened higher today, with the S&P 500 breaking a record high at the 5500 level. Data from the world's largest economy indicated a slight decline in the number of initial applications for unemployment benefits last week. Initial claims fell to 238k, lower than the 249k reported at the same time last year, despite a prolonged period of elevated interest rates. The resilience of the US economy was reflected in the dollar index, which rose above the 105.5 level. The 10-year US Treasury yield also increased, trading close to 4.28%.

Elsewhere, the Bank of England (BoE) kept the main interest rate unchanged at 5.25%. Although recent inflation figures pointed to price pressures softening to the target 2% level, policymakers reiterated the importance of ensuring the risk of inflation resurfacing is fully mitigated before commencing monetary easing. Investors increased their bets on a rate cut in August, with forward swaps currently pricing in more than a 60% chance of a cut in the summer.

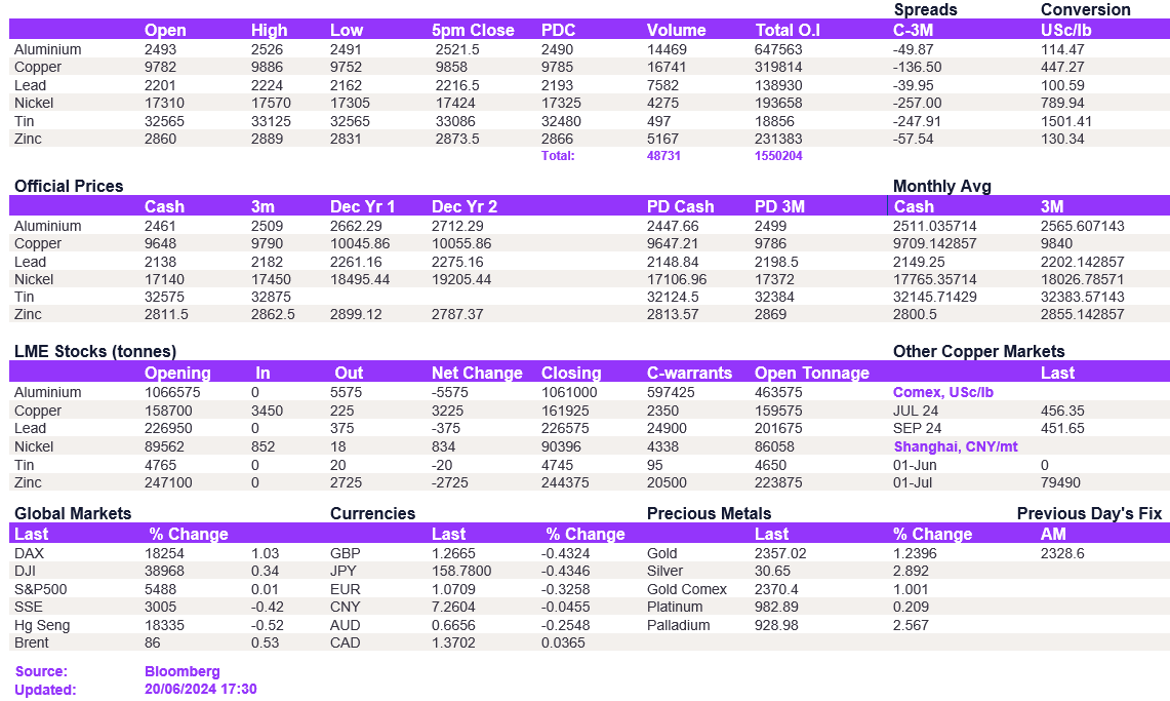

The LME space saw another day of upward movements, albeit with very soft price increases. Aluminium rose above $2,520/t—a level it has been testing but struggling to break since the start of the week—while copper increased above $9,850/t. Lead fluctuated around the $2,200/t level, while zinc tested the $2,880/t level, trading at $2,872/t at the time of writing.

Despite a stronger dollar and rising Treasury yields, precious metals jumped today. Gold rose to $2,358.4/oz, while silver surpassed the $30/oz mark again, trading at $30.64/oz. Oil also saw gains, with WTI and Brent crude trading at $82.25/bbl and $85.66/bbl, respectively.

All price data is from 20.06.2024 as of 17:30