US stocks rose at the opening today. The latest macroeconomic data showed the US trade deficit narrowing in August, from an upwardly revised -$78.9 billion in July to -$70.4 billion. This improvement came as exports surged to a record high, indicating continued strength in US manufacturing and robust foreign demand for American goods and services. This development suggests trade could contribute positively to GDP growth for the quarter or at least have a smaller negative impact compared to previous months. Along with strong labour market and consumer spending data, this reinforces expectations that the previously anticipated 50bps rate cut is now off the table. Instead, a more modest 25bps cut seems more likely, as the economy is showing greater resilience than expected. The dollar index rose again, trading at 102.57, while the 10-year US Treasury yield edged higher, standing above 4%.

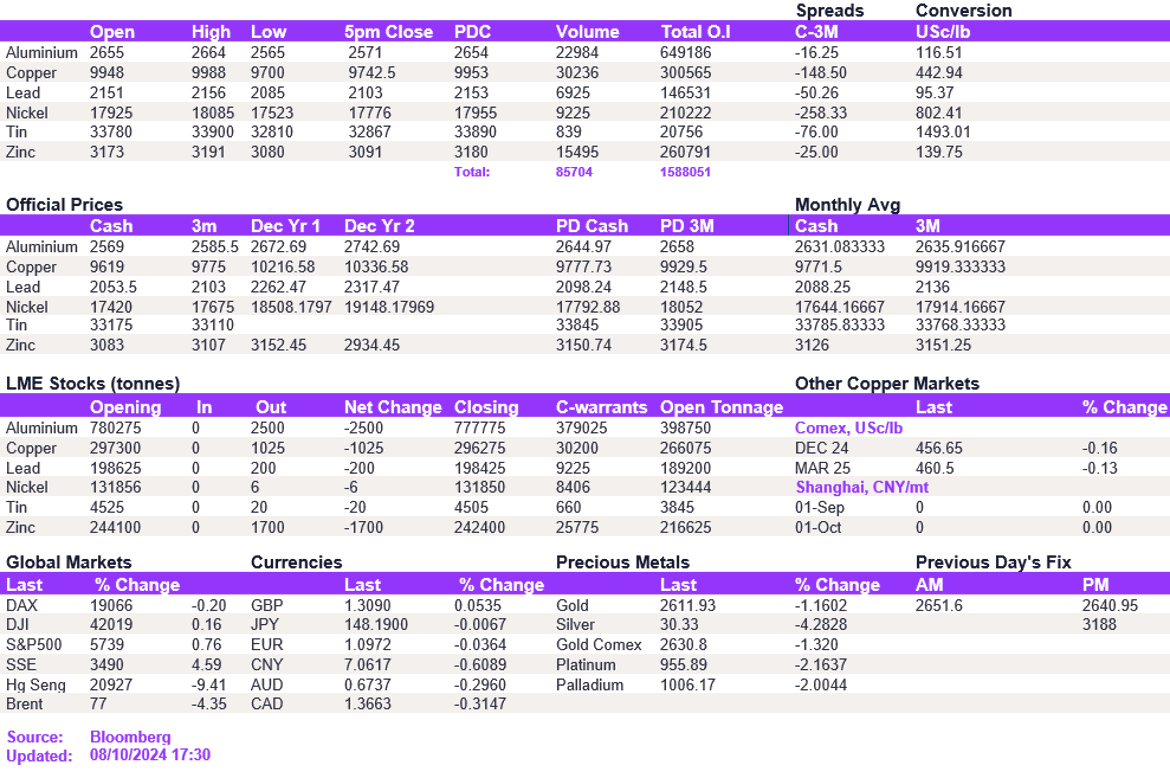

The base metals complex dropped today following a weaker-than-expected Chinese stimulus announcement. Although policymakers expressed confidence in achieving economic targets, a lack of additional major stimulus measures led to widespread market disappointment. Still, the decline in the metals sector was not as severe as that observed in Chinese equities, indicating a current lack of risk-off sentiment in the metals market. We anticipate that the initial price boost from China's return from the Golden Week earlier in the day absorbed some of the later downside experienced by the market. We expect prices to edge slightly lower in the near term as metals revert to their mean. In the meantime, aluminium and copper breached near-term support levels of $2,600/t and $9,800/t, respectively, as nickel remained above the $17,500/t level. Lead and zinc also weakened.

Precious metals faced downward pressure today as the continued signs of US economic strength temper expectations for faster Fed easing. The potential for slower rate cuts keeps Treasury yields elevated, reducing the appeal of non-yielding assets like gold and silver. Gold dropped to $2,614/oz, while silver plunged to $30.35/oz. Meanwhile, disappointing stimulus measures from China added downward pressure on oil prices, with WTI and Brent crude falling to $73.3/bbl and $77/bbl, respectively.

All price data is from 08.10.2024 as of 17:30