US stocks faced a sell-off today despite upbeat earnings from Microsoft and Meta. September’s PCE index—a key inflation gauge—eased to 2.2% YoY, its slowest annual increase in over three years, suggesting inflationary pressures may be cooling. Across the Atlantic, Eurozone CPI edged up to 2.0% YoY in October, surpassing forecasts and marking the fastest rise since April, signalling possible inflation risks. Nonetheless, markets are still pricing in a 25bps ECB cut for December. The dollar index held at 104.0, with the 10-year Treasury yield steady around 4.28%.

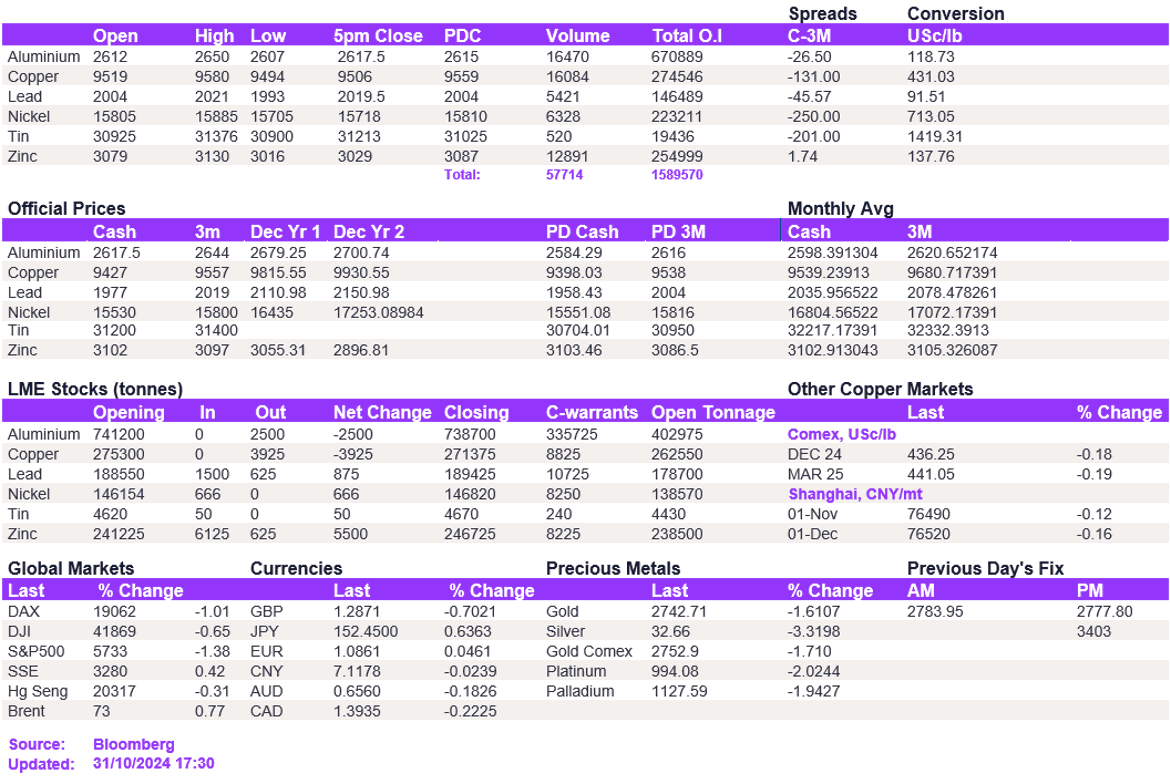

Base metals remained rangebound today, as a lack of strong directional appetite kept the metals supported within this week’s range. This is despite some positive PMI prints out of China. Aluminium and copper held above the robust support levels of $2,600/t and $9,500/t, respectively. Likewise, nickel and lead, which have been subject to downside pressures earlier in the week, have paused their decline as they approach their respective support levels. Meanwhile, zinc softened to $3,029/t, as the cash to 3-month spread continued to ease into $13.50/t backwardation, given another round of inflows on the LME exchange. We expect the $3,000/t level to hold in the coming weeks.

Stock selling drove some profit-taking in gold, often liquidated to cover losses during market stress, pushing gold down to $2,743/oz and silver to $32.6/oz. Oil prices saw a slight rise, with WTI and Brent at $69.2 and $73.

All price data is from 31.10.2024 as of 17:30