US stocks fluctuated today following the publication of macroeconomic data indicating continued strength in the US economy. The world’s largest economy grew faster than expected in Q2’24, driven by solid gains in consumer spending and business investment, while inflation pressures subsided. This development leaves intact the expectations of a September interest rate cut from the Fed. GDP grew at 2.8% QoQ last quarter, compared to 1.4% in the first three months of the year. The news had little impact on the dollar, with the dollar index remaining broadly unchanged at 104.25, while the 10-year US Treasury yield declined slightly, trading at 4.23%.

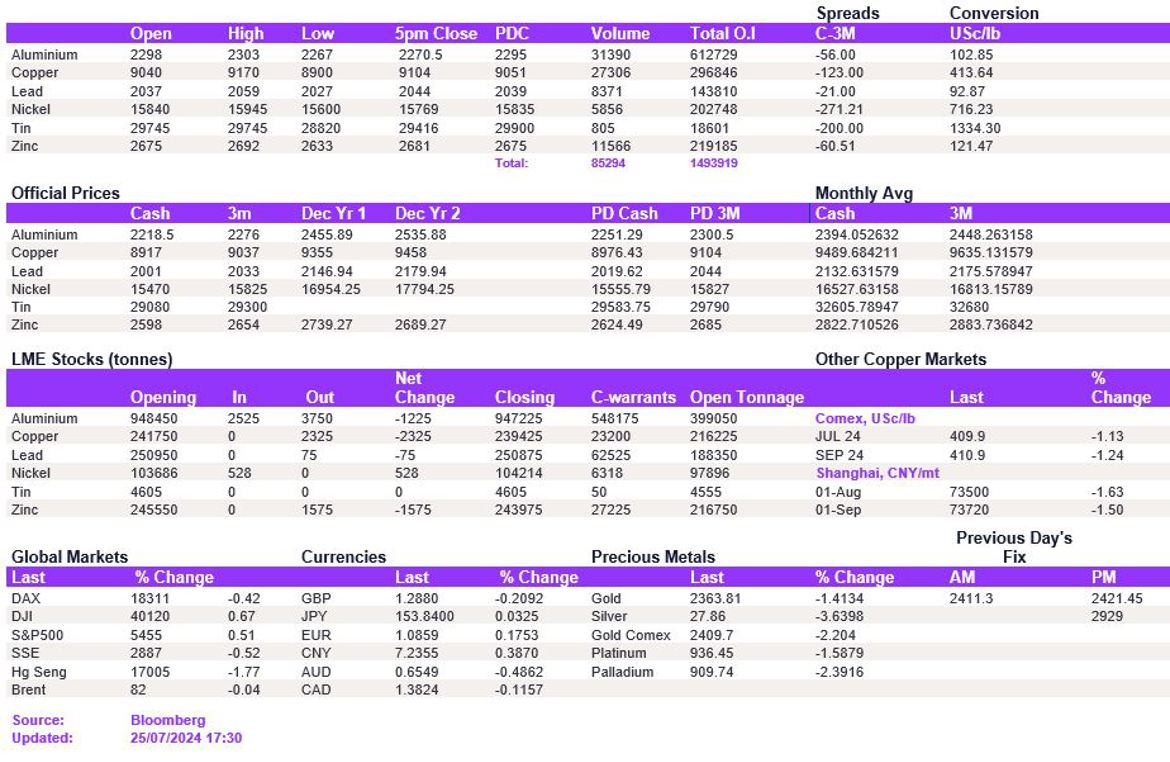

Another day of marginal moves was seen across the base metals market today. Copper was once again closely watched, testing the $8,900/t level before rebounding back above $9,100/t. Lead also rebounded slightly, trading at $2,052/t. Other metals in the complex weakened, with aluminium testing $2,270/t while nickel declined to $15,675/t.

Precious metals also saw losses today. Gold declined to $2,363/oz, while silver experienced a major sell-off, depreciating to $27.85/oz. Despite the US economy proving more resilient than expected, oil prices remained broadly unchanged, with WTI and Brent crude at $77.6/bbl and $81.5/bbl, respectively.