US stocks opened lower today after hovering near record highs last week. Investors are now focused on Thursday's CPI report, which is expected to clarify the Fed's next move in its monetary easing cycle. At the start of last week, markets were pricing in a 50bps cut for November, but Friday's unexpectedly strong Nonfarm Payrolls report has tempered these expectations. Now, there is an 80% chance of a more modest 25bps cut being priced in. Signs of a robust US labour market, combined with escalating geopolitical tensions in the Middle East, have put strong upward pressure on the dollar, which remained steady at 102.5 today. Meanwhile, the 10-year Treasury yield surged above 4% for the first time since July.

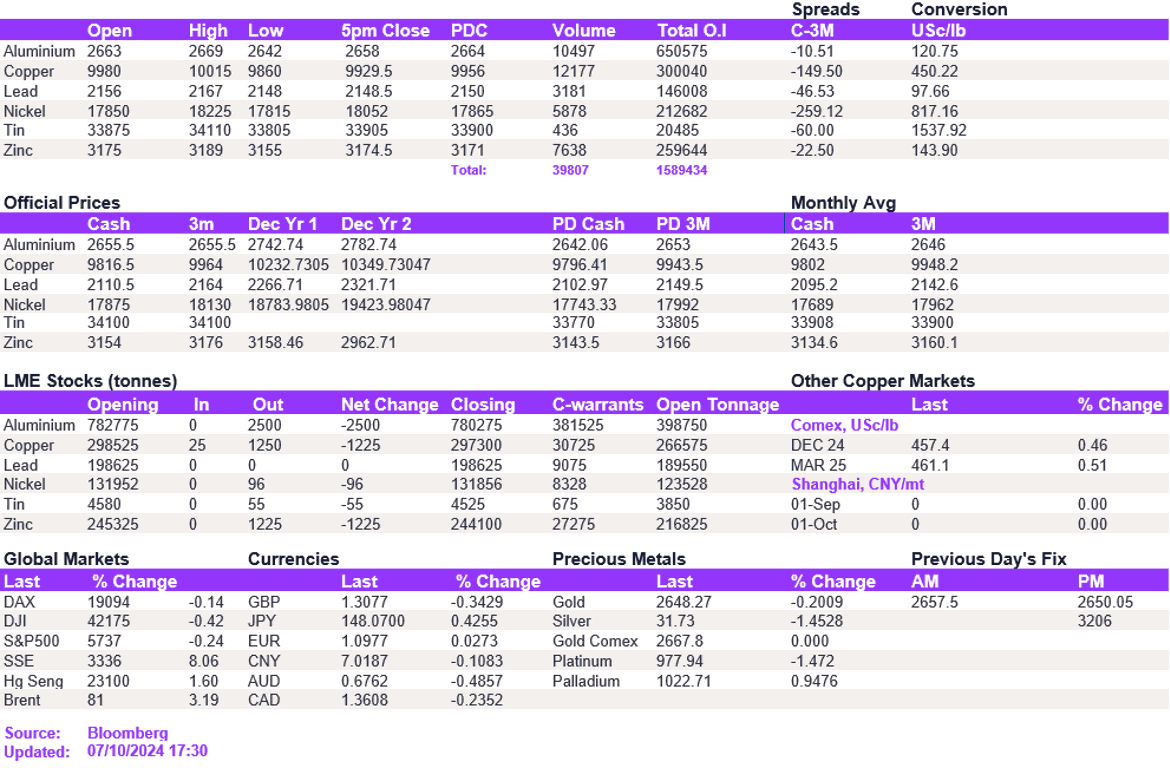

Base metals kept steady today, keeping the recent highs intact. Given prevailing market uncertainty about the future price potential, markets are hesitant to break out of the current ranges. Tomorrow, the top Chinese economic planner is meeting to discuss a package of policies aimed at economic growth. This could temporarily increase risk appetite for the market if the support is directed towards the country's construction sector. Aluminium and copper held their nerve at $2,658/t and $9,929.50/t, respectively. Nickel remained above the $18,000/t. Lead and zinc edged higher on the open but struggled to breach the previous week's resistance levels, prompting them to remain at $2,148.50/t and $3,174.50/t, respectively.

The lowering of expectations for a larger rate cut and the rising dollar have dampened the potential for precious metals to appreciate further. Gold edged slightly lower today, trading at $2,645/oz, while silver slipped below the $32/oz mark, trading at $31.7/oz. This day marks a year since the initial Hamas attack on Israel, which ignited the ongoing conflict. The recent escalations in the region continue to influence oil prices, with WTI and Brent crude trading at $76.1/bbl and $79.8/bbl, respectively.

All price data is from 07.10.2024 as of 17:30