US equities opened steady amid weaker-than-expected Q3 data, indicating the economy may be cooling slightly. GDP growth slowed to 2.8% QoQ from 3% in Q2, below the forecast. The growth largely relied on personal consumption, which accounts for two-thirds of the economy and climbed from 2.8% to 3.7%, underscoring consumer resilience despite tighter conditions. The Fed's preferred inflation measure, the PCE index, rose by 1.5% QoQ —falling below the 2% target and suggesting inflationary pressures may be easing—while core PCE stayed higher at 2.2% QoQ, showing core costs remain sticky. The dollar index dipped toward 104.0, while the 10-year US Treasury yield rose to 4.26%. In Europe, Q3 Eurozone GDP growth increased slightly from 0.2% to 0.4%, suggesting some stability amid economic challenges.

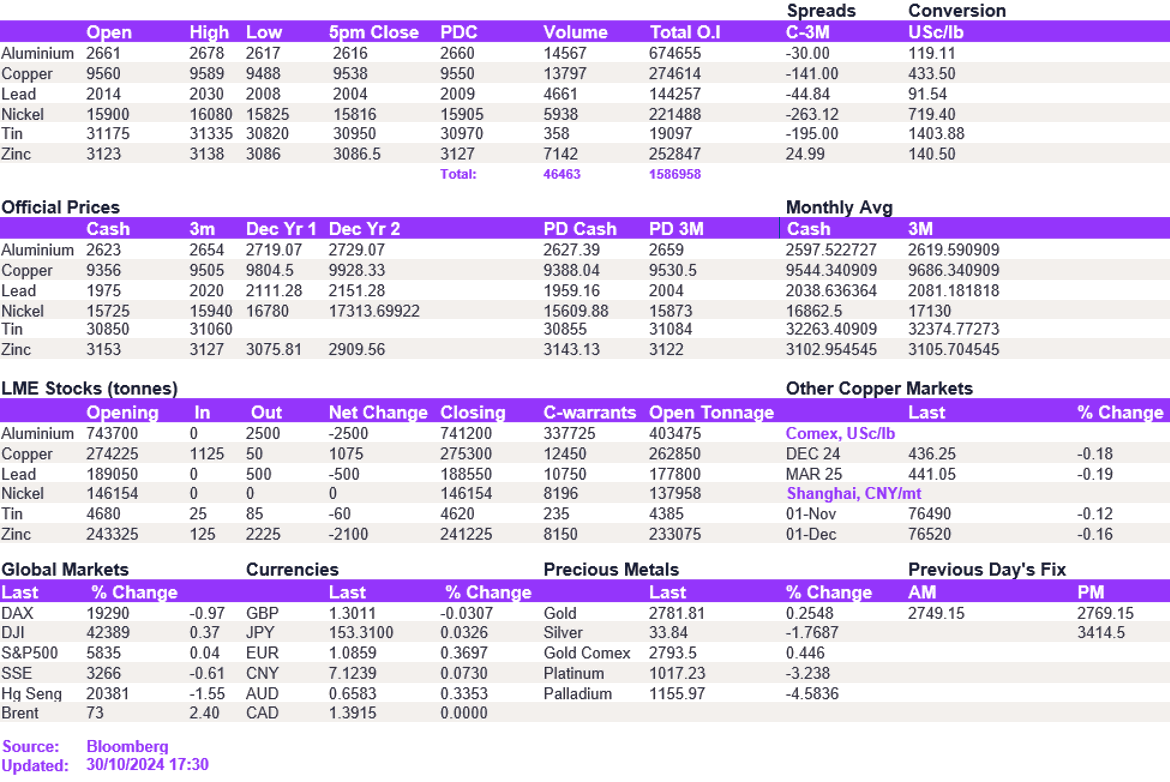

Moderate risk-off appetite was seen across the base metals complex today. Price moves were subdued given a lack of strong external market signals to drive momentum in either direction, keeping metals prices mostly rangebound day-to-day. Following yesterday's declines, lead and nickel struggled to break below the robust support levels of $2,000/t and $15,665/t, ultimately closing above these levels at $2,009/t and $15,816/t, respectively. Likewise, aluminium and copper were supported by near-term support levels, causing them to close at $2,616/t and $9,538/t, respectively.

Gold surged to a record $2,784/oz on safe-haven demand, while silver hovered just below $34. Oil prices also rebounded modestly, with WTI and Brent trading at $68.9 and $72.8, respectively, on hopes of demand resilience.

All price data is from 30.10.2024 as of 17:30