US stocks fluctuated today while the dollar index extended its gains, breaking above the 103.4 level. In contrast, the 10-year US Treasury yield softened, dipping to 4%. On the other side of the Atlantic, UK CPI came in lower than expected at 1.7% YoY for September, down from 2.2% in the previous month. This brings UK inflation closer to the Eurozone's 1.8% YoY reading for September. Earlier in the year, expectations that the BoE would cut rates more gradually than both the Fed and the ECB lent support to the pound, though that gap has now narrowed. Markets have raised their expectations for a 25bps rate cut from the BoE in November. The euro rebounded against the sterling today, trading at 0.836, though it remains near its lowest levels since 2022.

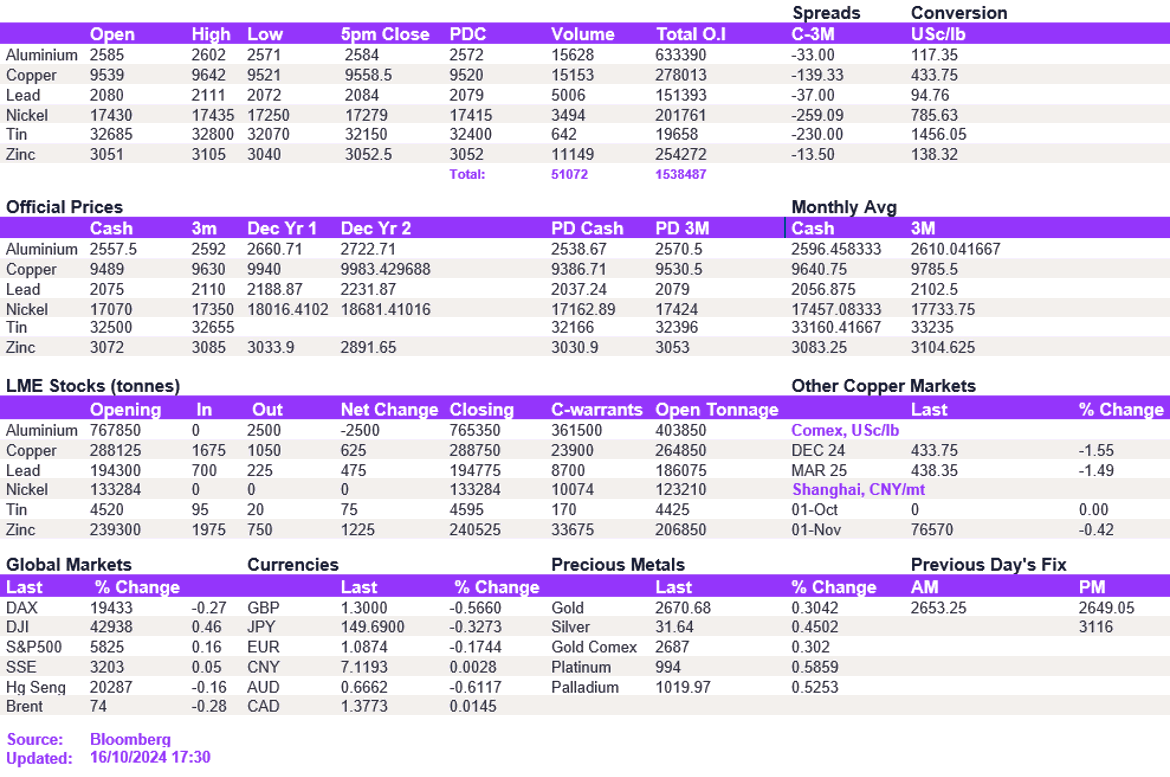

A mixed day of base metals performance was seen across the market today, with marginal softness driving the general trend. As the market looks forward to the upcoming briefing from China on Thursday, it finds itself in a dilemma. There's a low level of confidence in significant announcements from policymakers, but any disappointment could exacerbate market weakness tomorrow. The risk is biased towards the downside. In the meantime, given a lack of a clear market signal, metals continue to follow a mean-reverting strategy, edging closer to their averages. For copper, this level is currently at $9,450/t, and prices are slowly easing into this level, closing at $9,558.50/t. Aluminium held firmly at $2,584/t. Lead and zinc also remained unchanged. Nickel continued to soften, erasing early October gains to $17,279/t.

Gold tested record highs but struggled to break through $2,685/oz, held back by the strengthening dollar. Silver briefly tested the $32/oz level before softening to $31.8/oz. Oil prices also continued to decline, with WTI and Brent crude trading at $70.5/bbl and $74.2/bbl, respectively.

All price data is from 16.10.2024 as of 17:30