US equities opened lower today, pressured by persistent strength in Treasury yields, despite markets maintaining strong expectations for rate cuts. The 10-year yield has climbed to 4.34%, its highest level since early July, when markets anticipated the first Fed rate cut would occur in September. Even after a 50bps cut last month, and with an almost 100% chance priced in for an additional 25bps cut next week, yields continue to rise. This unusual divergence suggests that, despite expectations of monetary easing, underlying factors—particularly long-term inflation concerns—are driving yields higher, spurred by the prospect of a Donald Trump victory in next week's election. The dollar index also appreciated, trading at 104.4 at the time of writing.

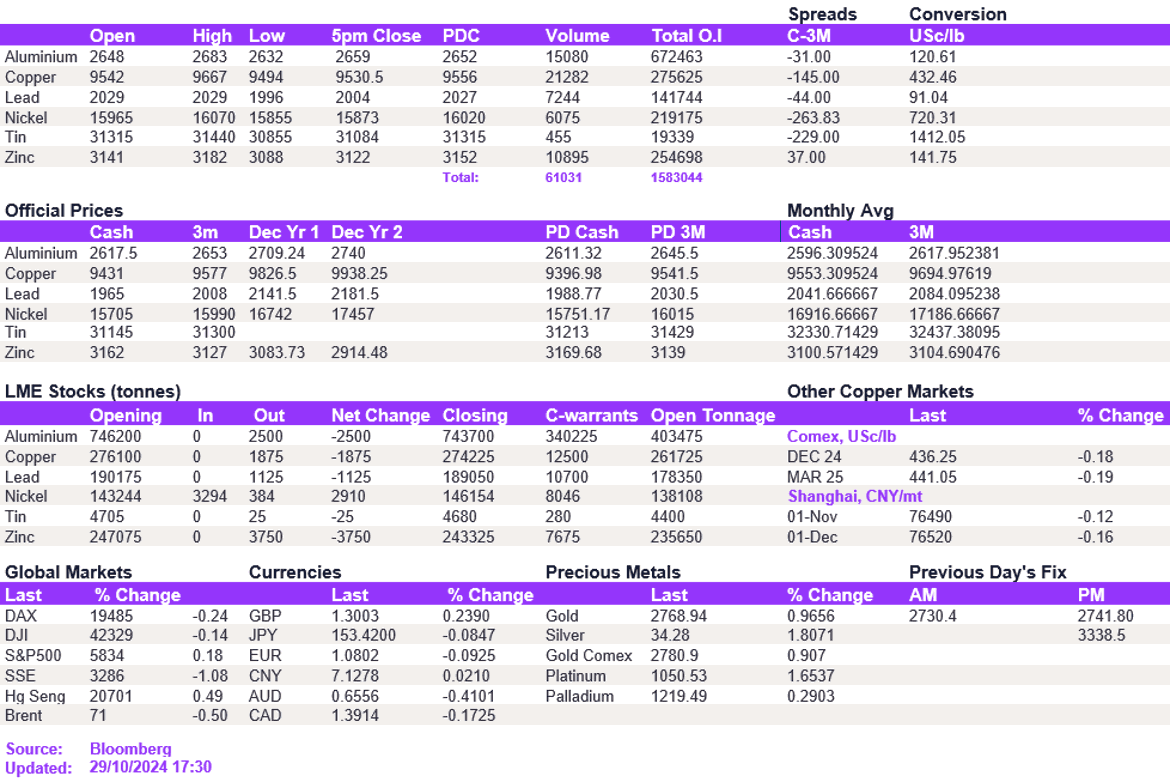

Base metals were mostly lower today despite reports that China is considering a stimulus package and the EU is moving forward with tariffs on China's EVs. As mentioned in our previous reports, there has been a noticeable disconnect between the broader metals market and macroeconomic fundamentals, suggesting that base metals are not effectively reflecting these significant developments. In particular, lead and nickel continued to soften, falling lower but still supported by longer-term support levels of $2,000/t and $15,665/t, respectively. Aluminium and copper remained broadly unchanged.

Gold broke another record today, reaching $2,770/oz, while silver climbed above $34/oz once again. Election-related volatility, combined with an expected interest rate cut next week and longer-term inflation fears driven by anticipated high tariffs from Trump, are set to keep precious metals in the spotlight. Oil prices softened, with WTI and Brent crude at $67.0 and $71.0, respectively.

All price data is from 29.10.2024 as of 17:30