US stocks opened lower today, reflecting caution ahead of several key economic reports due this week. Tuesday will bring the Eurozone CPI report, followed by the UK CPI on Wednesday, and Friday’s global PMI data will further shape market sentiment. The dollar index eased slightly to 106.67, though it remains elevated, suggesting potential for further weakening as the currency appears significantly overbought. Meanwhile, the 10-year US Treasury yield remained broadly stable at 4.45%.

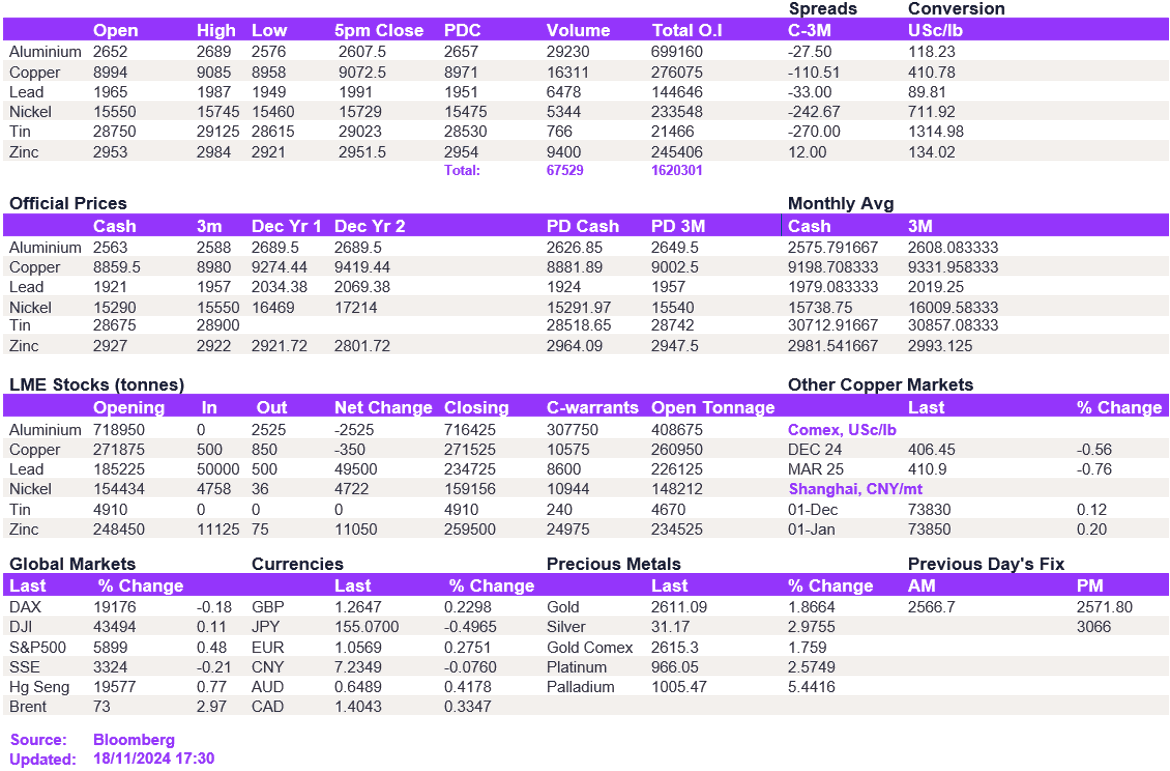

The base metals complex edged slightly higher today on the back of a softer dollar, helping to solidify support at current levels. In particular, copper found support at $9,000/t as it recovered to $9,072.50/t. Likewise, lead and nickel improved slightly to $1,991/t and $15,729/t, respectively. Aluminium remained broadly unchanged following Friday’s rally, prompting it to remain at $2,607.50/t.

Gold broke a six-day losing streak, rebounding to $2,612/oz, while silver followed suit, climbing to $31.24/oz. Although decreasing expectations of a December Fed rate cut could exert downward pressure on precious metals, geopolitical uncertainties, including Trump’s presidency and ongoing tensions in Ukraine and the Middle East, are likely to sustain safe-haven demand, potentially pushing gold closer to record highs in the coming weeks. Oil prices edged higher, with WTI trading at $68.8/bbl and Brent crude at $73.0/bbl, supported by a mix of supply concerns and steady demand.

All price data is from 18.11.2024 as of 17:30