US stocks opened higher today, buoyed by Nvidia’s impressive Q3 earnings report last evening. The chipmaker reported record quarterly revenue of $35.1 billion, up 94% YoY, surpassing even elevated expectations and solidifying its dominance in the AI-driven semiconductor market. Adding to the positive sentiment, October existing US home sales rose to 3.95 million, up from 3.83 million in September, reflecting a slight improvement in the housing market. This improvement comes amid easing mortgage rates, which have dipped from their highs, offering some relief to prospective homebuyers and boosting optimism across real estate markets. In the bond market, the 10-year US Treasury yield declined below 4.4%, while the dollar index held steady at the 106.55 level.

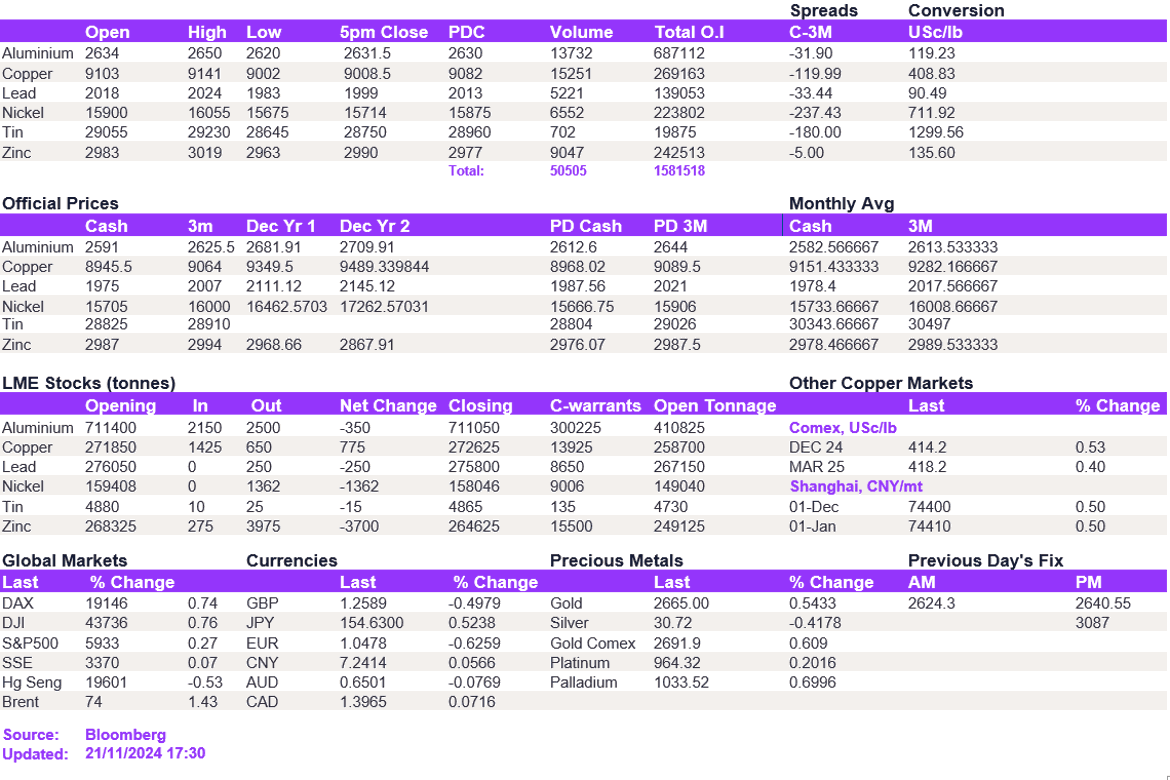

Base metals held steady as the dollar index remained elevated above 106, putting moderate pressure on prices. Copper is seen weakening to $9,000/t, as it held slightly above it at $9,008.50/t. Aluminium edged lower to $2,631.50/t. Nickel also broke back below $16,000/t. Only zinc held higher. We believe that the dollar will continue to influence prices in the near term.

Gold continued its upward momentum today, testing $2,670/oz, while silver edged slightly higher, nearing but failing to break the $31/oz mark. Oil prices saw another day of marginal gains, with WTI and Brent crude trading at $69.8/bbl and $73.8/bbl.

All price data is from 21.11.2024 as of 17:30