US stocks opened higher today following the release of macroeconomic data that solidified investors' expectations of the first Fed interest rate cut in September. The ADP Employment Change for July came in lower than anticipated, showing 122,000 new jobs added compared to the expected 150,000. This pushed US Treasury yields and the dollar lower. The 10-year yield declined to 4.09%, the lowest level since March, while the dollar index dropped to 104.0. Investors are now keenly awaiting this evening's FOMC meeting statement to gauge the future path of US monetary policy.

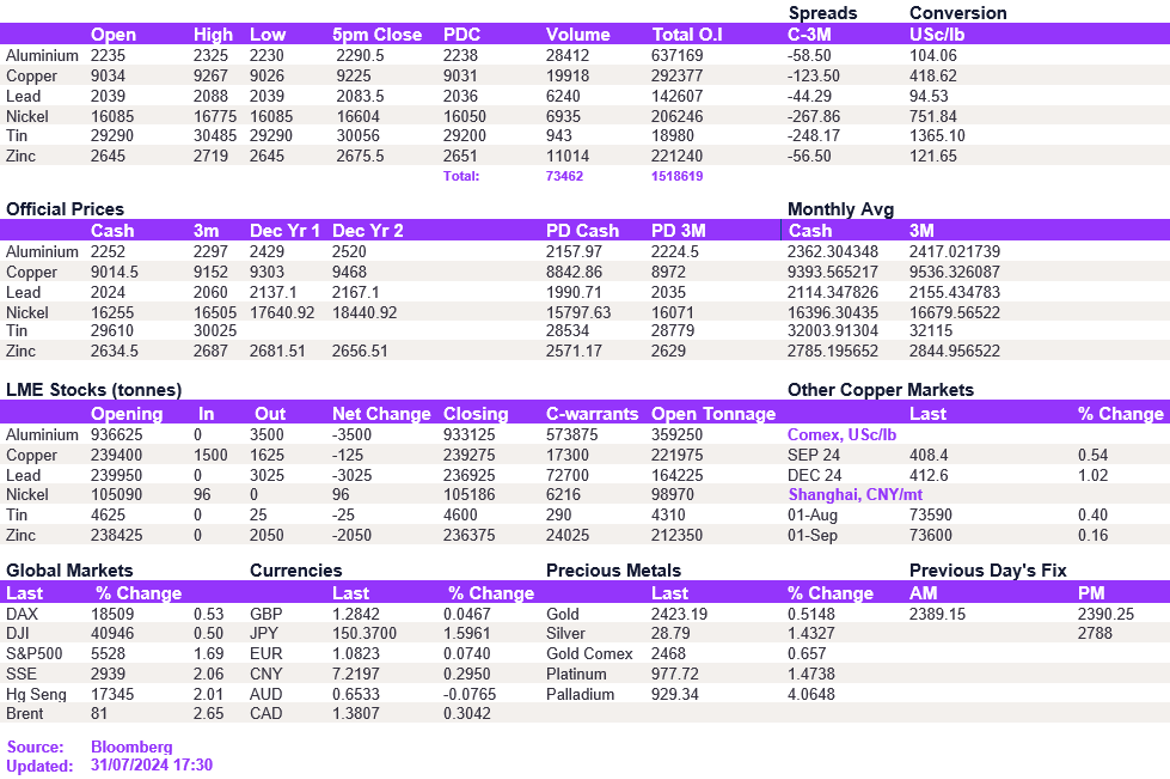

Despite a softer PMI performance out of China, the base metals complex closed the month on the front foot. The market's downside has been slowing in recent days, solidifying new support levels, and today's relief rally could indicate the end of the bearish trend. While we do not expect strong gains in the coming weeks, this acts as a welcoming sign for the market, where new support levels are firmly established. In particular, copper opened above the robust $9,000/t level, strengthening to $9,225/t. We expect that copper will continue to edge back to $9,700/t in the coming days. Likewise, aluminium jumped higher but struggled above the $2,300/t level. The rest of the complex followed suit.

The softer dollar pushed precious metal prices higher. Gold appreciated to $2,422/oz, while silver increased to $28.75/oz. Oil prices also traded higher, with WTI and Brent crude at $76.9/bbl and $80.6/bbl, respectively.

All price data is from 31.07.2024 as of 17:30