US stocks fell at the opening today following the release of stronger-than-expected labour market data. The ADP Employment Change report, which estimates monthly changes in non-farm private employment based on payroll data, showed an increase of 143,000 new jobs in September, significantly higher than the 99,000 recorded in the previous month. The dollar index surged, trading at 101.62, while the 10-year US Treasury yield rose, testing the 3.8% level once again. Elsewhere, Eurozone unemployment remained unchanged in August, holding close to its historic low of 6.4%.

The base metals complex continued to make strides, gaining enough momentum to breach the June resistance levels across the board. While China's stimulus measures have played a significant role in driving this upward trend, speculative players have also contributed to the exaggerated gains. We believe that China's underlying issues cannot be resolved solely through monetary injections; the market is aware of this. The lack of volatility and oversold sentiment from China in recent months drove some of the speculative players back into the market following the news, leading to a sharper-than-anticipated gain. In the coming weeks, we expect these gains to subside as investors come to terms with China's subdued economic reality.

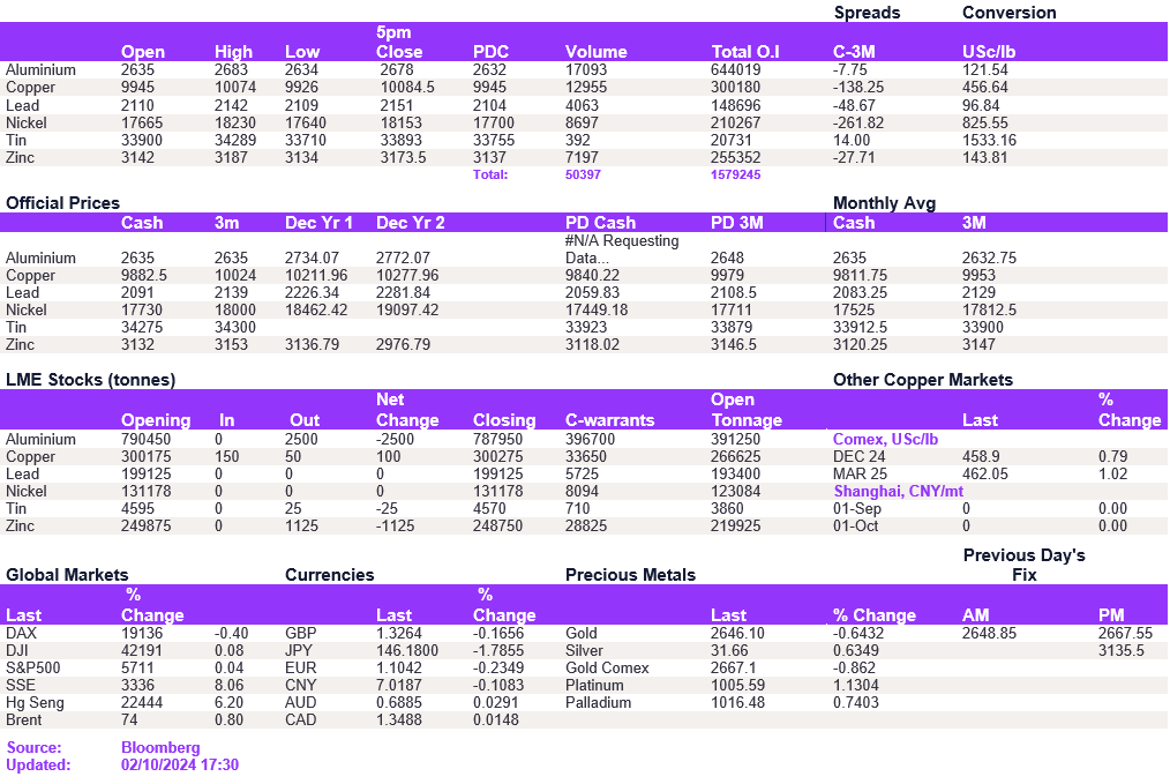

In the meantime, aluminium is testing new highs, attempting to breach the $2,660/t level today. Copper's gains were more muted as the resistance at $10,200/t stands firm; the metal finished the day at $10,084.50/t. In line with copper, zinc is cautiously testing new highs, closing at $3,173.50/t. Relative to other metals, nickel's upside has been extensive, as it continued to rally sharply for the fourth straight day, breaching the $18,000/t level to $18,153/t.

The rise in Treasury yields and a stronger dollar weighed on gold, with the metal struggling to stay above $2,660/oz. Silver also followed the broader metals trend, testing the $32/oz mark. After a larger move at the end of the last trading session, oil edged slightly higher, with WTI and Brent crude trading at $71.4/bbl and $75.1/bbl, respectively.

All price data is from 02.10.2024 as of 17:30