US stocks fluctuated today as investors digested a mix of global economic data. In the US, resilience in the economy continued, with September housing starts exceeding expectations, adding to the positive momentum. Nevertheless, after two weeks of consecutive increases, the dollar softened today, trading at 103.54, while the 10-year US Treasury yield also declined, hovering at 4.07%. In the UK, retail sales for September exceeded expectations, rising 3.9% YoY—the highest reading since early 2022. This surge was largely driven by strong tech sales, buoyed by the release of the new iPhone 16. The pound initially strengthened against both the euro and the dollar following the data but later retraced its gains.

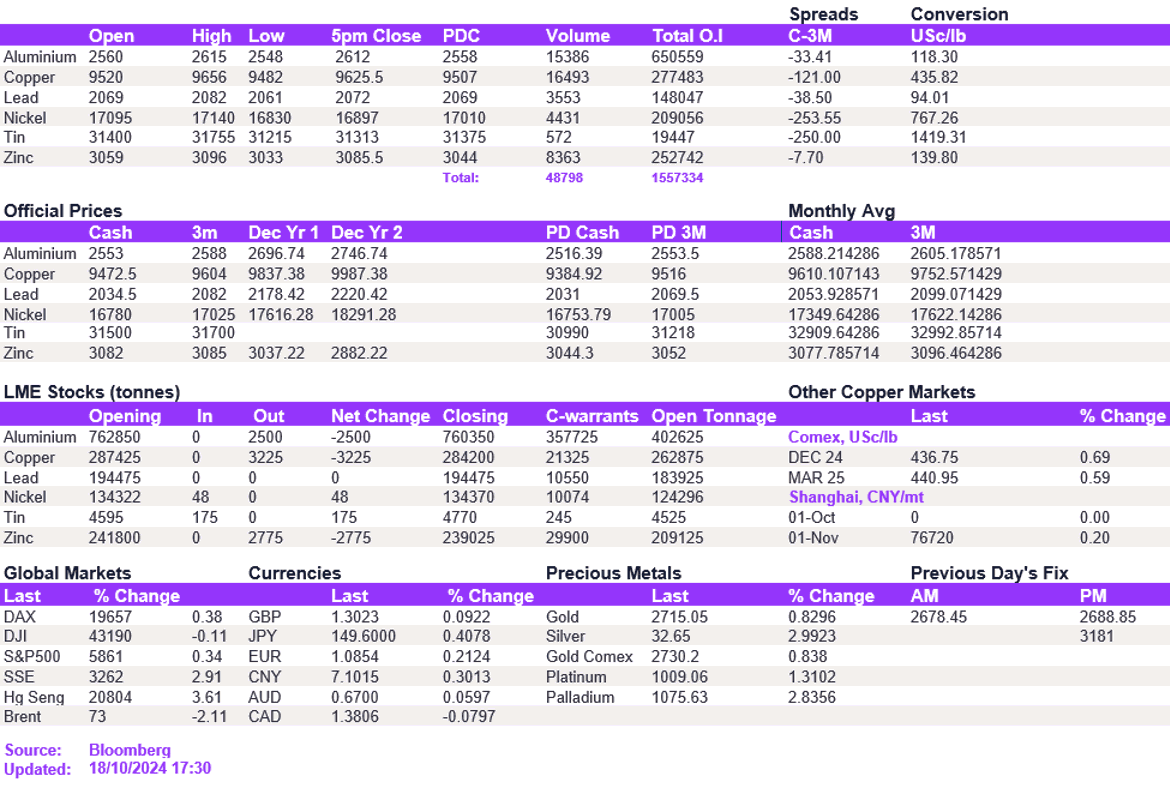

China's PBOC announced additional details about the measures aimed at boosting capital markets following the release of Q3 macroeconomic figures, which slowed QoQ, but exceeded estimates. In particular, GDP grew by 4.6% YoY, surpassing economists' expectations of 4.5%. Retail sales and industrial production significantly outpaced market expectations by growing by 5.4% and 3.2% YoY, respectively. While announcements initially boosted sentiment across the base metals space, the gains were relatively muted. We believe that market expectations regarding China's longer-term recovery are priced in further down the curve, keeping the near-term sentiment broadly unchanged. Indeed, China's CPI figures indicate continued deflationary environment, with year-on-year declines in producer prices and muted growth in the consumer segment. This is tempering the likelihood that any sustainable changes would be visible in the near term. As a result, aluminium and copper edged slightly higher to $2,612/t and $9,625.50/t, respectively. The rest of the complex remained unchanged. Nickel was the only exception. As mentioned in our previous comment, the recent increase in nickel prices has caused them to deviate further from their longer-term average compared to the rest of the complex. As prices continue to revert to the mean, nickel softened to $16,897/t.

The softening dollar provided a boost for precious metals, with gold finally breaking above the $2,700/oz mark for the first time, reaching $2,718/oz. Silver followed suit, climbing to $32.6/oz. In contrast, oil prices dipped, with WTI and Brent crude trading at $68.9/bbl and $72.7/bbl, respectively.

All price data is from 18.10.2024 as of 17:30