US stocks opened higher today, driven by a much stronger-than-expected Nonfarm Payrolls report for September, which showed an increase of 254k jobs—the highest figure since March—well above the 142k recorded in August. The unemployment rate edged down to 4.1%, further indicating resilience in the US labour market. The dollar index surged to 102.5, nearly 2% higher than mid-September levels when the Fed implemented its first 50bps interest rate cut in its new easing cycle. The 10-year US Treasury yield also jumped to 3.94%, marking its highest point since July. In recent months, market reactions to non-farm payrolls have typically been strong but short-lived, and today's data reinforces the view that the US labour market remains robust despite the prolonged period of high interest rates. This development has tempered expectations for aggressive rate cuts. While forward swaps last week were pricing in a 60% chance of a 50bps cut in November, expectations have now shifted to a more moderate 25bps reduction.

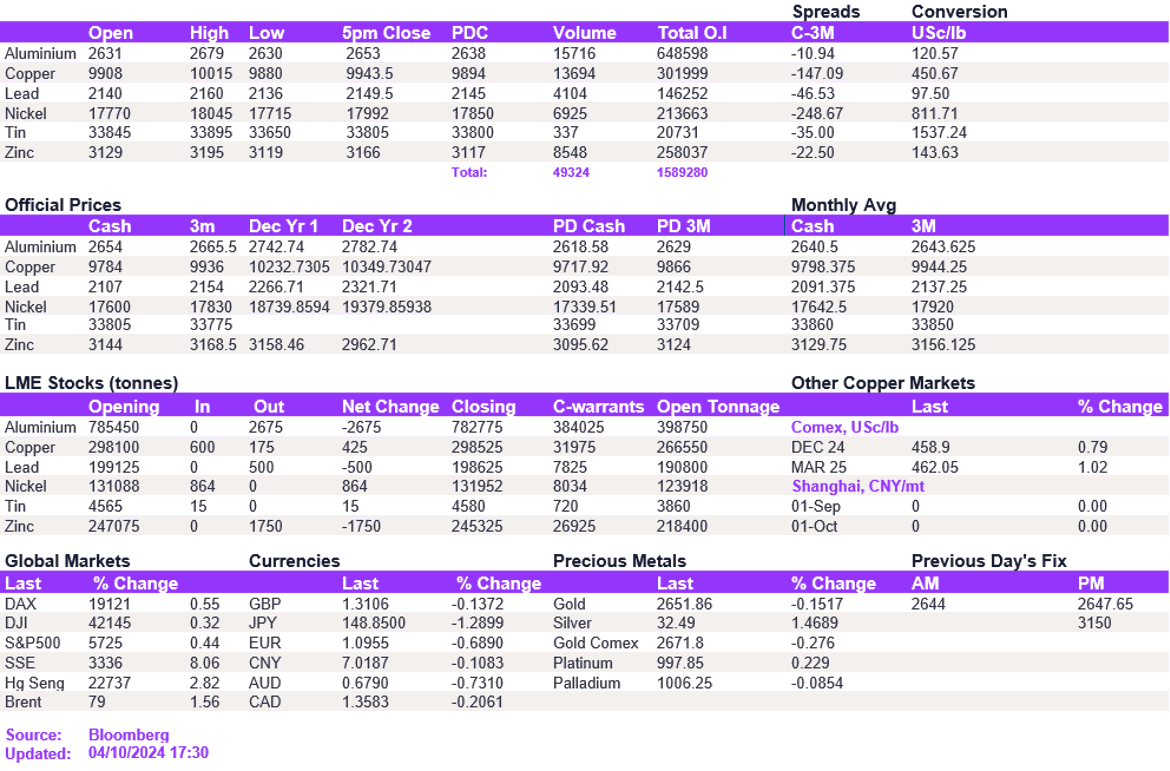

In the coming weeks, we expect recent base metals’ gains to subside as investors come to terms with China's subdued economic reality. In particular, the copper rally is stalling as market appetite struggles to push prices above the $10,000/t level. With further clarifications on Chinese stimulus measures following the national holiday, expect to see some gains in copper next week. However, the longer-term narrative of subdued growth means that these gains are likely to be marginal, and markets will struggle to breach the $10,200/t level completely. Today's subdued market action confirms a lack of upside appetite, with aluminium, nickel, and copper posting intraday moves.

Despite the dollar's strength, gold edged higher, nearing the $2,670/oz mark, bolstered by ongoing tensions in the Middle East and anticipation of further Fed rate cuts. Silver also surged, trading at $32.72/oz. Meanwhile, oil extended its upward trend, with WTI and Brent crude trading at $74.7/bbl and $78.5/bbl, respectively.

All price data is from 04.10.2024 as of 17:30