US stocks opened higher today. The current sentiment shows investors are increasingly certain that the Fed’s monetary easing will begin in early autumn. A higher-than-expected Producer Price Index (PPI) report, which measures the change in prices received by domestic producers for their output, did not alter the market’s expectations regarding the first Fed cut in September. The PPI for June rose to 0.2% YoY, up from a -0.2% YoY decline in the previous month and surpassing the forecasted 0.1% YoY increase. At the same time, June marked the fourth consecutive month of decline in the University of Michigan Consumer Sentiment Index. This index measures consumer attitudes and expectations regarding their personal financial situation, the overall economy, and buying intentions for various goods and services. The dollar index softened further, hovering just above 104.0, while the 10-year US Treasury yield remained mostly unchanged at 4.2%.

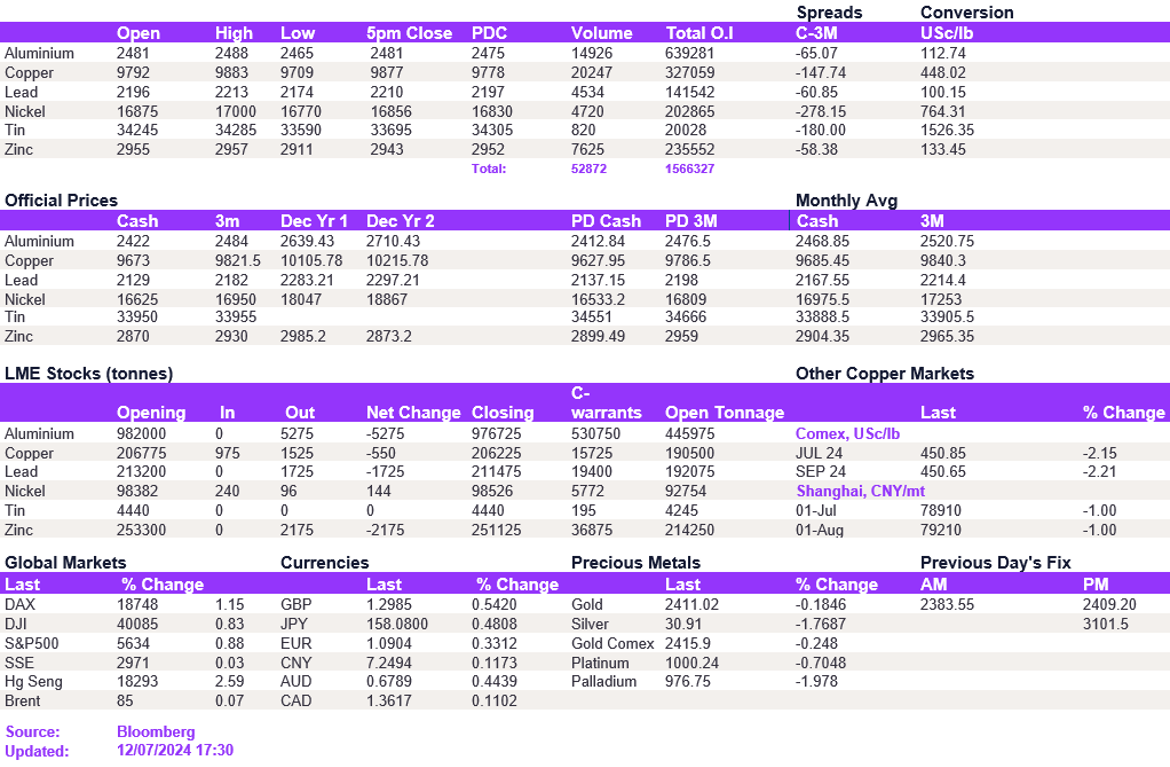

Base metals held their nerve today, assessing the appetite out of current trading ranges. Both copper and aluminium remained broadly unchanged at $2,481/t and $9,877/t, respectively. Nickel remained below the key $17,000/t level at $16,856/t. Tin weakened as protracted selling pressure erased recent days’ gain, closing at $33,695/t.

Despite a weaker dollar, precious metals gave a lacklustre performance. Gold traded at $2,410/oz, while silver stood at $30.9/oz. Oil prices also traded in a tight range, with WTI at $83.15/bbl and Brent crude at $85.7/bbl.

All price data is from 12.07.2024 as of 17:30