US stocks opened higher today, supported by strong consumer sentiment data. The University of Michigan's final sentiment reading for October came in at 70.5, its highest level since April, reflecting more positive consumer attitudes toward personal finances and the economy. Meanwhile, the dollar remained relatively stable around 104.0, with the 10-year Treasury yield also hovering near 4.2%.

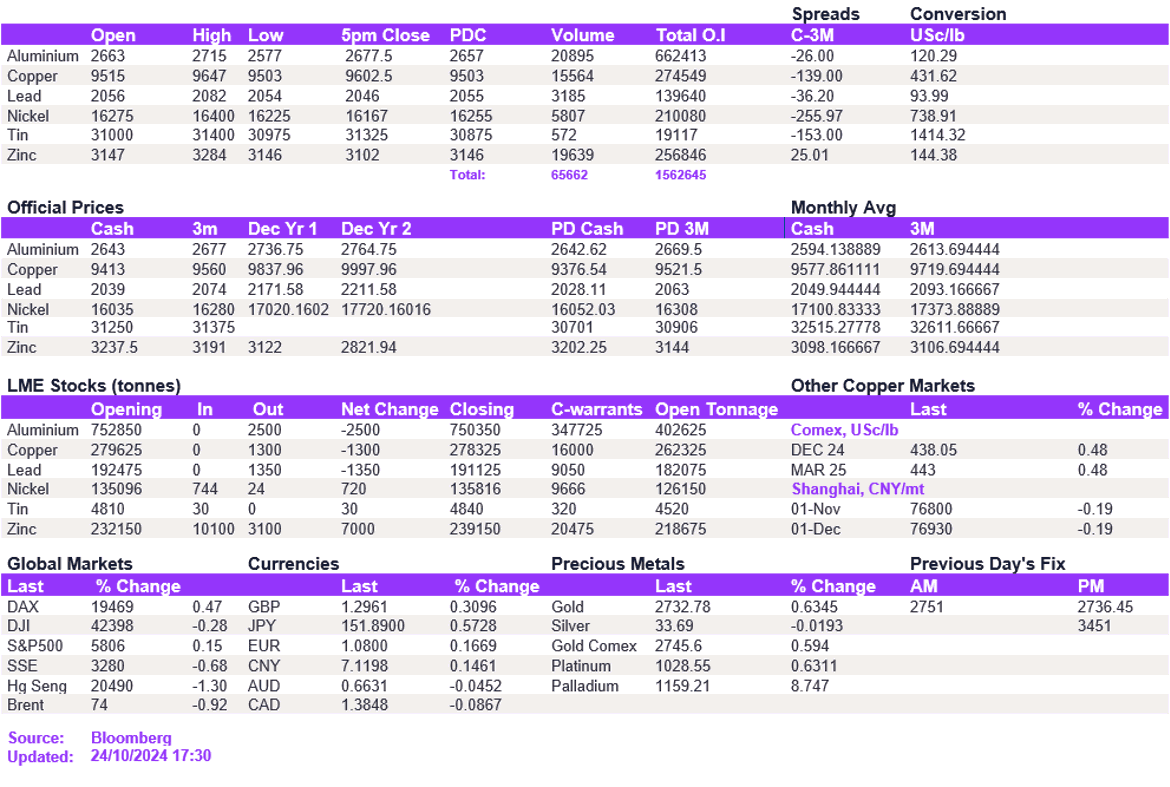

Base metals opened on the back foot this morning, driven by a sell-off in zinc prices. The cash to 3-month spread for zinc eased drastically, falling from $60/t to $15/t in backwardation, following another round of inflows of stocks at the LME exchange. This has led the rest of the complex lower. However, concerns surrounding concentrate tightness remain, resulting in a reversal of this trend later on in the day. Zinc remained above the $3,100/t support level at $3,102/t. Copper and aluminium, which have also been subject to mined material shortages, have remained elevated at $9,602.50/t and $2,677.50/t, respectively.

Gold climbed to $2,738/oz, while silver rose slightly but struggled to break the $34 barrier, trading at $33.9/oz. Oil prices edged higher, with WTI at $71.2/bbl and Brent at $75.4/bbl.

All price data is from 25.10.2024 as of 17:30