US stocks fell at the opening today. The US Consumer Confidence Index, as reported by the Conference Board, experienced a slight decline, decreasing to 100.3 in July, still above analysts' expectations. The dollar index increased slightly, standing at 104.66, while the 10-year US Treasury yield decreased further, trading at 4.17%. Elsewhere, the Eurozone GDP reading also exceeded expectations, growing 0.6% YoY in the second quarter compared to 0.4% YoY in the first quarter. Among large economies, France and Spain outperformed expectations, Italy maintained stability, while Germany's output unexpectedly contracted, heightening fears of a prolonged crisis in a country that had been Europe's powerhouse for a decade.

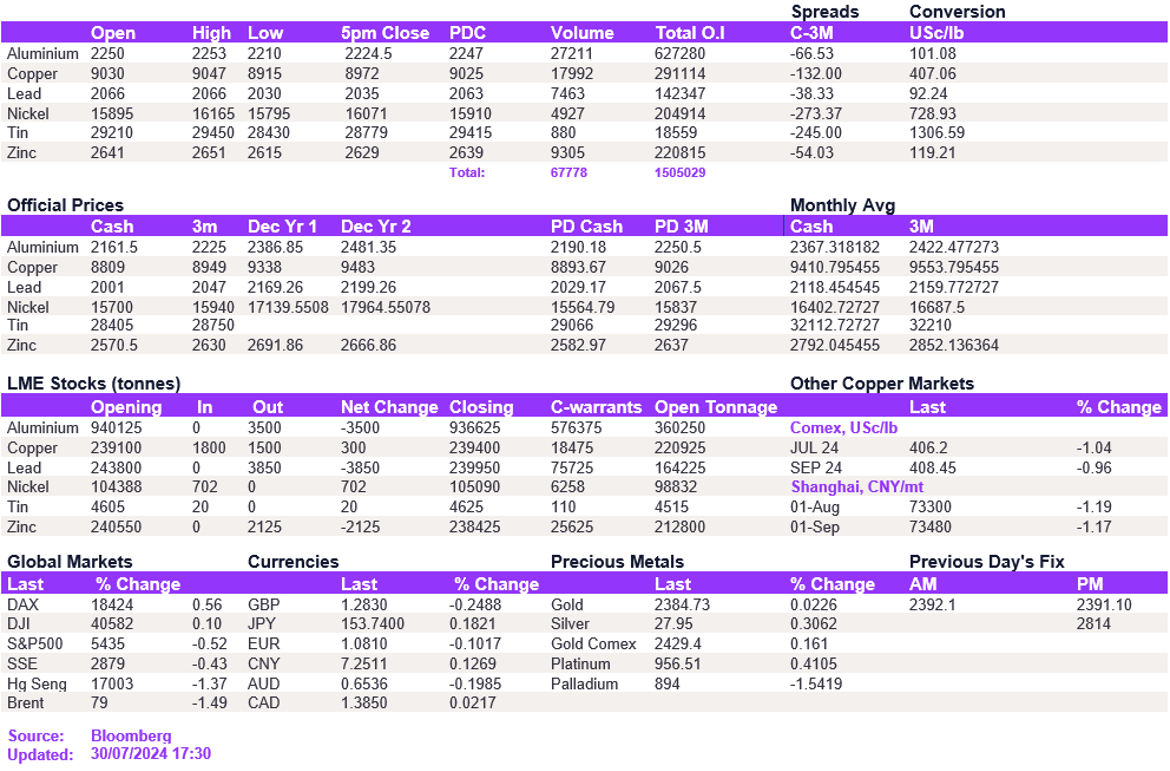

Base metals lacked appetite on the upside once again, prompting a cautious softness across the complex today. In particular, copper tested the robust $9,000/t support level again, trading near recent lows of $8,900/t at the time of writing. Aluminium edged closer to the $2,200/t support level, while lead weakened to $2,063/t. Nickel was the only exception, as prices gained momentum back above the robust $16,000/t level. We expect prices to rise slightly in the coming days, up to $16,400/t.

Precious metals saw marginal increases today, with gold recovering yesterday's losses and trading at $2,386/oz. Silver struggled to break the $28/oz level, standing at $27.9/oz. Oil prices declined, with WTI crude at $74.7/bbl and Brent crude at $78.5/bbl.

All price data is from 30.07.2024 as of 17:30