US stocks rose at the opening of a week packed with significant economic data releases. This week, data from the US labour market, including the ADP Employment report, changes in non-farm payrolls, and the unemployment rate, will be crucial for investors. Last month, a lower-than-expected ADP Employment report influenced market expectations, leading investors to fully price in a Fed interest rate cut in September. The upcoming FOMC meeting and statements from policymakers are expected to confirm that monetary easing will begin in September. As we approach the start of monetary easing, the US economy, despite some weakening, continues to show signs of resilience, making the dollar the most attractive currency in the safe-haven currency basket. The dollar index increased today, standing at 104.7, while the 10-year US Treasury yield softened, trading at 4.18%.

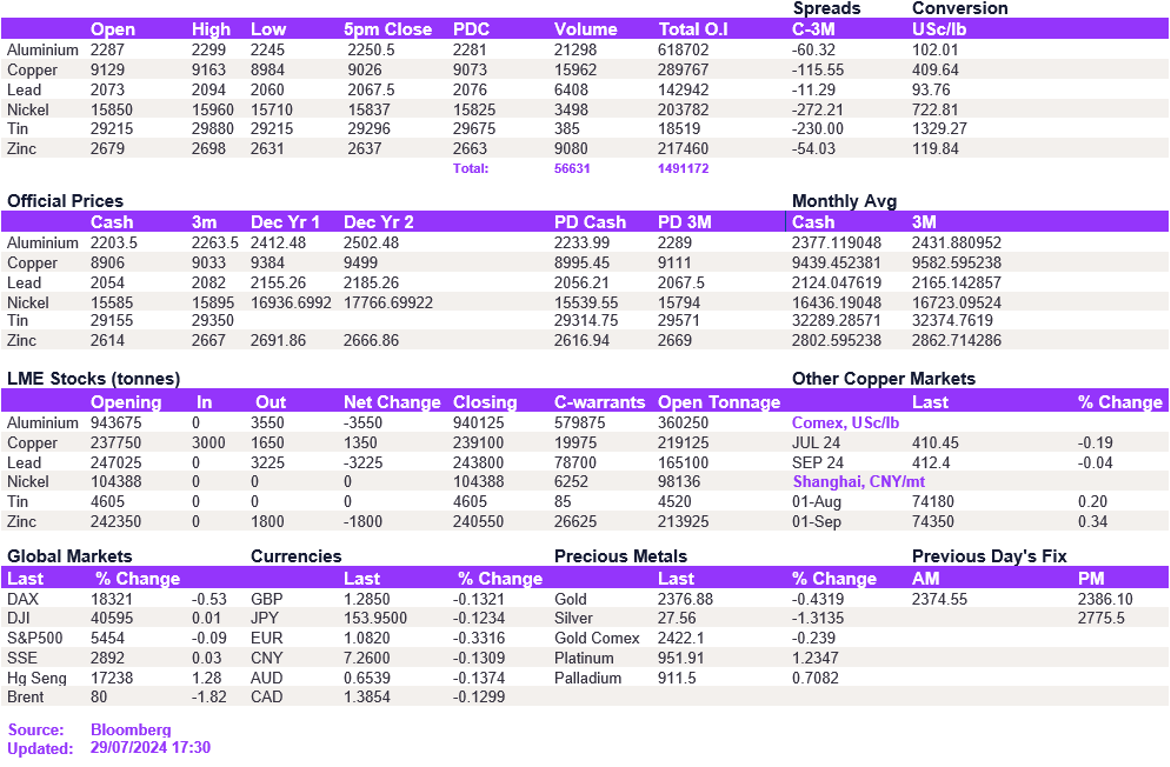

Last week, markets weakened to test new lows, creating the space for a relief rally. However, today's market was muted, with little interest in breaking out of the current ranges. Any upside was met with sellers, and investors struggled to find an entry point. While we believe that the downside is exhausted, the upside will remain defensive in the near term. In the meantime, base metals remained on the back foot today, with aluminium struggling above the $2,300/t mark as copper is testing the $9,000/t support level. Lead, which saw signs of a risk-on appetite on Friday, struggled to break above $2,100/t, edging back to $2,067.50/t.

A stronger dollar acted as a headwind for precious metals today. Gold softened to $2,381/oz, while silver declined to $27.62/oz, the lowest level since early May. Oil continued its downward trend, decreasing to the lowest level since May, with WTI and Brent crude trading at $75.7/bbl and $79.7/bbl, respectively.

All price data is from 29.07.2024 as of 17:30