US stocks weakened today, suggesting that momentum in the equity markets may be slowing down, at least temporarily. The S&P 500 is struggling to maintain its position above the psychological 6,000 level, leading to moderate declines across the board. Markets are also on the lookout for the CPI print tomorrow, which is expected to show that both monthly and yearly growth remained upwardly sticky in October. This could potentially strengthen the dollar further. In the meantime, the dollar index continues to make strides, with relative economic outperformance of the US compared to Europe and China, and it is now testing levels above 106. This level is near the June and April highs of 106.13 and 106.51, respectively; we believe the index may struggle to surpass these levels as we believe it to be overbought. From the macroeconomic perspective, household inflation expectations softened slightly, and workers feel slightly more confident about the job market, underscoring a supportive growth environment for the Fed to ease on the timing and scale of interest rate cuts in 2025.

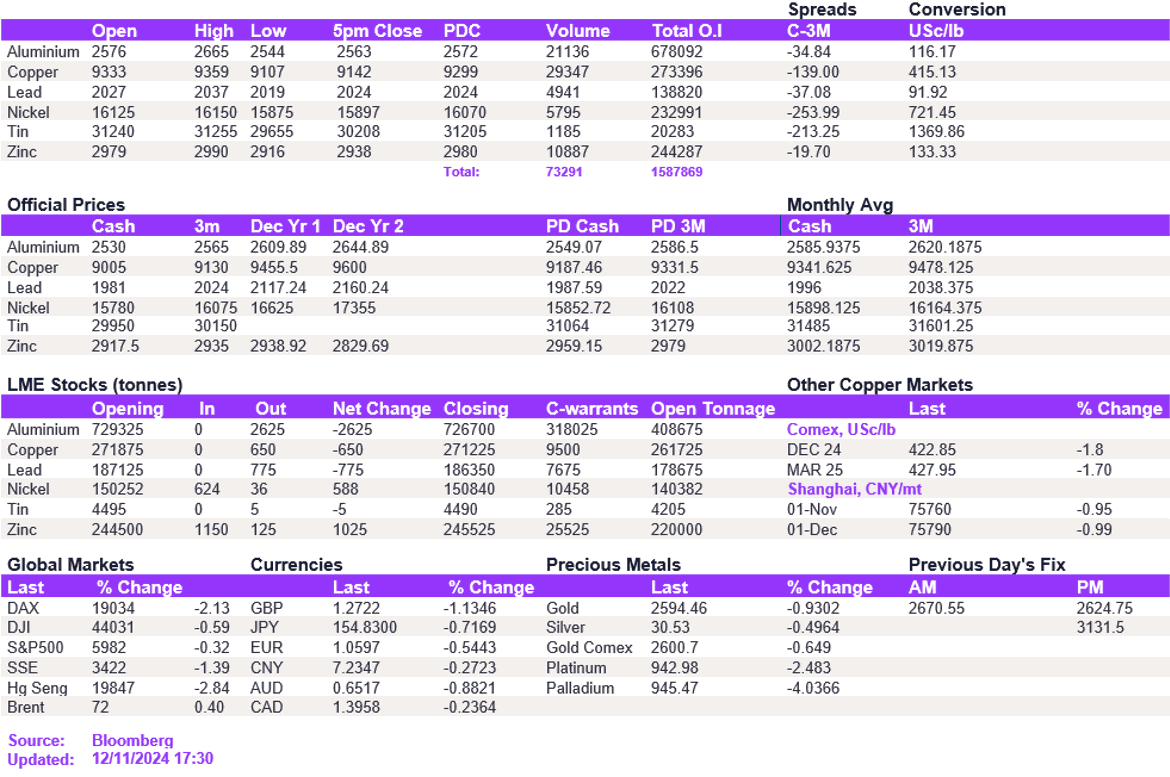

The base metals complex continued to weaken as the strengthening dollar exerted pressure on prices. Copper has felt this pressure more strongly than other base metals, falling by more than $250/t to close at $9,142/t. We believe that copper is at the lower end of its trading range and anticipate a potential moderate price recovery next week. Aluminium also weakened, but the losses were more subdued, with strong support holding at $2,550/t, prompting prices to close above it at $2,563/t. Nickel is weakening back to the support level of $15,705/t. Lead and zinc edged slightly lower.

Oil futures held steady today following the recent weakness of WTI and Brent, which found support at $68/bbl and $72/bbl, respectively. Likewise, despite ongoing dollar strength, gold and silver saw moderate downside pressures, as support at $2,600/oz and $30.50/oz held firm.

All price data is from 12.11.2024 as of 17:30