US stocks gapped higher on Monday morning as investors continued to bet on the long-term growth prospects of the US given Trump's agenda. Moreover, the relative weakness with the EU - exacerbated by the unexpected snap election in Germany - and China's struggles to restore confidence in its economy have made US assets more appealing. While post-election volatility is likely to subside further this week, the markets remain cautious in anticipation of any announcements from Trump. As a result, the dollar continued to rally, reaching 105.50, while the 10-year US Treasury yield stood at 4.30%. Market focus will shift to the US CPI report on Wednesday, which is expected to indicate persistent inflation. If this holds true, it could lead to a reassessment of future interest rate cuts by the Fed, thus keeping the dollar strong this week.

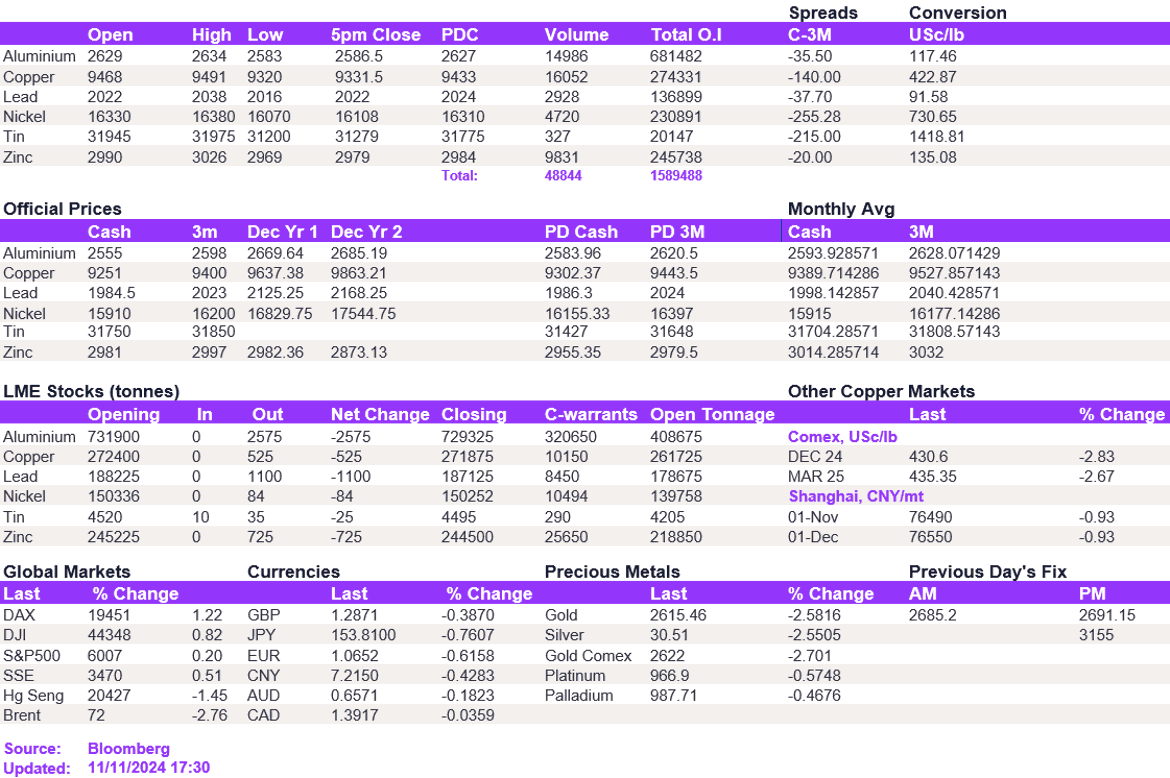

Base metals weakened once again today, primarily due to a stronger dollar and disappointing stimulus measures announced by China last week. Dollar moves have been key in driving the complex narrative in recent days. With little focus being paid to the effectiveness of subsequent support from China, we anticipate that the dollar will remain the primary factor influencing metal prices this week. We believe the dollar is overbought at current levels, given the relative strength of Trump's America compared to Europe and China. As a result, the dollar could weaken to 103.50 in the coming weeks, which should provide support for metal prices. In the meantime, metals weakened today but managed to hold support levels established last week. Copper held above the $9,317/t level at $9,331.50/t, and aluminium was just below the $2,600/t support at $2,586.50/t. The rest of the complex also showed a moderate downward trend.

Oil futures continued to weaken under the weight of dollar moves, with WTI and Brent falling to $68/bbl and $72/bbl. Likewise, gold and silver witnessed another day of weakness, falling to $2,615/oz and $30.50/oz, respectively.

All price data is from 11.11.2024 as of 17:30