The US market has once again captured market attention today as investors gauge the macroeconomic and political landscape under Trump's administration. Today's inflation release is a key factor contributing to the resilience of US-related assets. The US CPI aligned with market expectations, revealing that both monthly and yearly growth remained sticky in October, growing by 0.2% and 2.6%, respectively. The yearly growth also marks the first monthly acceleration since March. Coupled with the recent appointments within Trump's administration, this data is fuelling inflationary bets, mitigating some of the dovish narratives expected from the Fed for 2025. Nevertheless, the short-term expectations reflected by the forward swaps indicate increased bets for a 25bps cut in December, with probability now standing at 82%. The dollar approached the March high of 106.50 but hesitated above this level, trading slightly below it at 106.380.

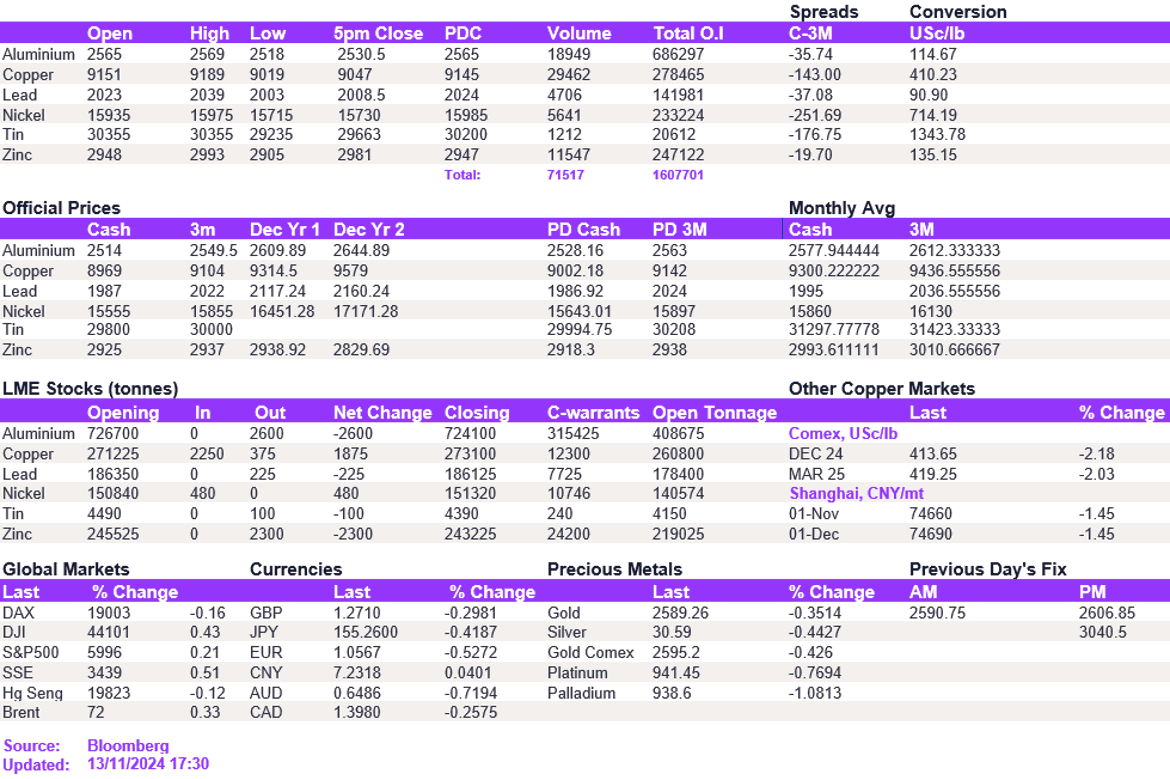

The dollar has continued to shape sentiment in the base metals market, putting another round of pressure on copper. Copper has experienced a sharp dislocation from its fundamentals, with the dollar emerging as the primary driver behind recent price moves as speculative trades have dominated. As mentioned in our commentary yesterday, we believe the dollar is overbought at current levels and anticipate a slight softening into the weekend, with potential downside momentum toward 104.50 by next week. This should support copper from the downside, allowing it to rebound toward $9,450/t, which we see as its fair value. In the meantime, the metal is trading at September lows of $9,047/t. Aluminium was also softer but stayed above the October support level of $2,500/t at $2,530.50/t. In contrast, the movements in lead and zinc were more moderate, further emphasising the impact of the dollar on macro-sensitive metals like copper and aluminium.

Oil prices have made moderate gains today, as precious metals held their support despite stronger dollar moves. Gold and silver have strong fundamental narratives that keep their prices historically elevated, including their safe-haven properties in times of political and macroeconomic uncertainty. We expect prices to hold at these levels and recover in the near term.

All price data is from 13.11.2024 as of 17:30