Nasdaq and S&P 500 opened higher today, buoyed by another set of positive macroeconomic data from the US. The S&P Global Composite PMI surpassed expectations, with Manufacturing at 47.8 and Services rising to 54.3, both stronger than September's figures. Additionally, New Home Sales jumped to 728k in September, up from 716k, marking one of the highest readings in two years. Meanwhile, the UK saw its PMI readings dip slightly but stay in expansionary territory, while the Eurozone saw a small uptick in manufacturing, with services softening. The dollar eased to 104.2, and the 10-year US Treasury yield tested support at 4.2%.

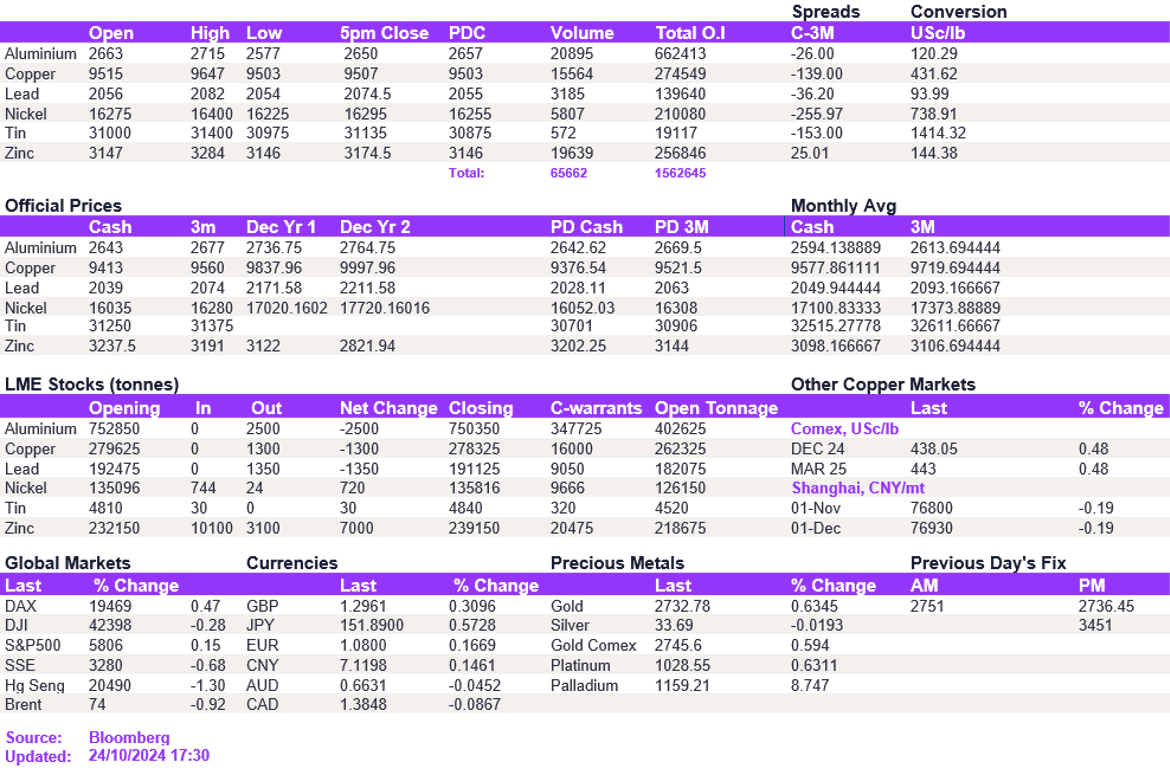

The base metals complex opened on the front foot this morning, with inc leading the gains due to ongoing concerns over concentrate supply shortages. As the cash to 3-month spread tightened to $58/t backwardation, zinc looked to breach the $3,200/t resistance level. However, this trend was short-lived as new inflows of zinc onto the LME alleviated some of the market's concerns. The spread has subsequently eased into $25.10/t, and the 3-month price weakened below the $3,200/t level to $3,174.50/t. The rest of the complex followed suit and, in line with zinc, lacked upside momentum, prompting a mixed day of trading across the board. Aluminium and copper remained unchanged day-on-day, at $2,650/t and $9,507/t, respectively. Nickel paused the downside trend seen in recent days as investors struggled below the $16,200/t level.

Gold advanced to $2,729/oz, while silver struggled to climb back above $34, hovering at $33.6/oz. Oil prices fluctuated, with WTI at $70.1/bbl and Brent at $74.4/bbl.

All price data is from 24.10.2024 as of 17:30