US equities rose at the open, hovering near record highs. As initial enthusiasm around China's fiscal stimulus faded, investors shifted back to the US dollar, attracted by the relative strength of the world’s largest economy, which remains the safe-haven investment of choice. The dollar index climbed for the eighth consecutive day, approaching the 103 mark—levels last seen in mid-August. Market sentiment has steadily adjusted, with expectations for the pace of monetary easing becoming more cautious. All eyes are on tomorrow's CPI report, which is anticipated to show inflation cooling. Despite this, the 10-year US Treasury yield edged higher, trading above 4%, suggesting that markets are still pricing in potential upside risks to inflation or rate expectations.

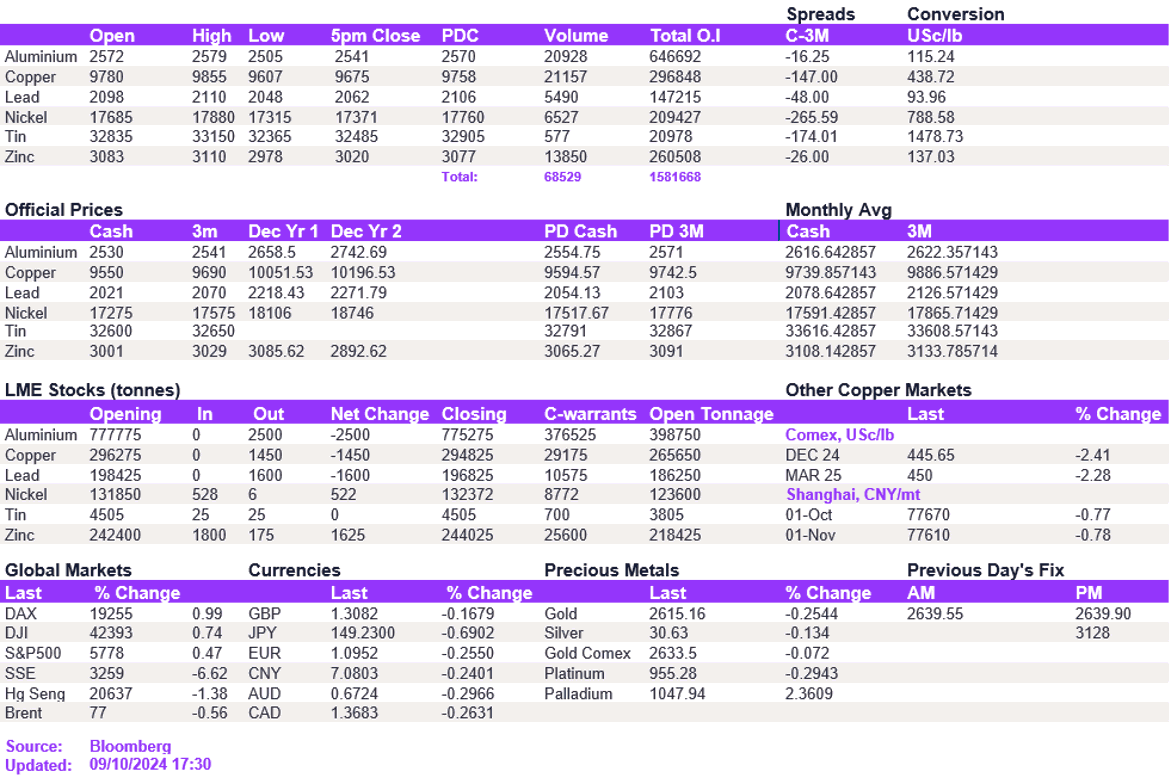

The base metals complex weakened once again today as markets continued to digest the news of the lower-than-expected Chinese stimulus announcement. This also follows the mean-reversion trend that metals exhibited for most of this year. Copper continued to soften, falling into the support of $9,600/t. Aluminium followed suit, testing the $2,500/t level but hesitating below it and coming back to $2,541/t. Other metals also witnessed moderate losses.

The strong dollar and rising Treasury yields continued to weigh on precious metals. Gold dropped again, trading at $2,616.2/oz, while silver remained mostly flat after yesterday's decline to $30.6/oz. Oil prices also retreated, with WTI and Brent crude at $73.1/bbl and $76.5/bbl, respectively.

All price data is from 09.10.2024 as of 17:30