US stocks opened higher today following the release of inflation data. Newly released US CPI for June showed that inflation softened more than expected, suggesting that price pressures are easing as we enter the summer holiday season. The headline CPI came in at 3.0% in June compared to 3.3% in May, while core inflation softened to 3.3% from 3.4%. This development fuels optimism that the Federal Reserve might lower interest rates in September. Forward swaps are now pricing in a 96% chance of a 25bps cut in the first month of autumn. The dollar index plunged today, trading at 104.25, while the 10-year US Treasury yield decreased below 4.18%.

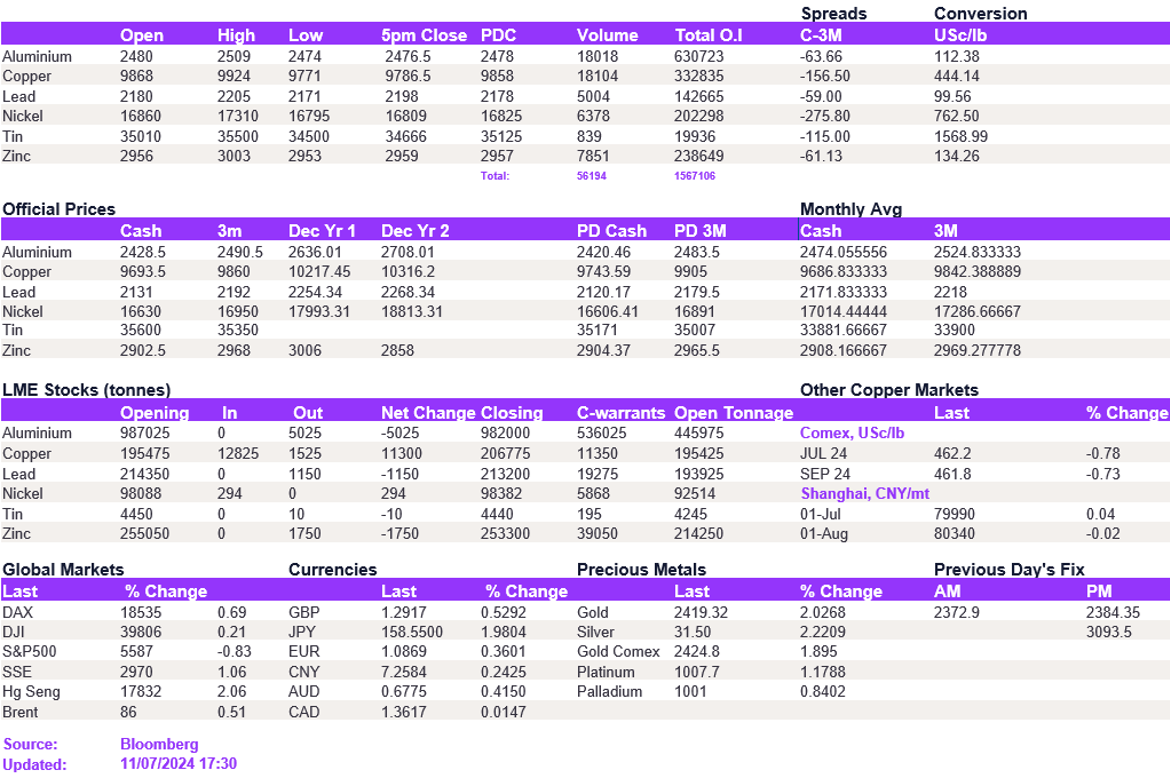

Base metals reversed yesterday's trend, suggesting the market lacks the conviction to break out of current trading ranges. In particular, aluminium found support at $2,470/t – the level that held firmly in recent weeks to close at $2,476.50/t. Copper was at $9,786.50/t. Nickel tested prices above the $17,000/t level but struggled above it, coming back to $16,809/t. Lead and zinc remained firmly below the resistance levels of $2,200/t and $3,000/t, respectively. The dollar's weakness struggled to provide any incentive on the upside, suggesting a growing disconnection between complex and macroeconomic factors. Instead, prices are likely to be driven by individual metal's narrative, and psychological support and resistance levels will be key to assessing appetite out of current trading ranges.

The decline in Treasury yields and the dollar drove up precious metal prices. Gold surpassed the $2,400/oz mark, while silver jumped above $31.5/oz. Oil fluctuated, with WTI and Brent crude trading at $81.9/bbl and $84.9/bbl, respectively, at the time of writing.

All price data is from 11.07.2024 as of 17:30