US stocks opened higher today. Data from the world’s largest economy pointed to a slight downturn in manufacturing activity in June. The S&P Global Manufacturing PMI for the US came in lower than expected at 51.6, compared to 51.7 in May, while the ISM Manufacturing Index fell to 48.5 from 48.7. The dollar index softened slightly to 105.62, while the 10-year US Treasury yield edged higher, testing 4.45%. Elsewhere, the outcome of the first round of the French elections sparked a relief rally, with the euro rising and the yield differential with German bonds narrowing. The absence of gridlock between the far-right and far-left reduced concerns about a radical policy shift. Markets are now pricing in a lower probability of Le Pen securing a majority compared to last week. If three parties remain in the race, uncertainty about the outcome will likely stay high this week.

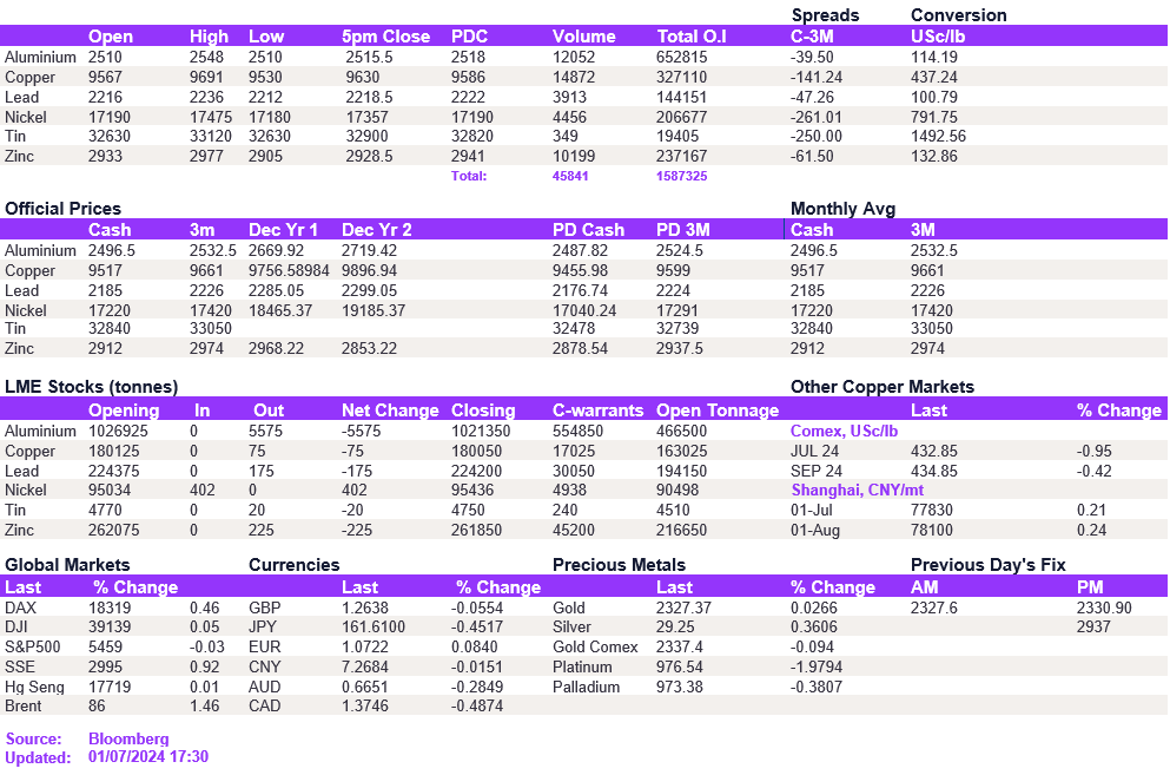

The base metals complex started the week on the front foot, partly due to better-than-expected data from China. Specifically, Caixin Manufacturing PMI showed the fastest growth since May 2021, with strong production and employment figures. This led to a rally in the Shanghai property index, indicating a potential shift in sentiment towards the property sector in the region. While we believe the segment will begin the recovery process in the second half of 2024, it may not be sufficient to boost demand and prices significantly. We anticipate that fundamental factors will continue to drive a marginal upside this week. In the meantime, aluminium edged back above the $2,500/t level while copper tested the $9,690/t resistance. The rest of the complex followed suit.

Precious metals saw an uptick, with gold increasing above $2,330/oz and silver testing $29.4/oz. Oil also appreciated, with WTI and Brent crude trading at $82.2/bbl and $85.7/bbl, respectively.

All price data is from 01.07.2024 as of 17:30