US stocks opened on the front foot this morning despite a softer-than-expected release of labour activity for the month of October. US payrolls increased by just 12,000 vs 254,000 in the previous month, with BLS citing hurricanes and strikes as the main reason behind such a drastic decline in hiring. While the US 10-year Treasury yield jumped to 4.32%, forward swaps indicated little to no change in market expectations regarding the upcoming cuts from the Fed. After the announcement, the dollar index sold off but quickly regained its strength above the 104 mark. This suggests that markets are viewing today’s release as a one-off in regard to the strength of the US economy.

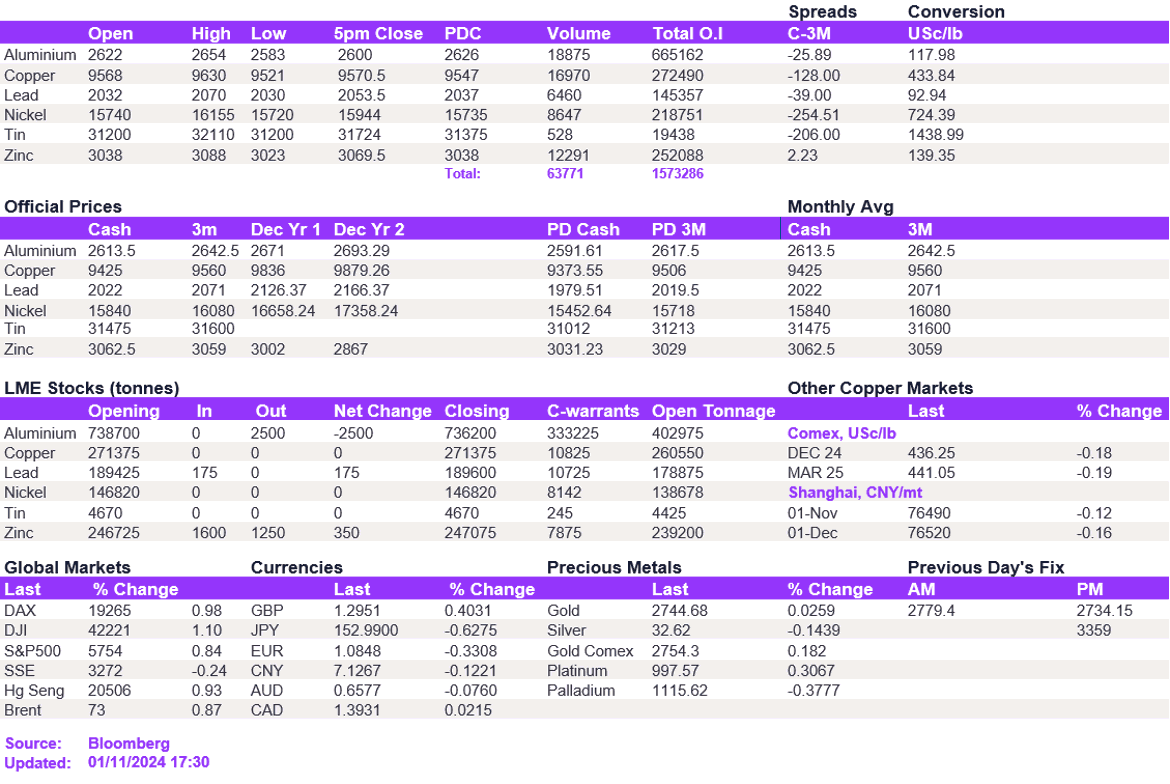

A mixed day of trading was seen across the base metals complex today, with metals that were subject to recent selling pressure rebounding rapidly. In particular, nickel rallied after testing the key support level of $15,720/t, prompting prices to test the $16,000/t level to close slightly below it at $15,944/t. Likewise, lead followed suit, gaining appetite to $2,053.50/t. The rest of the complex remained broadly unchanged, supported by key support levels.

Oil futures remained elevated following yesterday’s gains, with WTI and Brent trading at $70/bbl and $73/bbl at the time of writing. Gold and silver recovered marginally after yesterday’s equity market weakness prompted margin cover calls.

All price data is from 01.11.2024 as of 17:30