All eyes were on the results of the US election today, which showed that Donald Trump became the next US president, winning the votes by a larger margin than many in the market had anticipated. This resulted in major volatility across the FX space, with the dollar rallying to 105, prompting major weakness in other currencies as a result. Although investors were hoping for more insights from Trump's victory speech—particularly regarding tariffs and his broader political and economic agenda—the lack of clarity resulted in a slight pause in market volatility. In response to the results, the 10-year US Treasury yield jumped to 4.45%; investors also brace for the upcoming Fed meeting tomorrow. Additionally, US stocks marked another day of record highs. We believe that markets will remain on edge for the rest of the week, amplifying any external signals that may arise from Trump's subsequent speeches or announcements from the central banks.

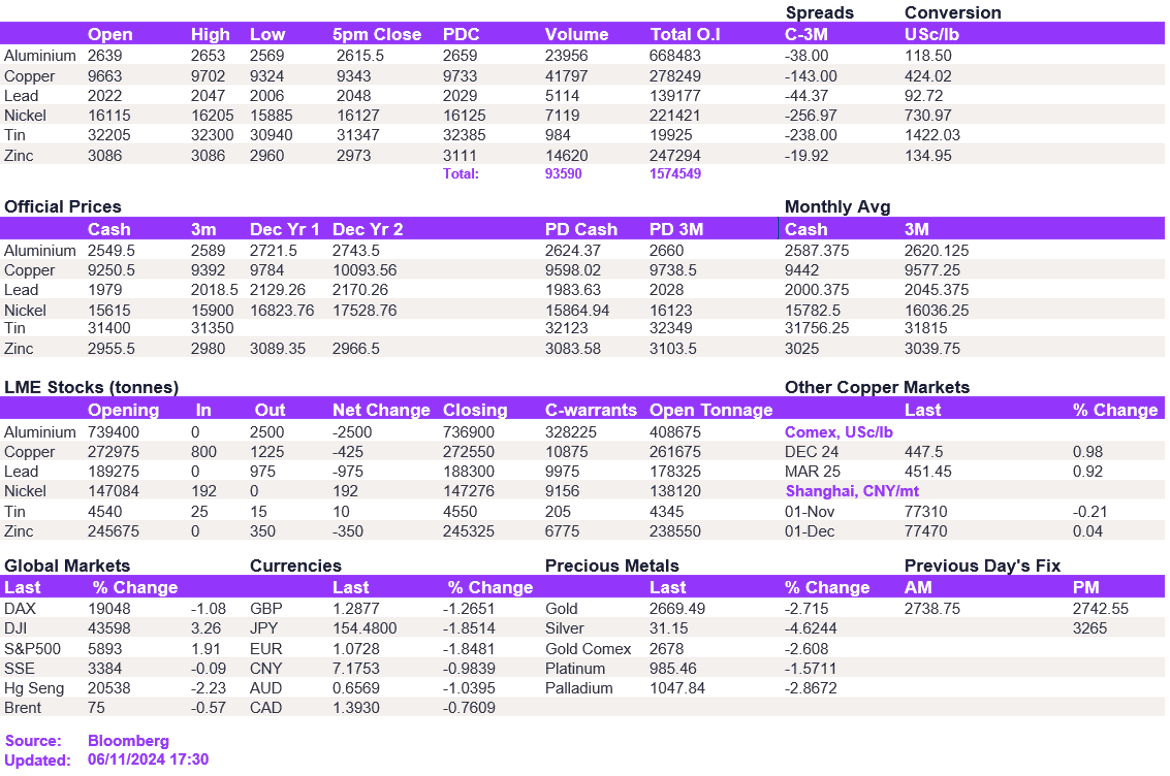

While the base metals market had a muted reaction at the opening, the midday expiry intensified earlier weaknesses, leading to a sell-off of some metals today. In particular, copper erased more than $300/t in the second half of the day, testing the key trend support level at $9,350/t before recovering slightly to $9,343/t. Other metals remained muted, bound by the near-term support levels. Aluminium briefly tested the $2,600/t but quickly regained momentum back to $2,615.50/t. Nickel remained above the $16,000/t mark.

Oil experienced volatility but remained broadly unchanged day-on-day. Meanwhile, precious metals sold off on the back of the dollar rally, prompting gold and silver to weaken to $2,668/oz and $31.50/oz, respectively.

All price data is from 06.11.2024 as of 17:30