US stocks opened lower today, mirroring declines in European equities as markets brace for Nvidia's Q3 earnings report. With expectations already sky-high—Nvidia's stock has surged 198% over the past 12 months—investors anticipate strong results, but even those might not be enough to fuel further market gains. In the bond market, US Treasury yields remained steady, hovering above 4.4%, while the dollar index climbed sharply, nearing 107 again and trading at 106.7 at the time of writing. Across the Atlantic, UK inflation data for October came in hotter than expected, with headline CPI at 2.3% YoY and core CPI at 3.3% YoY. The uptick in inflation was largely driven by a 10% increase in the energy price cap for the October-December period, signalling the need for gradual monetary easing.

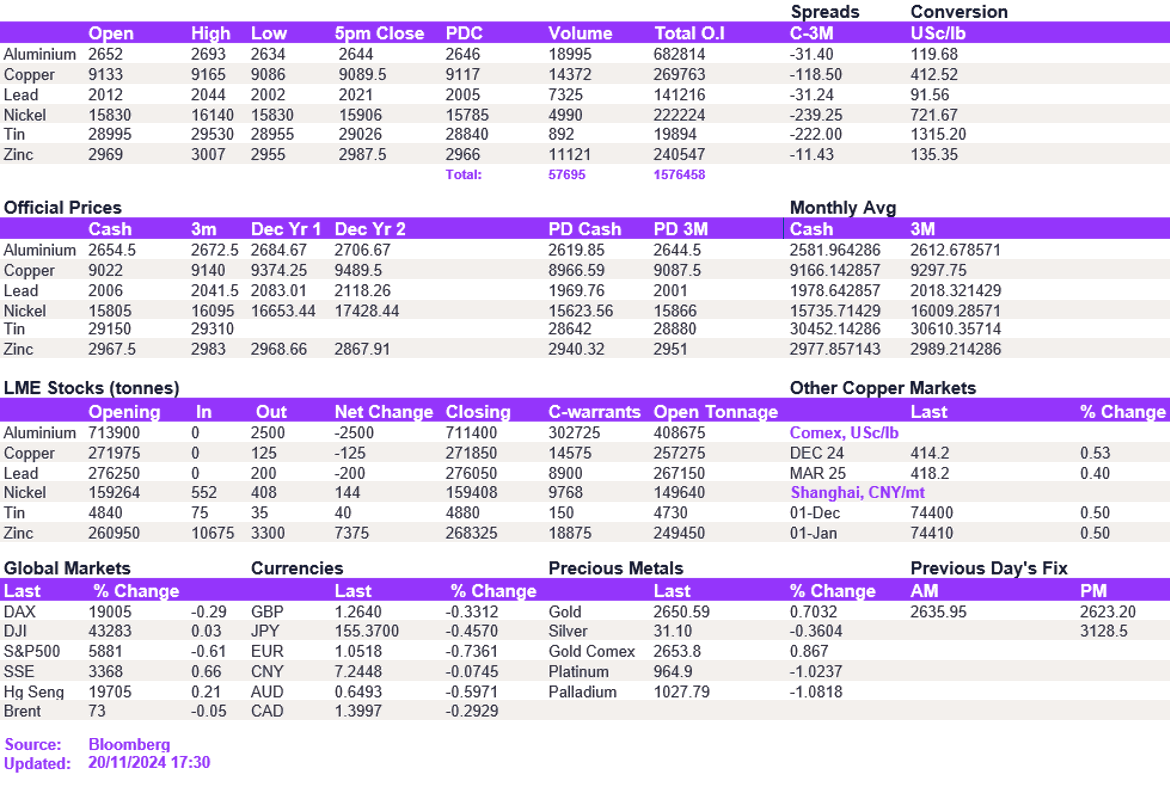

The base metals complex opened on the front foot this morning but struggled to break significantly higher, with the dollar strength weighing on performance. Aluminium and copper are trading slightly above the previous day's lows at $2,644/t and $9,089.50/t, respectively. Gains were slightly more pronounced in lead, as the metal mean reverted to $2,021/t. Nickel struggled above the $16,000/t level once again. As markets await news from the Trump administration regarding potential tariffs on China next year, liquidity will likely remain subdued into the year-end.

Geopolitical uncertainties, particularly around the Russia-Ukraine conflict, continue to provide support for gold. The precious metal gained traction, recovering closer to October levels and trading at $2,448/oz, while silver softened slightly to $31/oz. Oil prices edged higher, with WTI at $69.7/bbl and Brent crude at $73.4/bbl.

All price data is from 20.11.2024 as of 17:30